Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose there are 2 stocks in the market, stocks A and C, with the following properties: Expected Return Standard Deviation TA = 5% A

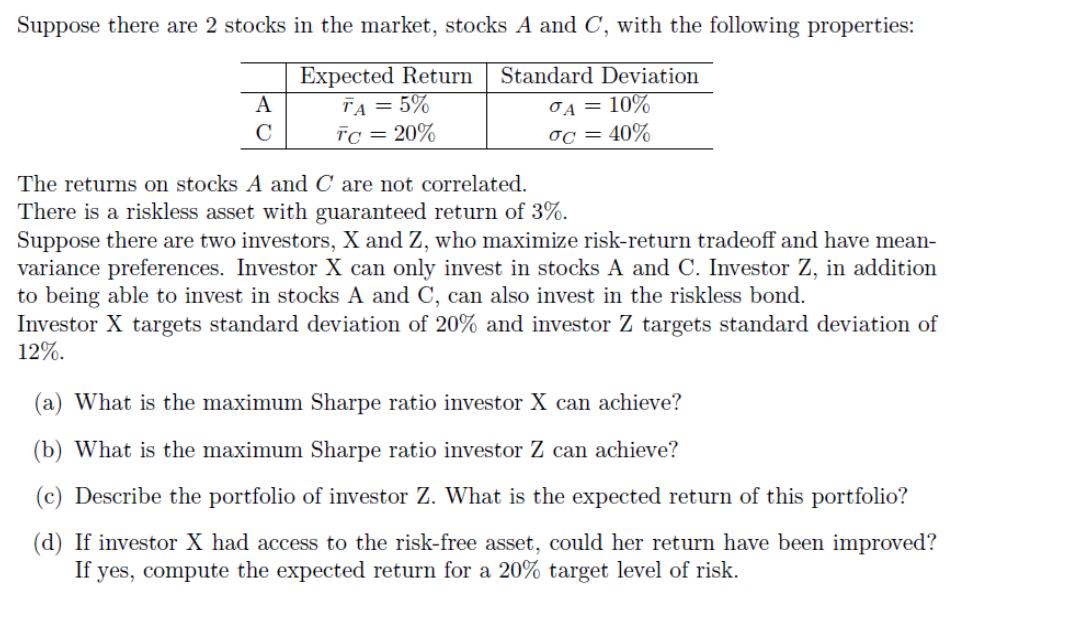

Suppose there are 2 stocks in the market, stocks A and C, with the following properties: Expected Return Standard Deviation TA = 5% A = 10% TC = 20% oC = 40% A C The returns on stocks A and C are not correlated. There is a riskless asset with guaranteed return of 3%. Suppose there are two investors, X and Z, who maximize risk-return tradeoff and have mean- variance preferences. Investor X can only invest in stocks A and C. Investor Z, in addition to being able to invest in stocks A and C, can also invest in the riskless bond. Investor X targets standard deviation of 20% and investor Z targets standard deviation of 12%. (a) What is the maximum Sharpe ratio investor X can achieve? (b) What is the maximum Sharpe ratio investor Z can achieve? (c) Describe the portfolio of investor Z. What is the expected return of this portfolio? (d) If investor X had access to the risk-free asset, could her return have been improved? If yes, compute the expected return for a 20% target level of risk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the maximum Sharpe ratio for each investor we need to find the optimal portfolios that maximize the riskreturn tradeoff The Sharpe ratio is defined as the ratio of excess return to the st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started