Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxpayers may either have a high income or low income, and they may be either opportunistic or honest. The tax collector cannot observe any

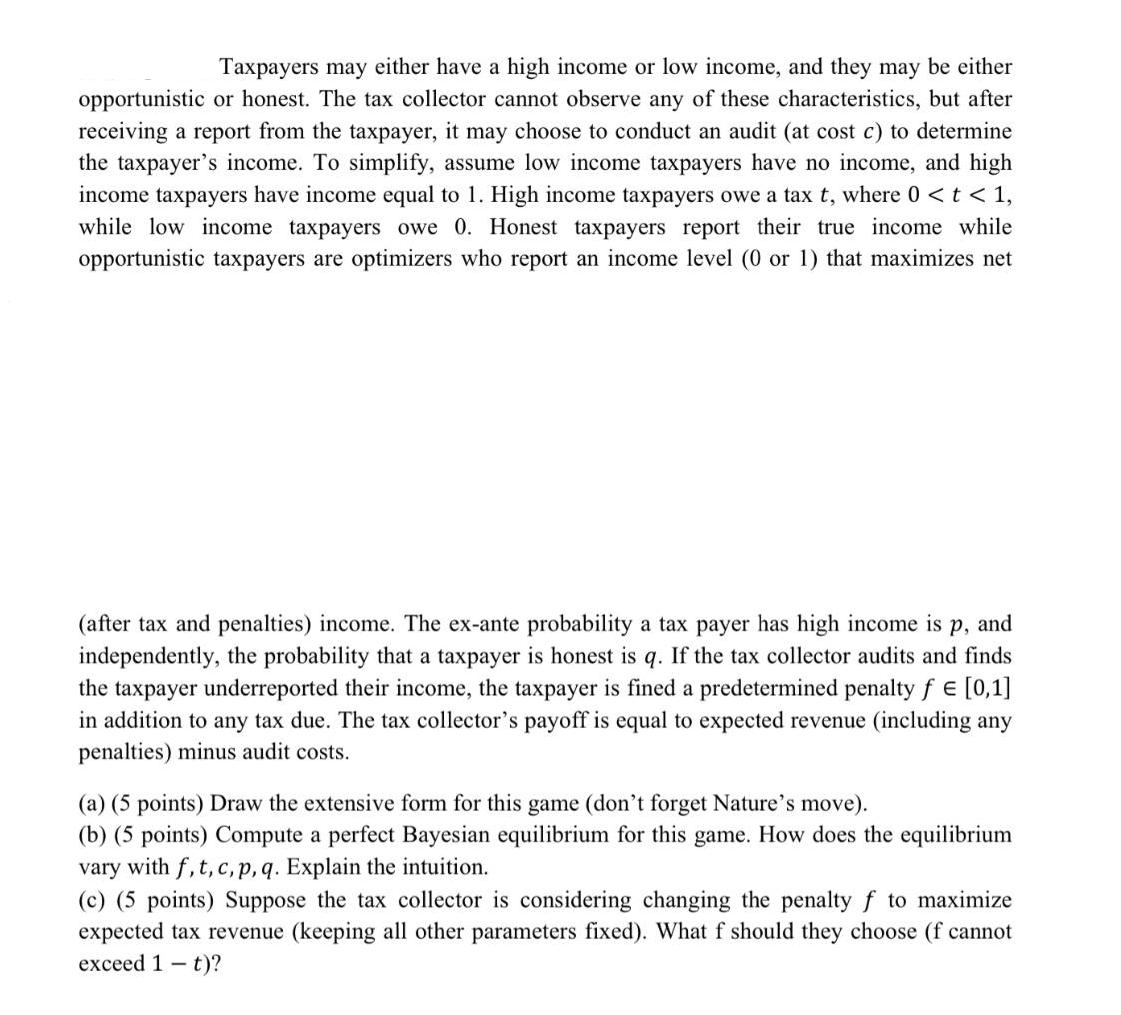

Taxpayers may either have a high income or low income, and they may be either opportunistic or honest. The tax collector cannot observe any of these characteristics, but after receiving a report from the taxpayer, it may choose to conduct an audit (at cost c) to determine the taxpayer's income. To simplify, assume low income taxpayers have no income, and high income taxpayers have income equal to 1. High income taxpayers owe a tax t, where 0 < t < 1, while low income taxpayers owe Honest taxpayers report their true income while opportunistic taxpayers are optimizers who report an income level (0 or 1) that maximizes net (after tax and penalties) income. The ex-ante probability a tax payer has high income is p, and independently, the probability that a taxpayer is honest is q. If the tax collector audits and finds the taxpayer underreported their income, the taxpayer is fined a predetermined penalty f = [0,1] in addition to any tax due. The tax collector's payoff is equal to expected revenue (including any penalties) minus audit costs. (a) (5 points) Draw the extensive form for this game (don't forget Nature's move). (b) (5 points) Compute a perfect Bayesian equilibrium for this game. How does the equilibrium vary with f, t, c, p, q. Explain the intuition. (c) (5 points) Suppose the tax collector is considering changing the penalty f to maximize expected tax revenue (keeping all other parameters fixed). What f should they choose (f cannot exceed 1 t)?

Step by Step Solution

★★★★★

3.27 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started