Question

Suppose there are two periods: current and future, and three possible states in the future period, Good (G), Fair (F) and Bad (B). Three

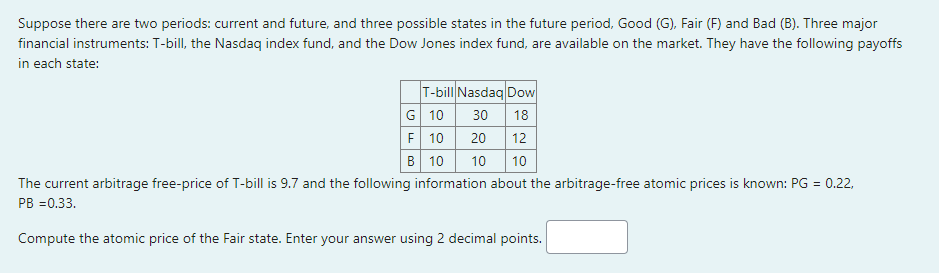

Suppose there are two periods: current and future, and three possible states in the future period, Good (G), Fair (F) and Bad (B). Three major financial instruments: T-bill, the Nasdaq index fund, and the Dow Jones index fund, are available on the market. They have the following payoffs in each state: T-bill Nasdaq Dow G 10 30 18 F 10 12 B 10 10 10 The current arbitrage free-price of T-bill is 9.7 and the following information about the arbitrage-free atomic prices is known: PG = 0.22, PB =0.33. Compute the atomic price of the Fair state. Enter your answer using 2 decimal points.

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Solution To compute the atomic price of the Fair state we need to use the formula Atomic ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Christopher T.S. Ragan, Richard G Lipsey

14th canadian Edition

321866347, 978-0321866349

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App