Question

Suppose there is a forward contract on an investment asset. The asset does not provide any income, neither it incurs any storage cost. The forward

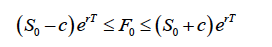

Suppose there is a forward contract on an investment asset. The asset does not provide any income, neither it incurs any storage cost. The forward contract will mature at time T. Current time is time 0. The spot price of the asset is per unit at time 0. There is a transaction cost for buying or selling the investment asset only in the spot market. This transaction cost is per unit. The risk-free interest rate is with continuously compounding. Prove that to make sure there is no arbitrage opportunity, the forward contract price must satisfy the following inequalities:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started