Question

Suppose there is no riskless asset and we have three stocks: A, B and C. Their expected returns are given by 10% r =

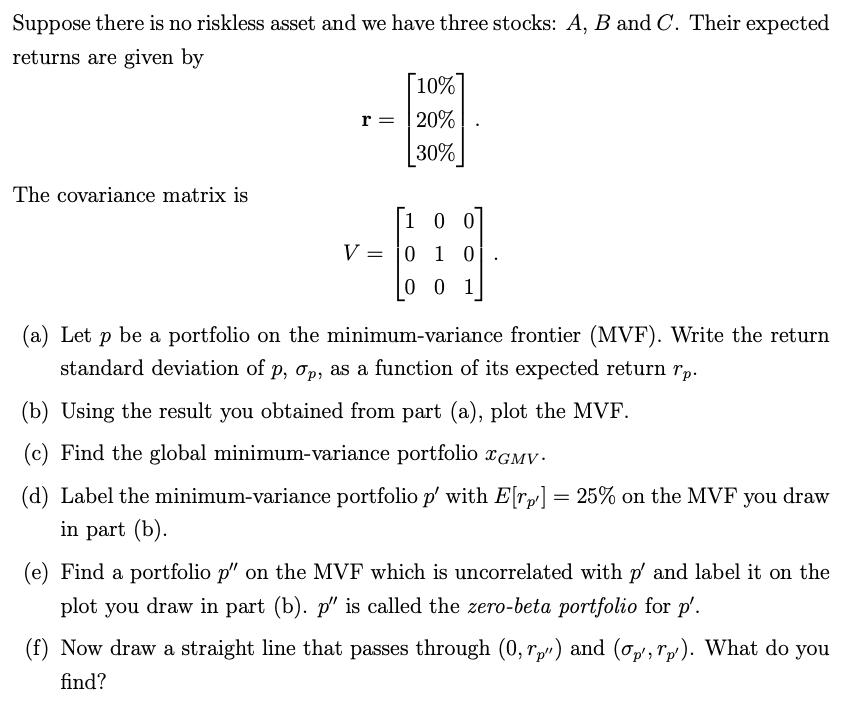

Suppose there is no riskless asset and we have three stocks: A, B and C. Their expected returns are given by 10% r = 20% 30% The covariance matrix is 1 0 0 V = 0 1 0 0 0 1 (a) Let p be a portfolio on the minimum-variance frontier (MVF). Write the return standard deviation of p, p, as a function of its expected return rp. (b) Using the result you obtained from part (a), plot the MVF. (c) Find the global minimum-variance portfolio GMV. (d) Label the minimum-variance portfolio p' with E[rp'] = 25% on the MVF you draw in part (b). (e) Find a portfolio p" on the MVF which is uncorrelated with p' and label it on the plot you draw in part (b). p" is called the zero-beta portfolio for p'. (f) Now draw a straight line that passes through (0,rp") and (p', Tp). What do you find?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App