Question

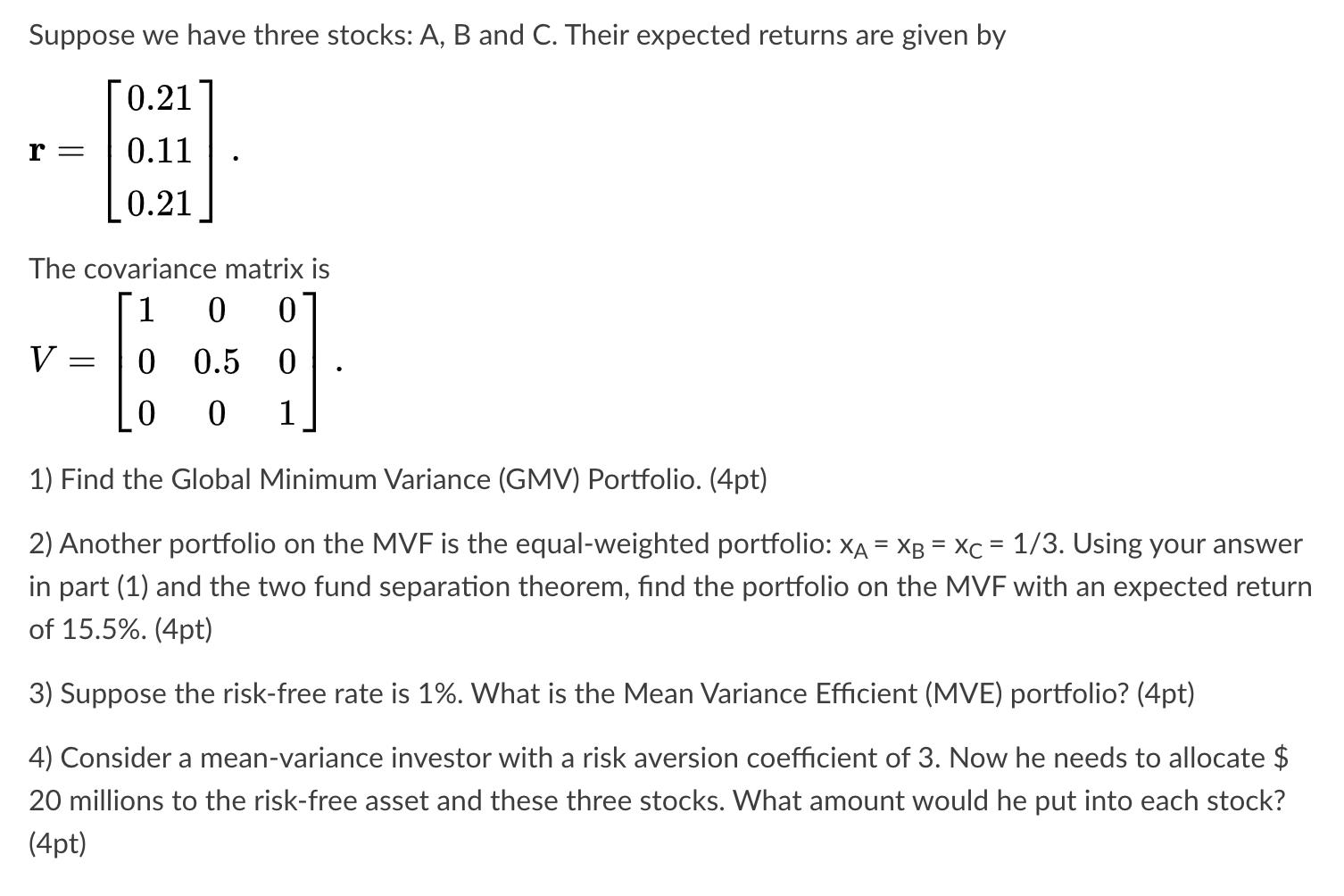

Suppose we have three stocks: A, B and C. Their expected returns are given by 0.21 r = 0.11 0.21 The covariance matrix is

Suppose we have three stocks: A, B and C. Their expected returns are given by 0.21 r = 0.11 0.21 The covariance matrix is 1 0 0 V = 0 0.5 0 0 0 1 1) Find the Global Minimum Variance (GMV) Portfolio. (4pt) 2) Another portfolio on the MVF is the equal-weighted portfolio: XA = XB = Xc = 1/3. Using your answer in part (1) and the two fund separation theorem, find the portfolio on the MVF with an expected return of 15.5%. (4pt) 3) Suppose the risk-free rate is 1%. What is the Mean Variance Efficient (MVE) portfolio? (4pt) 4) Consider a mean-variance investor with a risk aversion coefficient of 3. Now he needs to allocate $ 20 millions to the risk-free asset and these three stocks. What amount would he put into each stock? (4pt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

8th edition

978-1408041802, 1408041804, 978-1408048566, 1408048566, 978-1408093887

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App