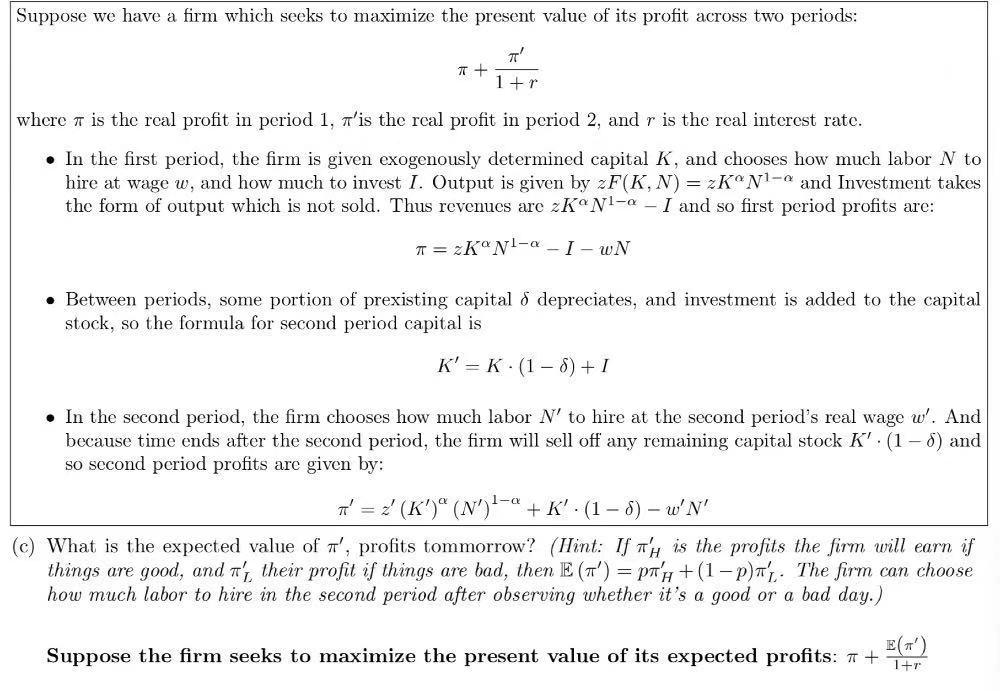

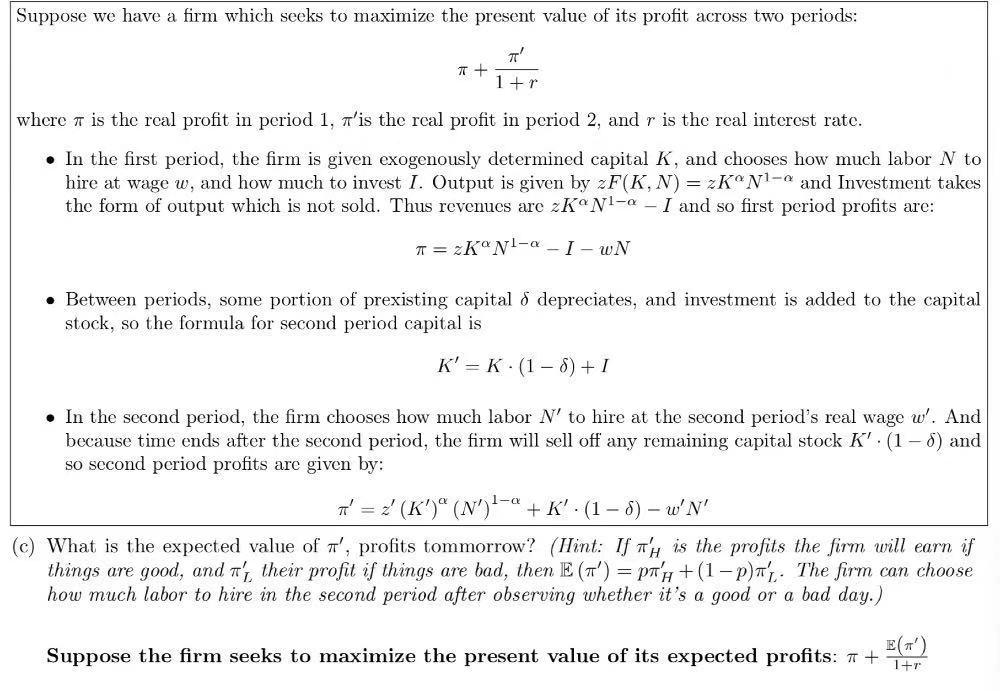

Suppose we have a firm which seeks to maximize the present value of its profit across two periods: TT 7 + 1 +r where n is the real profit in period 1, T'is the real profit in period 2, and r is the real interest rate. In the first period, the firm is given exogenously determined capital K, and chooses how much labor N to hire at wage w, and how much to invest I. Output is given by zF(K, N)= 2KNl-e and Investment takes the form of output which is not sold. Thus revenues are zKNl-a - I and so first period profits are: T= 2K N-a - 1 - WN Between periods, some portion of prexisting capital 8 depreciates, and investment is added to the capital stock, so the formula for second period capital is K' = K. (1-8) + 1 . In the second period, the firm chooses how much labor N' to hire at the second period's real wage w'. And because time ends after the second period, the firm will sell off any remaining capital stock K'.(1-0) and so second period profits are given by: T' = z' (K')" (N") ?- + K': (1 - 0) W'N' (C) What is the expected value of T', profits tommorrow? (Ilint: If n'h is the profits the firm will earn if things are good, and t'i their profit if things are bad, then E (T') = pth +(1-p)'. The firm can choose how much labor to hire in the second period after observing whether it's a good or a bad day.) Suppose the firm seeks to maximize the present value of its expected profits: 1 + 1+r Suppose we have a firm which seeks to maximize the present value of its profit across two periods: TT 7 + 1 +r where n is the real profit in period 1, T'is the real profit in period 2, and r is the real interest rate. In the first period, the firm is given exogenously determined capital K, and chooses how much labor N to hire at wage w, and how much to invest I. Output is given by zF(K, N)= 2KNl-e and Investment takes the form of output which is not sold. Thus revenues are zKNl-a - I and so first period profits are: T= 2K N-a - 1 - WN Between periods, some portion of prexisting capital 8 depreciates, and investment is added to the capital stock, so the formula for second period capital is K' = K. (1-8) + 1 . In the second period, the firm chooses how much labor N' to hire at the second period's real wage w'. And because time ends after the second period, the firm will sell off any remaining capital stock K'.(1-0) and so second period profits are given by: T' = z' (K')" (N") ?- + K': (1 - 0) W'N' (C) What is the expected value of T', profits tommorrow? (Ilint: If n'h is the profits the firm will earn if things are good, and t'i their profit if things are bad, then E (T') = pth +(1-p)'. The firm can choose how much labor to hire in the second period after observing whether it's a good or a bad day.) Suppose the firm seeks to maximize the present value of its expected profits: 1 + 1+r