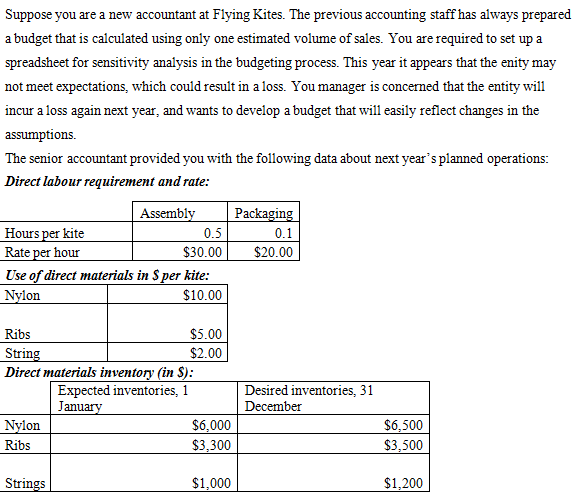

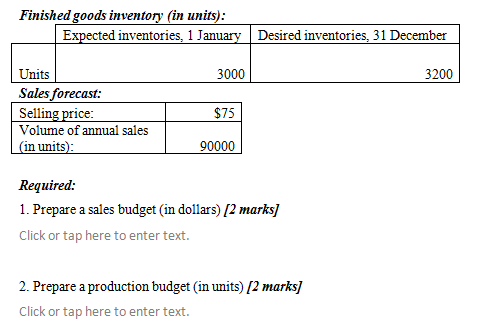

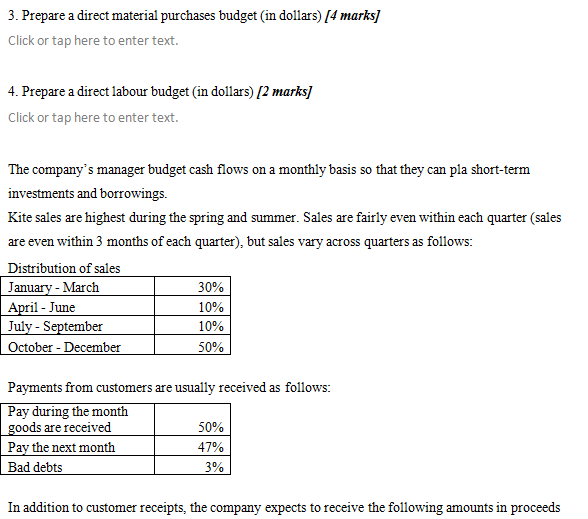

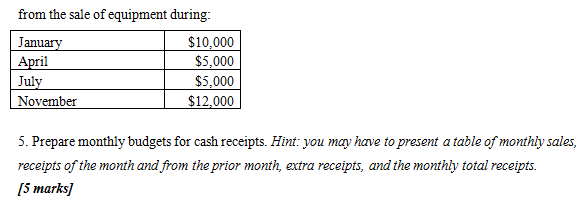

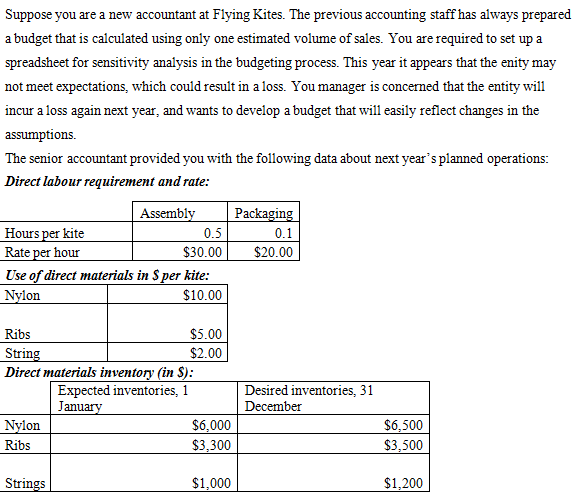

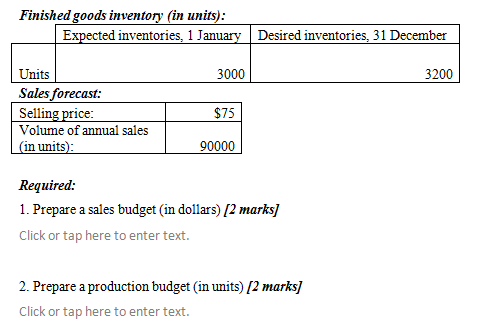

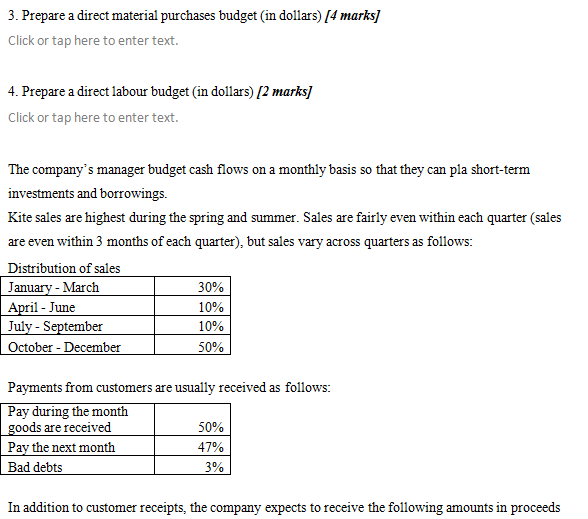

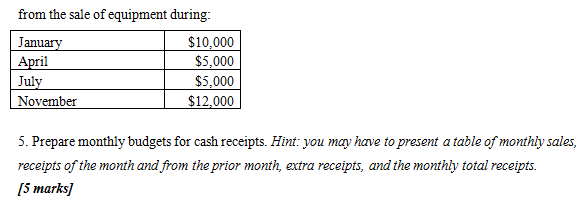

Suppose you are a new accountant at Flying Kites. The previous accounting staff has always prepared a budget that is calculated using only one estimated volume of sales. You are required to set up a spreadsheet for sensitivity analysis in the budgeting process. This year it appears that the enity may not meet expectations, which could result in a loss. You manager is concerned that the entity will incur a loss again next year, and wants to develop a budget that will easily reflect changes in the assumptions The senior accountant provided you with the following data about next year's planned operations: Direct labour requirement and rate: Assembly Hours per kite 0.5 Rate per hour $30.00 Use of direct materials in Sper kite: Nylon $10.00 Packaging 0.1 $20.00 Ribs $5.00 String $2.00 Direct materials inventory (in $): Expected inventories, 1 January Nylon $6,000 Ribs $3,300 Desired inventories, 31 December $6,500 $3,500 Strings $1,000 $1,200 Finished goods inventory (in units): Expected inventories, 1 January Desired inventories, 31 December 3000 3200 Units Sales forecast: Selling price: Volume of annual sales (in units): $75 90000 Required: 1. Prepare a sales budget (in dollars) (2 marks] Click or tap here to enter text. 2. Prepare a production budget (in units) [2 marks] Click or tap here to enter text. 3. Prepare a direct material purchases budget (in dollars) [4 marks] Click or tap here to enter text. 4. Prepare a direct labour budget (in dollars) [2 marks] Click or tap here to enter text. The company's manager budget cash flows on a monthly basis so that they can pla short-term investments and borrowings. Kite sales are highest during the spring and summer. Sales are fairly even within each quarter (sales are even within 3 months of each quarter), but sales vary across quarters as follows: Distribution of sales January - March 30% April - June 10% July - September 10% October - December 50% Payments from customers are usually received as follows: Pay during the month goods are received 50% Pay the next month 47% Bad debts 3% In addition to customer receipts, the company expects to receive the following amounts in proceeds from the sale of equipment during: January $10,000 April $5,000 July $5,000 November $12.000 5. Prepare monthly budgets for cash receipts. Hint: you may have to present a table of monthly sales, receipts of the month and from the prior month, extra receipts, and the monthly total receipts. 15 marks]