Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are a sales manager for Johnson & Johnson, an American pharmaceutical and consumer goods manufacturer. You have just signed a deal to

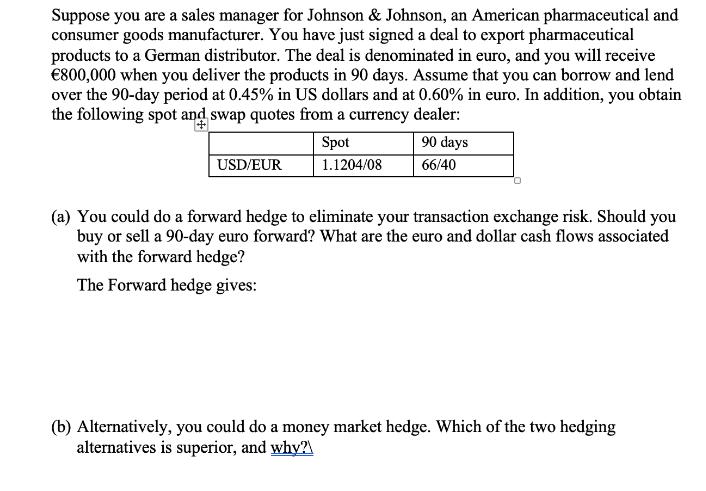

Suppose you are a sales manager for Johnson & Johnson, an American pharmaceutical and consumer goods manufacturer. You have just signed a deal to export pharmaceutical products to a German distributor. The deal is denominated in euro, and you will receive 800,000 when you deliver the products in 90 days. Assume that you can borrow and lend over the 90-day period at 0.45% in US dollars and at 0.60% in euro. In addition, you obtain the following spot and swap quotes from a currency dealer: Spot 1.1204/08 USD/EUR 90 days 66/40 (a) You could do a forward hedge to eliminate your transaction exchange risk. Should you buy or sell a 90-day euro forward? What are the euro and dollar cash flows associated with the forward hedge? The Forward hedge gives: (b) Alternatively, you could do a money market hedge. Which of the two hedging alternatives is superior, and why?

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To eliminate the transaction exchange risk using a forward hedge ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started