Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are a single tax filer in the current tax year. Your standard deduction is $ 1 2 , 5 5 0 ; however,

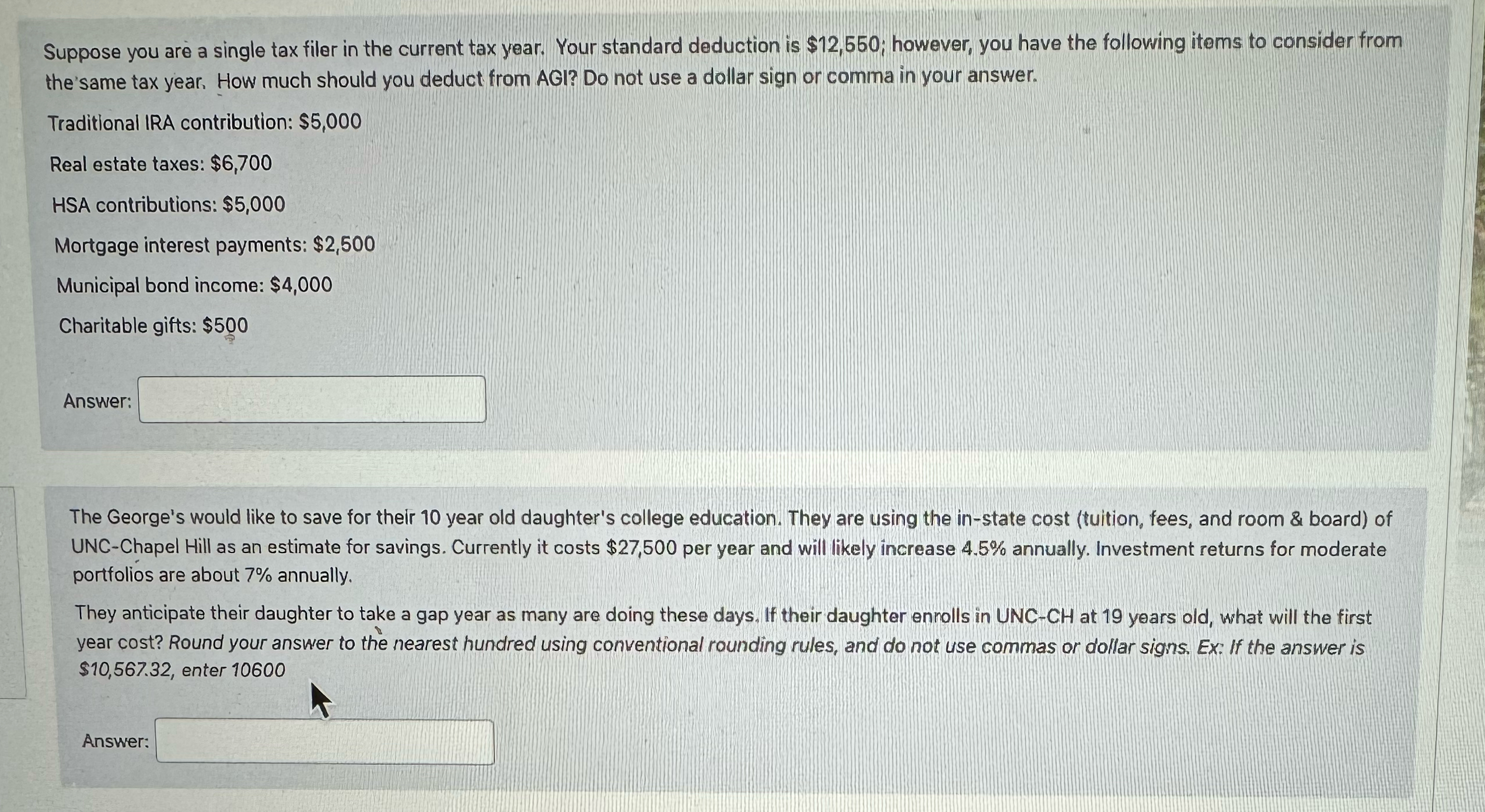

Suppose you are a single tax filer in the current tax year. Your standard deduction is $; however, you have the following items to consider from the'same tax year. How much should you deduct from AGI? Do not use a dollar sign or comma in your answer.

Traditional IRA contribution: $

Real estate taxes: $

HSA contributions: $

Mortgage interest payments: $

Municipal bond income: $

Charitable gifts: $

Answer:

The George's would like to save for their year old daughter's college education. They are using the instate cost tuition fees, and room & board of UNCChapel Hill as an estimate for savings. Currently it costs $ per year and will likely increase annually. Investment returns for moderate portfolios are about annually.

They anticipate their daughter to take a gap year as many are doing these days. If their daughter ennolls in UNCCH at years old, what will the first year cost? Round your answer to the nearest hundred using conventional rounding rules, and do not use commas or dollar signs. Ex: If the answer is $ enter

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started