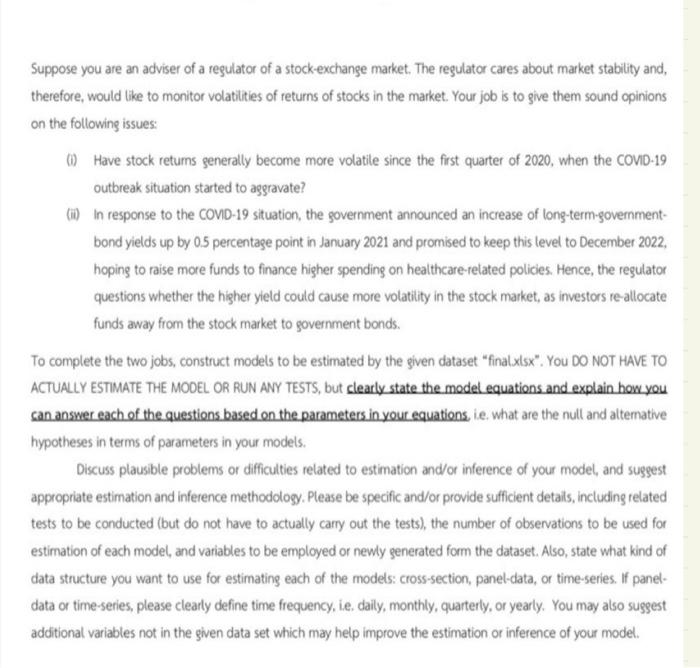

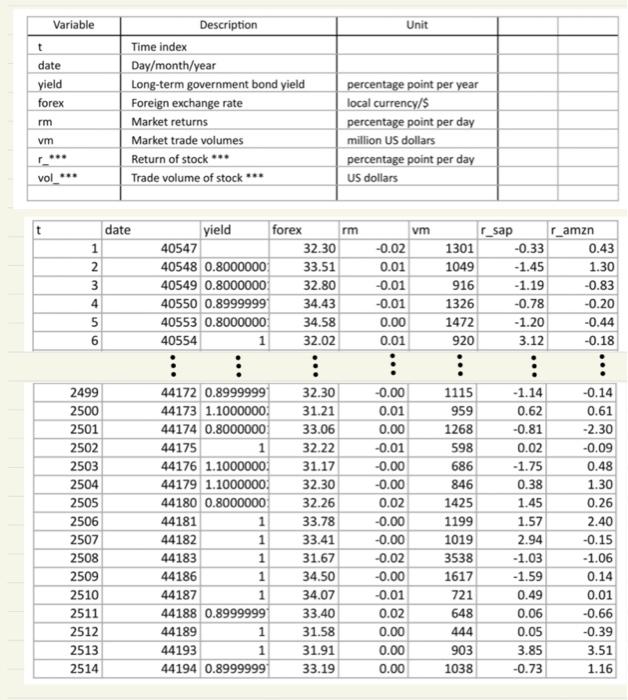

Suppose you are an adviser of a regulator of a stock exchange market. The regulator cares about market stability and, therefore, would like to monitor volatilities of returns of stocks in the market. Your job is to give them sound opinions on the following issues: ) Have stock retums generally become more volatile since the first quarter of 2020, when the COVID-19 outbreak situation started to aggravate? (1) In response to the COVID-19 situation, the government announced an increase of long-term-government- bond yields up by 0.5 percentage point in January 2021 and promised to keep this level to December 2022, hoping to raise more funds to finance higher spending on healthcare-related policies. Hence, the regulator questions whether the higher yield could cause more volatility in the stock market, as investors re-allocate funds away from the stock market to government bonds. To complete the two jobs, construct models to be estimated by the given dataset "final.xlsx". YOU DO NOT HAVE TO ACTUALLY ESTIMATE THE MODEL OR RUN ANY TESTS, but clearly state the model equations and explain how you can answer each of the questions based on the parameters in your equations, le, what are the null and alternative hypotheses in terms of parameters in your models. Discuss plausible problems or difficulties related to estimation and/or inference of your model, and suggest appropriate estimation and inference methodology. Please be specific and/or provide sufficient details, including related tests to be conducted (but do not have to actually carry out the tests), the number of observations to be used for estimation of each model, and variables to be employed or newly generated form the dataset. Also, state what kind of data structure you want to use for estimating each of the models: cross-section, panel-data, or time-series. If panel- data or time-series, please clearly define time frequency, ie daily, monthly, quarterly, or yearly. You may also suggest additional variables not in the given data set which may help improve the estimation or inference of your model Variable Unit t date yield forex Description Time index Day/month/year Long-term government bond yield Foreign exchange rate Market returns Market trade volumes Return of stock *** Trade volume of stock *** rm percentage point per year local currency/s percentage point per day million US dollars percentage point per day US dollars vm vole t OWN date 1 2 3 4 5 6 yield forex rm 40547 32.30 40548 0.8000000 33.51 40549 0.8000000 32.80 40550 0.8999999 34.43 40553 0.8000000 34.58 40554 1 32.02 vm -0.02 0.01 -0.01 -0.01 0.00 0.01 r_sap r_amzn 1301 -0.33 0.43 1049 -1.45 1.30 916 -1.19 -0.83 1326 -0.78 -0.20 1472 -1.20 -0.44 920 3.12 -0.18 2499 2500 2501 2502 2503 2504 2505 2506 2507 2508 2509 2510 2511 2512 2513 2514 44172 0.8999999 44173 1.1000000 44174 0.8000000 44175 44176 1.1000000 44179 1.1000000 44180 0.8000000 44181 1 44182 1 44183 1 44186 1 44187 1 44188 0.8999999 44189 1 44193 1 44194 0.8999999 32.30 31.21 33.06 32.22 31.17 32.30 32.26 33.78 33.41 31.67 34.50 34.07 33.40 31.58 31.91 33.19 -0.00 0.01 0.00 -0.01 -0.00 -0.00 0.02 -0.00 -0.00 -0.02 -0.00 -0.01 0.02 0.00 0.00 0.00 1115 959 1268 598 686 846 1425 1199 1019 3538 1617 721 648 444 903 1038 -1.14 0.62 -0.81 0.02 -1.75 0.38 1.45 1.57 2.94 -1.03 -1.59 0.49 0.06 0.05 3.85 -0.73 -0.14 0.61 -2.30 -0.09 0.48 1.30 0.26 2.40 -0.15 -1.06 0.14 0.01 -0.66 -0.39 3.51 1.16 Suppose you are an adviser of a regulator of a stock exchange market. The regulator cares about market stability and, therefore, would like to monitor volatilities of returns of stocks in the market. Your job is to give them sound opinions on the following issues: ) Have stock retums generally become more volatile since the first quarter of 2020, when the COVID-19 outbreak situation started to aggravate? (1) In response to the COVID-19 situation, the government announced an increase of long-term-government- bond yields up by 0.5 percentage point in January 2021 and promised to keep this level to December 2022, hoping to raise more funds to finance higher spending on healthcare-related policies. Hence, the regulator questions whether the higher yield could cause more volatility in the stock market, as investors re-allocate funds away from the stock market to government bonds. To complete the two jobs, construct models to be estimated by the given dataset "final.xlsx". YOU DO NOT HAVE TO ACTUALLY ESTIMATE THE MODEL OR RUN ANY TESTS, but clearly state the model equations and explain how you can answer each of the questions based on the parameters in your equations, le, what are the null and alternative hypotheses in terms of parameters in your models. Discuss plausible problems or difficulties related to estimation and/or inference of your model, and suggest appropriate estimation and inference methodology. Please be specific and/or provide sufficient details, including related tests to be conducted (but do not have to actually carry out the tests), the number of observations to be used for estimation of each model, and variables to be employed or newly generated form the dataset. Also, state what kind of data structure you want to use for estimating each of the models: cross-section, panel-data, or time-series. If panel- data or time-series, please clearly define time frequency, ie daily, monthly, quarterly, or yearly. You may also suggest additional variables not in the given data set which may help improve the estimation or inference of your model Variable Unit t date yield forex Description Time index Day/month/year Long-term government bond yield Foreign exchange rate Market returns Market trade volumes Return of stock *** Trade volume of stock *** rm percentage point per year local currency/s percentage point per day million US dollars percentage point per day US dollars vm vole t OWN date 1 2 3 4 5 6 yield forex rm 40547 32.30 40548 0.8000000 33.51 40549 0.8000000 32.80 40550 0.8999999 34.43 40553 0.8000000 34.58 40554 1 32.02 vm -0.02 0.01 -0.01 -0.01 0.00 0.01 r_sap r_amzn 1301 -0.33 0.43 1049 -1.45 1.30 916 -1.19 -0.83 1326 -0.78 -0.20 1472 -1.20 -0.44 920 3.12 -0.18 2499 2500 2501 2502 2503 2504 2505 2506 2507 2508 2509 2510 2511 2512 2513 2514 44172 0.8999999 44173 1.1000000 44174 0.8000000 44175 44176 1.1000000 44179 1.1000000 44180 0.8000000 44181 1 44182 1 44183 1 44186 1 44187 1 44188 0.8999999 44189 1 44193 1 44194 0.8999999 32.30 31.21 33.06 32.22 31.17 32.30 32.26 33.78 33.41 31.67 34.50 34.07 33.40 31.58 31.91 33.19 -0.00 0.01 0.00 -0.01 -0.00 -0.00 0.02 -0.00 -0.00 -0.02 -0.00 -0.01 0.02 0.00 0.00 0.00 1115 959 1268 598 686 846 1425 1199 1019 3538 1617 721 648 444 903 1038 -1.14 0.62 -0.81 0.02 -1.75 0.38 1.45 1.57 2.94 -1.03 -1.59 0.49 0.06 0.05 3.85 -0.73 -0.14 0.61 -2.30 -0.09 0.48 1.30 0.26 2.40 -0.15 -1.06 0.14 0.01 -0.66 -0.39 3.51 1.16