Question

Suppose you are computing net cash flow from operating activities using the indirect method. Use the same income statement and additional information provided in Question

Suppose you are computing net cash flow from operating activities using the indirect method. Use the same income statement and additional information provided in Question 1.

a. Within the income statement, identify all the accounts that need to be removed from net income in order to compute net cash flow from operating activities. For each account, write the account name and the adjustment to net income (e.g., +100, -100), and briefly explain why the adjustment is needed.

b. For each paragraph in the additional information, show how you would adjust net income using the information provided. Write the account involved in the adjustment (e.g., accounts receivable for paragraph 1) and the amount of adjustment (e.g., +100, -100). If a paragraph results in multiple adjustments, write them in separate lines. If no adjustment is needed for a paragraph, write none for the description and write 0 for the adjustment.

c. Should the amount of net cash flow from operating activities computed using the indirect method be the same as that computed using the direct method?

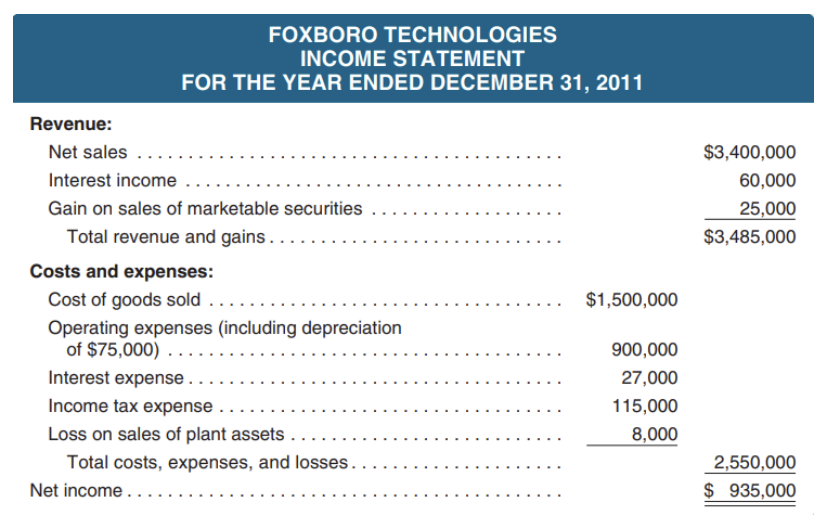

Question 1. You are the controller for Foxboro Technologies. Your staff has prepared an income statement for the current year and has developed the following additional information by analyzing changes in the companys balance sheet accounts.

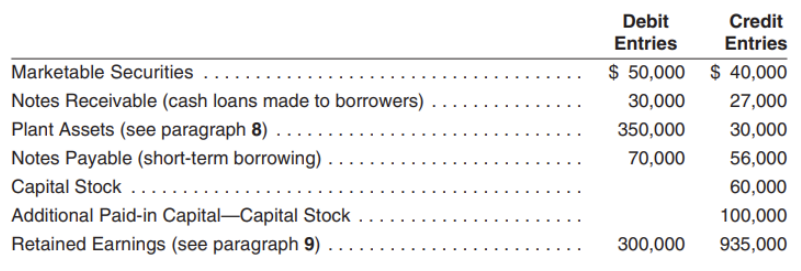

Additional information

1. Accounts receivable increased by $60,000.

2. Accrued interest receivable decreased by $5,000.

3. Inventory decreased by $30,000, and accounts payable to suppliers of merchandise decreased by $22,000.

4. Short-term prepayments of operating expenses increased by $8,000, and accrued liabilities for operating expenses decreased by $9,000.

5. The liability for accrued interest payable increased by $4,000 during the year.

6. The liability for accrued income taxes payable decreased by $10,000 during the year.

7. The schedule (i.e., appendix table) shown after paragraph 11 summarizes the total debit and credit entries during the year in other balance sheet accounts.

8. In the schedule, the $30,000 in credit entries to the Plant Assets account is net of any debits to Accumulated Depreciation when plant assets were sold or retired. That means the $30,000 in credit entries represents the book value of all plant assets sold or retired during the year (i.e., $30,000 credit to Plant Assets = Cost of the plant assets Accumulated Depreciation).

9. In the schedule, the $300,000 debit to Retained Earnings represents dividends declared and paid during the year. The $935,000 credit entry represents the net income shown in the income statement.

10. All investing and financing activities were cash transactions.

11. Cash and cash equivalents amount to $20,000 at the beginning of the year and to $473,000 at year-end.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started