Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years. The company did not

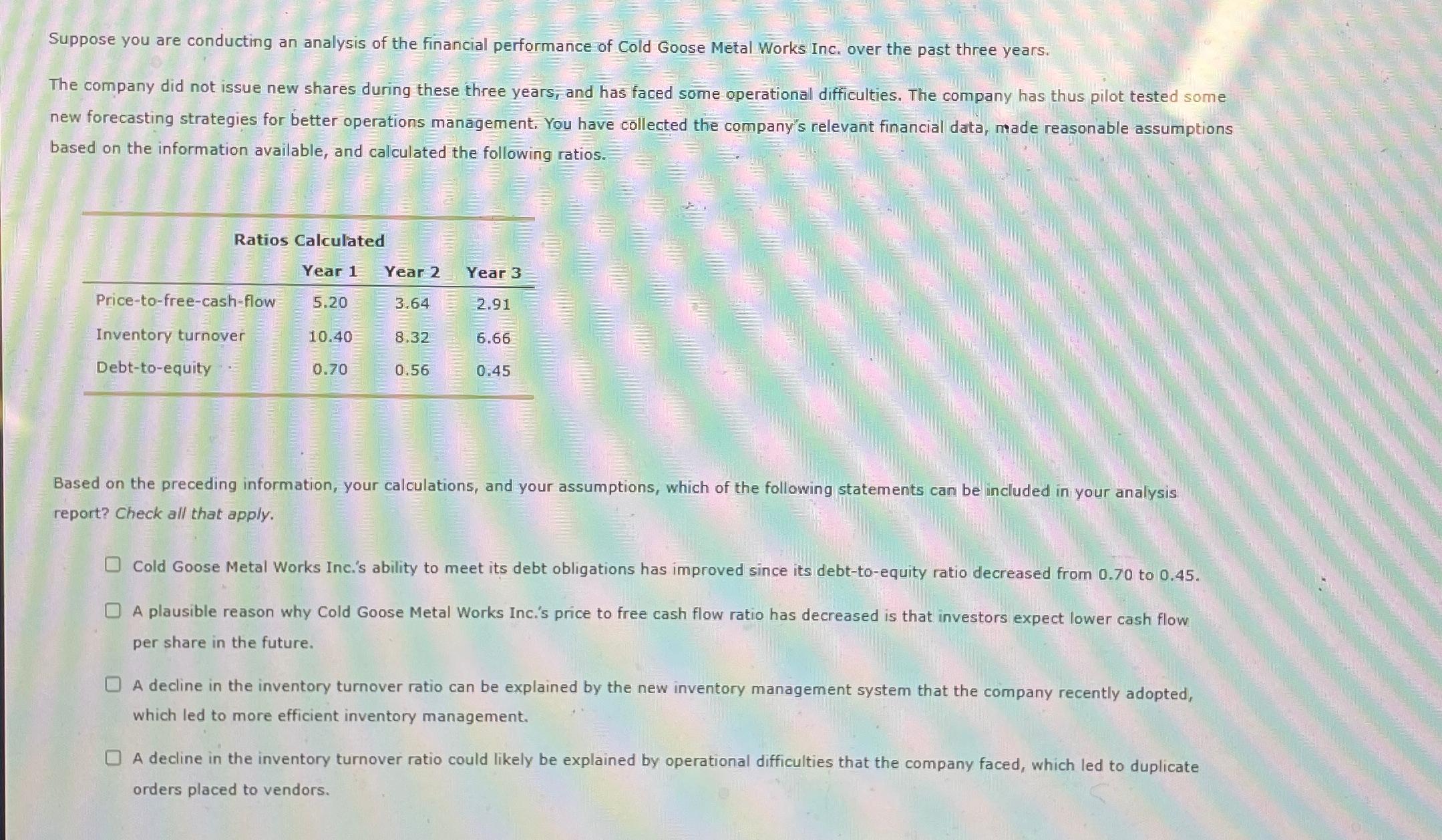

Suppose you are conducting an analysis of the financial performance of Cold Goose Metal Works Inc. over the past three years.

The company did not issue new shares during these three years, and has faced some operational difficulties. The company has thus pilot tested some new forecasting strategies for better operations management. You have collected the company's relevant financial data, made reasonable assumptions based on the information available, and calculated the following ratios.

Ratios Calculated

tableYear Year Year Pricetofreecashflow,Inventory turnover,Debttoequity,

Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply.

Cold Goose Metal Works Inc.s ability to meet its debt obligations has improved since its debttoequity ratio decreased from to

A plausible reason why Cold Goose Metal Works Inc.s price to free cash flow ratio has decreased is that investors expect lower cash flow per share in the future.

A decline in the inventory turnover ratio can be explained by the new inventory management system that the company recently adopted, which led to more efficient inventory management.

A decline in the inventory turnover ratio could likely be explained by operational difficulties that the company faced, which led to duplicate orders placed to vendors.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started