| Suppose you buy a 7.6 percent coupon bond today for $1,070. The bond has 12 years to maturity. | | What rate of return do you expect to earn on your investment? | | Two years from now, the YTM on your bond has increased by 2 percent, and you decide to sell. What price will your bond sell for | | What is the Macaulay duration of a 5.6 percent coupon bond with ten years to maturity and a current price of $1,057.70? | Consider a 4.6 percent coupon bond with five years to maturity and a current price of $1,046.10. Suppose the yield on the bond suddenly increases by 2 percent? | | a. | Use duration to estimate the new price of the bond? | | | | LKD Co. has 13 percent coupon bonds with a YTM of 8.9 percent. The current yield on these bonds is 9.5 percent. How many years do these bonds have left until they mature? | |

| Ghost Rider Corporation has bonds on the market with 8 years to maturity, a YTM of 5 percent, and a current price of $945. What must the coupon rate be on the companys bonds? | Great Wall Pizzeria issued 5-year bonds one year ago at a coupon rate of 5.9 percent. If the YTM on these bonds is 7.7 percent, what is the current bond price? | Atlantis Fisheries issues zero coupon bonds on the market at a price of $477 per bond. These are callable in 8 years at a call price of $540. Using semiannual compounding, what is the yield to call for these bonds | | |

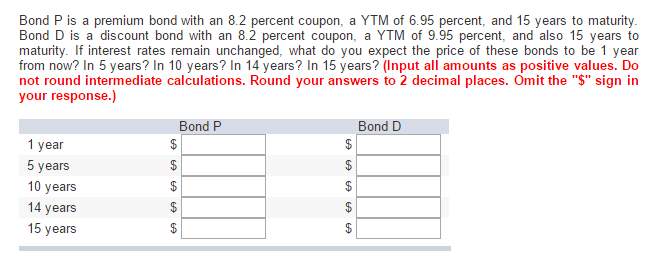

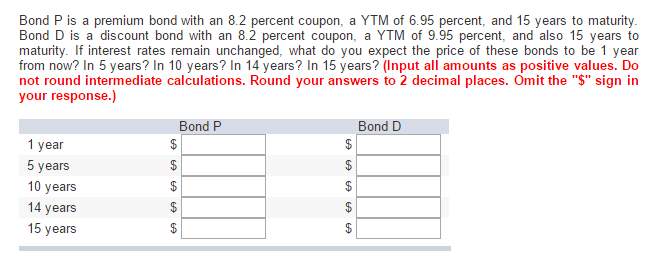

Bond P is a premium bond with an 8.2 percent coupon, a YTM of 6.95 percent, and 15 years to maturity Bond D is a discount bond with an 8.2 percent coupon, a YTM of 9.95 percent, and also 15 years to maturity. If interest rates remain unchanged, what do you expect the price of these bonds to be 1 year from now? In 5 years? In 10 years? In 14 years? In 15 years? (Input all amounts as positive values. Do not round intermediate calculations. Round your answers to 2 decimal places. Omit the "$" sign in your response.) Bond P Bond D 1 year 5 years 10 years 14 years 15 years