Question

Suppose you buy a May expiration put option on 100 shares with the exercise price of $50. If the stock price at option expiration

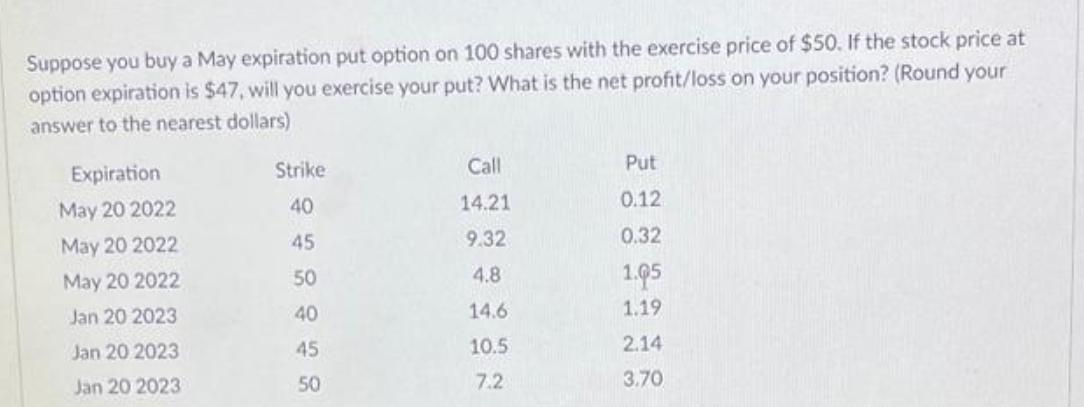

Suppose you buy a May expiration put option on 100 shares with the exercise price of $50. If the stock price at option expiration is $47, will you exercise your put? What is the net profit/loss on your position? (Round your answer to the nearest dollars) Expiration Strike Call Put May 20 2022 40 14.21 0.12 May 20 2022 45 9.32 0.32 May 20 2022 50 4.8 1.05 Jan 20 2023 40 14.6 1.19 Jan 20 2023 45 10.5 2.14 Jan 20 2023 50 7.2 3.70

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether to exercise the put option and calculate the net profit or ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

ISE Essentials Of Investments

Authors: Zvi Bodie, Alex Kane, Alan Marcus

12th International Edition

1265450099, 9781265450090

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App