Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose you conduct currency carry trade by borrowing $1,000,000 at the start of each year and investing in the New Zealand dollar for one

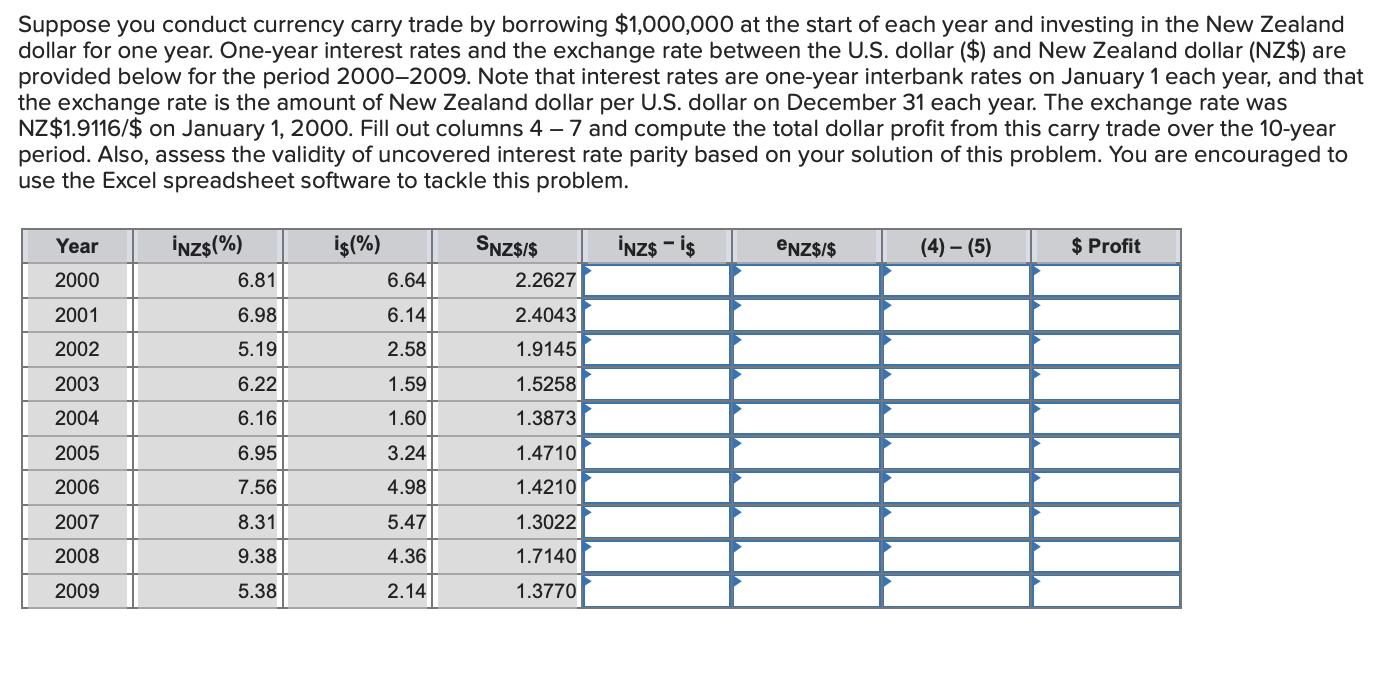

Suppose you conduct currency carry trade by borrowing $1,000,000 at the start of each year and investing in the New Zealand dollar for one year. One-year interest rates and the exchange rate between the U.S. dollar ($) and New Zealand dollar (NZ$) are provided below for the period 2000-2009. Note that interest rates are one-year interbank rates on January 1 each year, and that the exchange rate is the amount of New Zealand dollar per U.S. dollar on December 31 each year. The exchange rate was NZ$1.9116/$ on January 1, 2000. Fill out columns 4-7 and compute the total dollar profit from this carry trade over the 10-year period. Also, assess the validity of uncovered interest rate parity based on your solution of this problem. You are encouraged to use the Excel spreadsheet software to tackle this problem. Year 2000 INZ$(%) is(%) SNZS/$ iNZS - is eNZS/S (4)-(5) $ Profit 6.81 6.64 2.2627 2001 6.98 6.14 2.4043 2002 5.19 2.58 1.9145 2003 6.22 1.59 1.5258 2004 6.16 1.60 1.3873 2005 6.95 3.24 1.4710 2006 7.56 4.98 1.4210 2007 8.31 5.47 1.3022 2008 9.38 4.36 1.7140 2009 5.38 2.14 1.3770

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we can use the following steps 1 Calculate the interest earned on the borrowed 1000000 in the New Zealand dollar NZ each year 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started