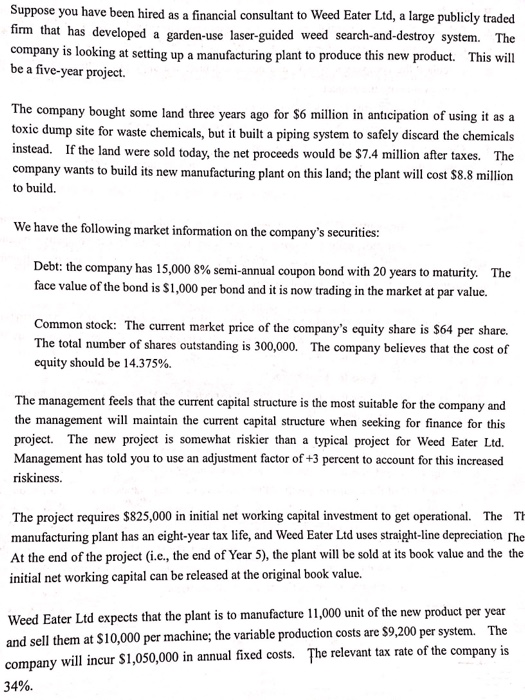

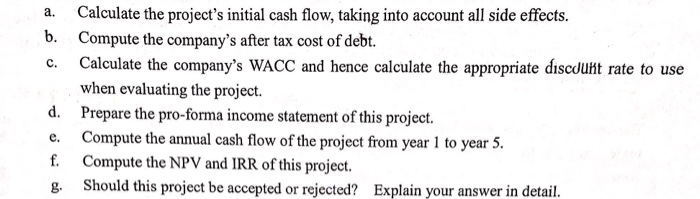

Suppose you have been hired as a financial consultant to Weed Eater Ltd, a large publicly traded firm that has developed a garden-use laser-guided weed search-and-destroy system. The company is looking at setting up a manufacturing plant to produce this new product. This will be a five-year project. The company bought some land three years ago for $6 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. If the land were sold today, the net proceeds would be $7.4 million after taxes. The company wants to build its new manufacturing plant on this land; the plant will cost $8.8 million to build. We have the following market information on the company's securities: Debt: the company has 15,000 8% semi-annual coupon bond with 20 years to maturity. The face value of the bond is $1,000 per bond and it is now trading in the market at par value. Common stock: The current market price of the company's equity share is $64 per share. The total number of shares outstanding is 300,000. The company believes that the cost of equity should be 14.375%. The management feels that the current capital structure is the most suitable for the company and the management will maintain the current capital structure when seeking for finance for this project. The new project is somewhat riskier than a typical project for Weed Eater Ltd. Management has told you to use an adjustment factor of +3 percent to account for this increased riskiness. The project requires $825,000 in initial net working capital investment to get operational. The Th manufacturing plant has an eight-year tax life, and Weed Eater Ltd uses straight-line depreciation The- At the end of the project (i.e., the end of Year 5), the plant will be sold at its book value and the the initial net working capital can be released at the original book value. Weed Eater Ltd expects that the plant is to manufacture 11,000 unit of the new product per year and sell them at S10,000 per machine; the variable production costs are $9,200 per system. The The relevant tax rate of the company is company will incur $1,050,000 in annual fixed costs. 34%. Calculate the project's initial cash flow, taking into account all side effects. Compute the company's after tax cost of debt. Calculate the company's WACC and hence calculate the appropriate discJunt rate to use when evaluating the project. a. b. c. d. Prepare the pro-forma income statement of this project. Compute the annual cash flow of the project from year 1 to year 5. e. f. Compute the NPV and IRR of this project. Should this project be accepted or rejected? Explain your answer in detail. g