Answered step by step

Verified Expert Solution

Question

1 Approved Answer

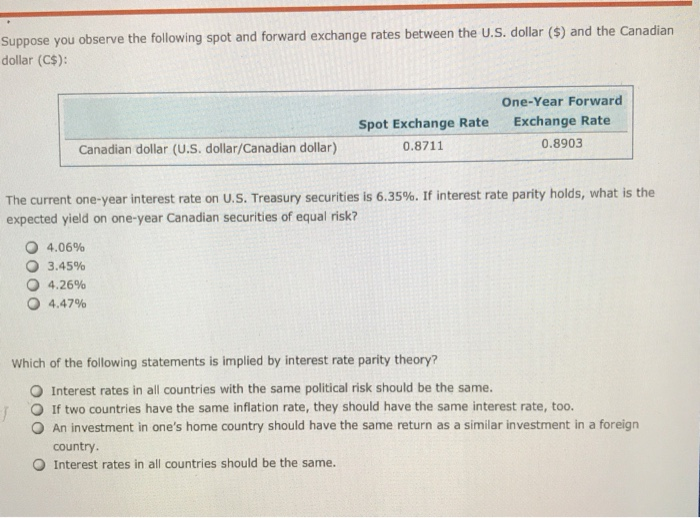

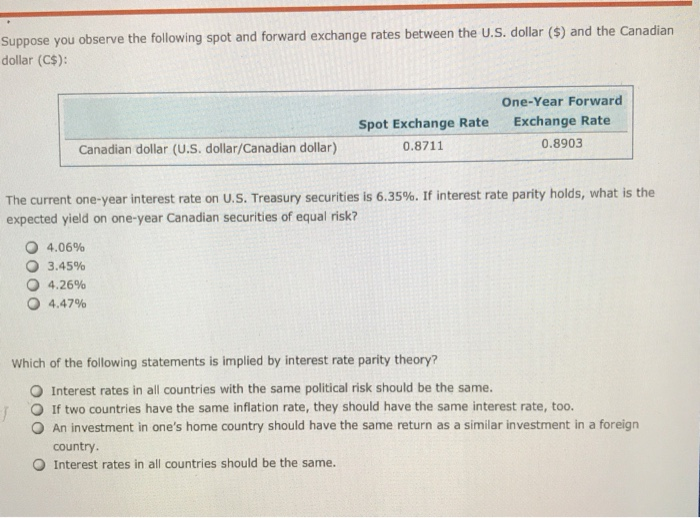

Suppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (C$): Spot Exchange Rate 0.8711 One-Year

Suppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (C$): Spot Exchange Rate 0.8711 One-Year Forward Exchange Rate 0.8903 Canadian dollar (U.S. dollar/Canadian dollar) The current one-year interest rate on us. Treasury securities is 6.35%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk? 4.06% 3.45% 4.26% 4.47% Which of the following statements is implied by interest rate parity theory? O Interest rates in all countries with the same political risk should be the same. O If two countries have the same inflation rate, they should have the same interest rate, too. O An investment in one's home country should have the same return as a similar investment in a foreign country. O Interest rates in all countries should be the same

Suppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (C$): Spot Exchange Rate 0.8711 One-Year Forward Exchange Rate 0.8903 Canadian dollar (U.S. dollar/Canadian dollar) The current one-year interest rate on us. Treasury securities is 6.35%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk? 4.06% 3.45% 4.26% 4.47% Which of the following statements is implied by interest rate parity theory? O Interest rates in all countries with the same political risk should be the same. O If two countries have the same inflation rate, they should have the same interest rate, too. O An investment in one's home country should have the same return as a similar investment in a foreign country. O Interest rates in all countries should be the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started