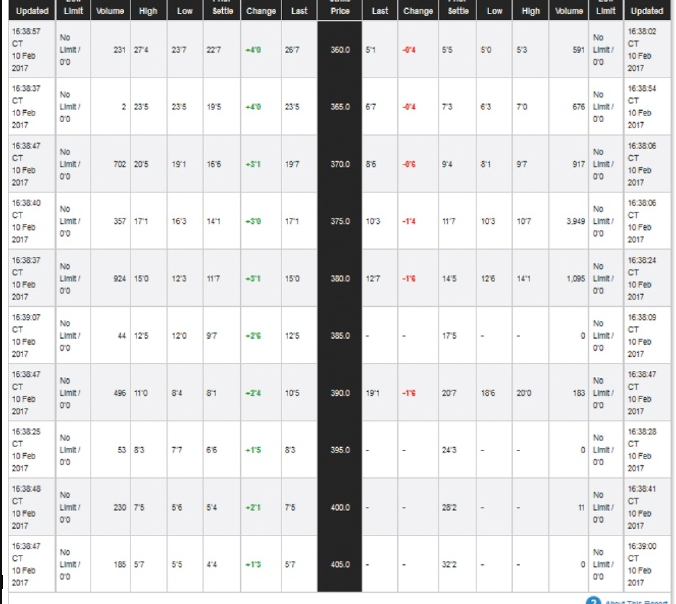

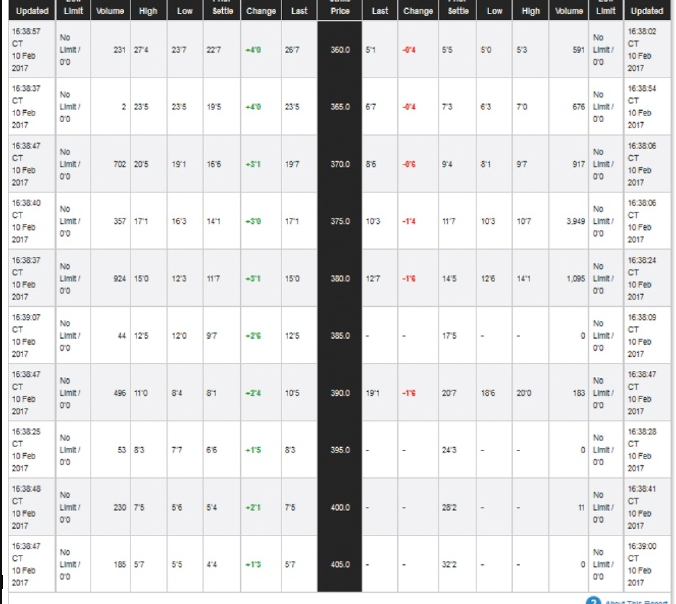

Suppose you purchase the May 2017 call option on corn futures with a strike price of $3.95. Assume you purchased the option at the last price of the day. Use Table 23.2 a. How much does your option cost per bushel of corn? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn is $3.79 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) d. What is your net profit or loss if corn futures prices are $4.21 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) Answer is not complete. a. Option cost $ 0.10500 $ 20,300.00 per bushel b. Total cost C. d. Updated Limit Volume High LOW Bottle Change Last Price Last Change Sattie LON High Volume Limit Updated 16.38.02 CT 16:38:57 10 Feb 2017 NO Limit 00 231 274 237 360.0 51 55 50 53 No 591 Limit 00 10 Feb 2017 16:38:37 CT No Limt 00 195 3650 67 -04 703 63 70 No 676 Limit 00 16:38:54 CT 10 Feb 2017 10 Feb 2017 16:38:47 10 Feb 2017 NO Limit 00 702 205 191 166 197 3700 18 org 94 81 97 No 917 Limit 00 16.38.06 10 Feb 2017 16,38:40 10 Feb 2017 NO Limit 00 357 171 163 141 -30 171 375.0 103 117 103 107 NO 3.949 Limit 00 16 38.06 10 Feb 2017 16.38.37 10 Feb 2017 NO Limit 00 924 150 123 117 +31 150 3800 127 2 126 No 1.095 Limit 00 141 16:38:24 10 Feb 2017 15:39:07 CT 10 Feb 2017 NO Limit 00 44 125 120 97 125 385.0 175 - NO 0 Lt 00 16 3809 CT 10 Feb 2017 16:38:47 10 Feb 2017 NO Limit 00 496 110 84 81 105 390.0 207 186 200 NO 183 Limit 00 16:38:47 CT 10 Feb 2017 16.38 25 10 Feb 2017 NO Limit 53 33 66 -15 83 3950 243 - NO 0 Limit 00 16:38:28 CT 10 Feb 2017 16:38:48 10 Feb 2017 NO Limit 00 230 75 56 ! 75 400.0 - NO 11 Limit 00 16:38:41 CT 10 Feb 2017 NO 16:38:47 10 Feb 2017 185 57 55 57 405.0 NO 0 Limit 00 16:39:00 CT 10 Feb 2017 00 Suppose you purchase the May 2017 call option on corn futures with a strike price of $3.95. Assume you purchased the option at the last price of the day. Use Table 23.2 a. How much does your option cost per bushel of corn? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of corn is $3.79 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) d. What is your net profit or loss if corn futures prices are $4.21 per bushel at expiration? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Enter your answer as a positive value.) Answer is not complete. a. Option cost $ 0.10500 $ 20,300.00 per bushel b. Total cost C. d. Updated Limit Volume High LOW Bottle Change Last Price Last Change Sattie LON High Volume Limit Updated 16.38.02 CT 16:38:57 10 Feb 2017 NO Limit 00 231 274 237 360.0 51 55 50 53 No 591 Limit 00 10 Feb 2017 16:38:37 CT No Limt 00 195 3650 67 -04 703 63 70 No 676 Limit 00 16:38:54 CT 10 Feb 2017 10 Feb 2017 16:38:47 10 Feb 2017 NO Limit 00 702 205 191 166 197 3700 18 org 94 81 97 No 917 Limit 00 16.38.06 10 Feb 2017 16,38:40 10 Feb 2017 NO Limit 00 357 171 163 141 -30 171 375.0 103 117 103 107 NO 3.949 Limit 00 16 38.06 10 Feb 2017 16.38.37 10 Feb 2017 NO Limit 00 924 150 123 117 +31 150 3800 127 2 126 No 1.095 Limit 00 141 16:38:24 10 Feb 2017 15:39:07 CT 10 Feb 2017 NO Limit 00 44 125 120 97 125 385.0 175 - NO 0 Lt 00 16 3809 CT 10 Feb 2017 16:38:47 10 Feb 2017 NO Limit 00 496 110 84 81 105 390.0 207 186 200 NO 183 Limit 00 16:38:47 CT 10 Feb 2017 16.38 25 10 Feb 2017 NO Limit 53 33 66 -15 83 3950 243 - NO 0 Limit 00 16:38:28 CT 10 Feb 2017 16:38:48 10 Feb 2017 NO Limit 00 230 75 56 ! 75 400.0 - NO 11 Limit 00 16:38:41 CT 10 Feb 2017 NO 16:38:47 10 Feb 2017 185 57 55 57 405.0 NO 0 Limit 00 16:39:00 CT 10 Feb 2017 00