Question

Suppose you sell eight February 2017 silver futures contracts on this day, at the last price of the day. Use Table 23.1 a. What will

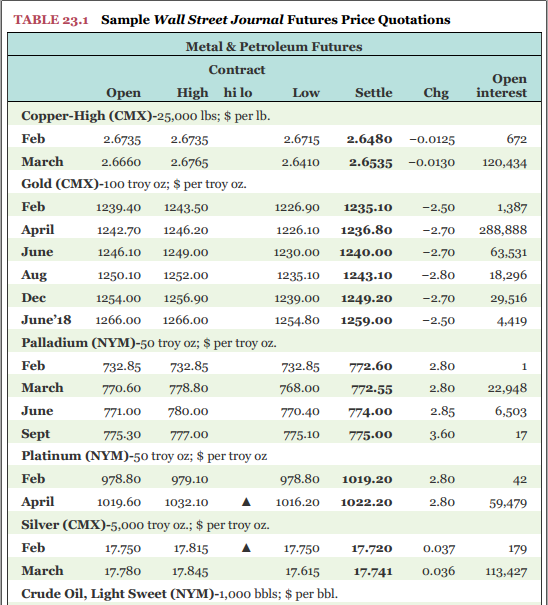

Suppose you sell eight February 2017 silver futures contracts on this day, at the last price of the day. Use Table 23.1 a. What will your profit or loss be if silver prices turn out to be $17.79 per ounce at expiration? (Do not round intermediate calculations. Enter your answer as a positive value rounded to the nearest whole number, e.g., 32.) b. What will your profit or loss be if silver prices are $17.59 per ounce at expiration? (Do not round intermediate calculations. Enter your answer as a positive value rounded to the nearest whole number, e.g., 32.)

Open interest 672 120,434 June TABLE 23.1 Sample Wall Street Journal Futures Price Quotations Metal & Petroleum Futures Contract Open High hilo Low Settle Chg Copper-High (CMX)-25,000 lbs: $ per lb. Feb 2.6735 2.6735 2.6715 2.6480 -0.0125 March 2.6660 2.6765 2.6410 2.6535 -0.0130 Gold (CMX)-100 troy oz; $ per troy oz. Feb 1239.40 1243-50 1226.90 1235.10 -2.50 April 1242.70 1246.20 1226.10 1236.80 -2.70 1246.10 1249.00 1230.00 1240.00 -2.70 Aug 1250.10 1252.00 1235.10 1243.10 -2.80 Dec 1254.00 1256.90 1239.00 1249.20 -2.70 June'18 1266.00 1266.00 1254.80 1259.00 -2.50 Palladium (NYM)-50 troy oz; $ per troy oz. Feb 732.85 732.85 732.85 772.60 2.80 March 770.60 778.80 768.00 772.55 2.80 June 771.00 780.00 770.40 774.00 2.85 Sept 775-30 777.00 775.10 775.00 3.60 Platinum (NYM)-50 troy oz; $ per troy oz Feb 978.80 979.10 978.80 1019.20 2.80 April 1019.60 1032.10 A 1016.20 1022.20 2.80 Silver (CMX)-5,000 troy oz.; $ per troy oz. Feb 17.750 17.815 A 17.750 17.720 0.037 March 17.780 17.845 17.615 17.741 0.036 Crude Oil, Light Sweet (NYM)-1,000 bbls: $ per bbl. 1 ,387 288,888 63,531 18,296 29,516 4,419 22,948 6,503 17 42 59,479 179 113,427Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started