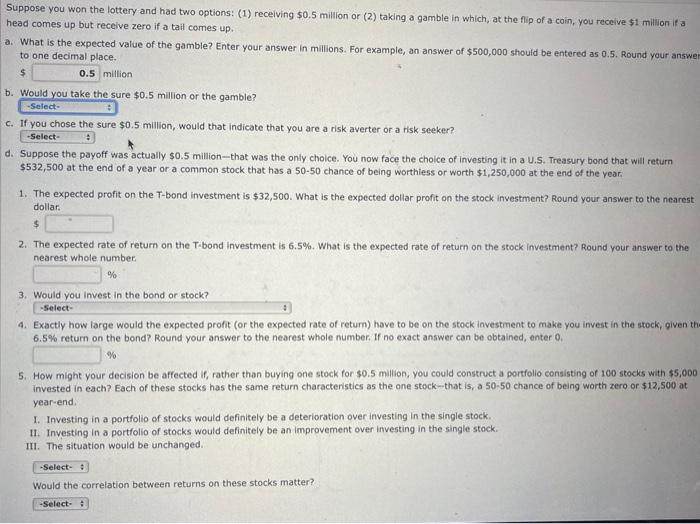

Suppose you won the lottery and had two options: (1) receiving $0.5 million or (2) taking a gamble in which, at the flip of a coin, you receive $1 million if a head comes up but receive zero if a tail comes up. a. What is the expected value of the gamble? Enter your answer in millions. For example, an answer of $500,000 should be entered as 0.5. Round your answer to one decimal place. $ 0.5 million b. Would you take the sure $0.5 million or the gamble? -Select- c. If you chose the sure $0.5 million, would that indicate that you are a risk averter or a risk seeker? -Select- d. Suppose the payoff was actually $0.5 million-that was the only choice. You now face the choice of investing it in a U.S. Treasury bond that will return $532,500 at the end of a year or a common stock that has a 50-50 chance of being worthless or worth $1,250,000 at the end of the year. 1. The expected profit on the T-bond investment is $32,500. What is the expected dollar profit on the stock investment? Round your answer to the nearest dollar. $ 2. The expected rate of return on the T-bond investment is 6.5%. What is the expected rate of return on the stock investment? Round your answer to the nearest whole number. % 3. Would you invest in the bond or stock? -Select- 4. Exactly how large would the expected profit (or the expected rate of return) have to be on the stock investment to make you invest in the stock, given the 6.5% return on the bond? Round your answer to the nearest whole number. If no exact answer can be obtained, enter 0. % 5. How might your decision be affected if, rather than buying one stock for $0.5 million, you could construct a portfolio consisting of 100 stocks with $5,000 invested in each? Each of these stocks has the same return characteristics as the one stock-that is, a 50-50 chance of being worth zero or $12,500 at year-end. I. Investing in a portfolio of stocks would definitely be a deterioration over investing in the single stock.. II. Investing in a portfolio of stocks would definitely be an improvement over investing in the single stock. III. The situation would be unchanged.. -Select- : Would the correlation between returns on these stocks matter? -Select