Answered step by step

Verified Expert Solution

Question

1 Approved Answer

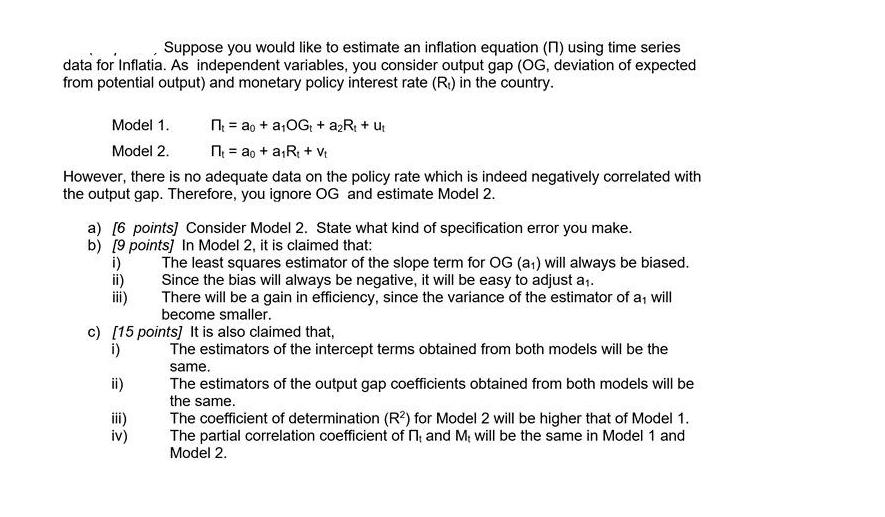

Suppose you would like to estimate an inflation equation (n) using time series data for Inflatia. As independent variables, you consider output gap (OG,

Suppose you would like to estimate an inflation equation (n) using time series data for Inflatia. As independent variables, you consider output gap (OG, deviation of expected from potential output) and monetary policy interest rate (R) in the country. Model 1. = a + aOG + aR + Ut Model 2. = a + aR + Vt However, there is no adequate data on the policy rate which is indeed negatively correlated with the output gap. Therefore, you ignore OG and estimate Model 2. a) [6 points] Consider Model 2. State what kind of specification error you make. b) [9 points] In Model 2, it is claimed that: i) ii) The least squares estimator of the slope term for OG (a) will always be biased. Since the bias will always be negative, it will be easy to adjust a. There will be a gain in efficiency, since the variance of the estimator of a will become smaller. c) [15 points] It is also claimed that, i) ii) iii) iv) The estimators of the intercept terms obtained from both models will be the same. The estimators of the output gap coefficients obtained from both models will be the same. The coefficient of determination (R) for Model 2 will be higher that of Model 1. The partial correlation coefficient of , and M, will be the same in Model 1 and Model 2.

Step by Step Solution

★★★★★

3.32 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a The specification error made in Model 2 is that of omitted variable bias This is due to the fact that we are omitting the output gap variable from t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started