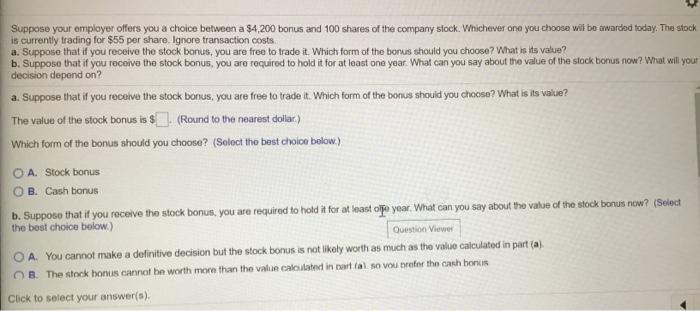

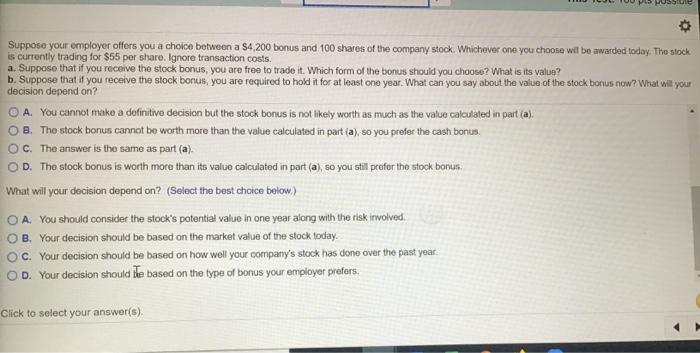

Suppose your employer offers you a choice between a $4,200 bonus and 100 shares of the company stock. Whichever one you choose wil be awarded today. The stock is currently trading for $55 per share. Ignore transaction costs a. Suppose that if you receive the stock bonus, you are free to trade it. Which form of the bonus should you choose? What is its value? b. Suppose that if you receive the stock bonus, you are required to hold it for at least one year. What can you say about the value of the stock bonus now? What will your decision dopond on? a. Suppose that if you receive the stock bonus, you are free to trade it. Which form of the bonus should you choose? What is its value? The value of the stock bonus is $. (Round to the nearest dollar) Which form of the bonus should you choose? (Select the best choice below) O A. Stock bonus OB. Cash bonus b. Suppose that if you receive the stock bonus, you are required to hold it for at least ofje year. What can you say about the value of the stock bonus now? (Select the best choice below.) Question Viewer O A. You cannot make a definitive decision but the stock bonus is not likely worth as much as the value calculated in part (a) B. The stock bonus cannot be worth more than the value calculated in partial so vou prefer the cash bonus Click to select your answer(s) PHASE Suppose your employer offers you a choice between a $4,200 bonus and 100 shares of the company stock. Whichever one you choose wit be awarded today. The stock is currently trading for $55 per share. Ignore transaction costs. a. Suppose that if you receive the stock bonus, you are free to trade it. Which form of the bonus should you choose? What is its value? b. Suppose that if you receive the stock bonus, you are required to hold it for at least one year. What can you say about the value of the stock bonus now? What will your decision depend on? A. You cannot make a definitive decision but the stock bonus is not likely worth as much as the value calculated in part (a). OB. The stock bonus cannot be worth more than the value calculated in part (a), so you prefer the cash bonus. C. The answer is the same as part (a). OD. The stock bonus is worth more than its value calculated in part (a), so you still prefer the stock bonus. What will your decision depend on? (Select the best choice below) A. You should consider the stock's potential value in one year along with the risk irwolved. B. Your decision should be based on the market value of the stock today. OC. Your decision should be based on how well your company's stock has done over the past year. OD. Your decision should be based on the type of bonus your employer prefers. Click to select your answer(s)