Answered step by step

Verified Expert Solution

Question

1 Approved Answer

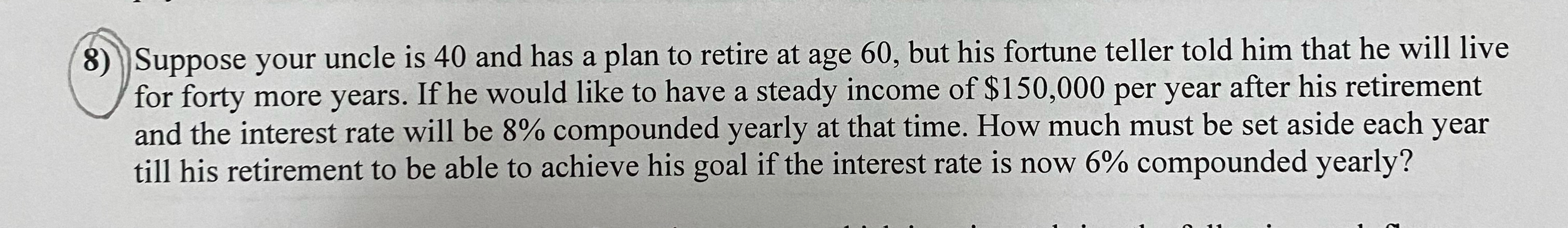

Suppose your uncle is 4 0 and has a plan to retire at age 6 0 , but his fortune teller told him that he

Suppose your uncle is and has a plan to retire at age but his fortune teller told him that he will live for forty more years. If he would like to have a steady income of $ per year after his retirement and the interest rate will be compounded yearly at that time. How much must be set aside each year till his retirement to be able to achieve his goal if the interest rate is now compounded yearly?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started