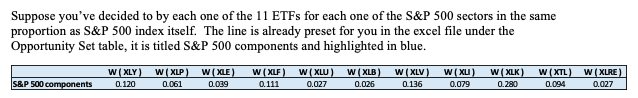

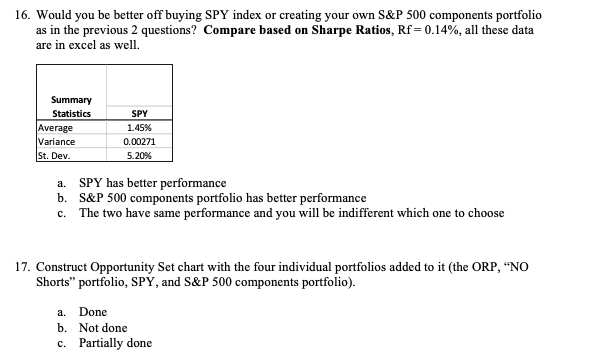

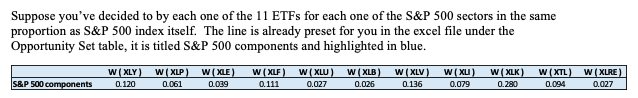

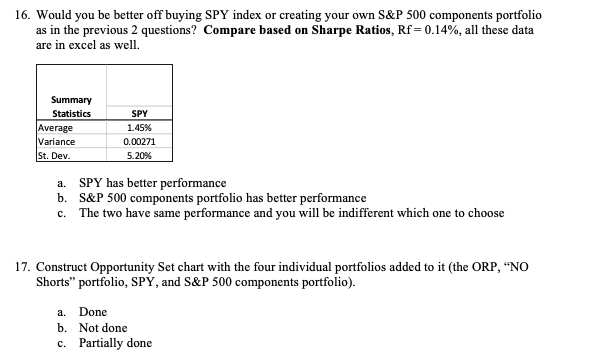

Suppose you've decided to by each one of the 11 ETFs for each one of the S&P 500 sectors in the same proportion as S&P 500 index itself. The line is already preset for you in the excel file under the Opportunity Set table, it is titled S&P 500 components and highlighted in blue. W(XLY) 0.120 WXLP 0.061 W(XLE) 0.039 W(XLF) 0.111 W(XLU) 0.027 W(XLB) 0.026 W(XLV) 0.136 w (XL) 0.079 W(XL) 0.280 w (XL) 0.094 WXLRE 0.027 S&P 500 components 16. Would you be better off buying SPY index or creating your own S&P 500 components portfolio as in the previous 2 questions? Compare based on Sharpe Ratios, Rf = 0.14%, all these data are in excel as well. Summary Statistics Average Variance St. Dev. SPY 1.45% 0.00271 5.20% a. SPY has better performance b. S&P 500 components portfolio has better performance c. The two have same performance and you will be indifferent which one to choose 17. Construct Opportunity Set chart with the four individual portfolios added to it (the ORP, "NO Shorts" portfolio, SPY, and S&P 500 components portfolio). a. Done b. Not done c. Partially done Suppose you've decided to by each one of the 11 ETFs for each one of the S&P 500 sectors in the same proportion as S&P 500 index itself. The line is already preset for you in the excel file under the Opportunity Set table, it is titled S&P 500 components and highlighted in blue. W(XLY) 0.120 WXLP 0.061 W(XLE) 0.039 W(XLF) 0.111 W(XLU) 0.027 W(XLB) 0.026 W(XLV) 0.136 w (XL) 0.079 W(XL) 0.280 w (XL) 0.094 WXLRE 0.027 S&P 500 components 16. Would you be better off buying SPY index or creating your own S&P 500 components portfolio as in the previous 2 questions? Compare based on Sharpe Ratios, Rf = 0.14%, all these data are in excel as well. Summary Statistics Average Variance St. Dev. SPY 1.45% 0.00271 5.20% a. SPY has better performance b. S&P 500 components portfolio has better performance c. The two have same performance and you will be indifferent which one to choose 17. Construct Opportunity Set chart with the four individual portfolios added to it (the ORP, "NO Shorts" portfolio, SPY, and S&P 500 components portfolio). a. Done b. Not done c. Partially done