Question

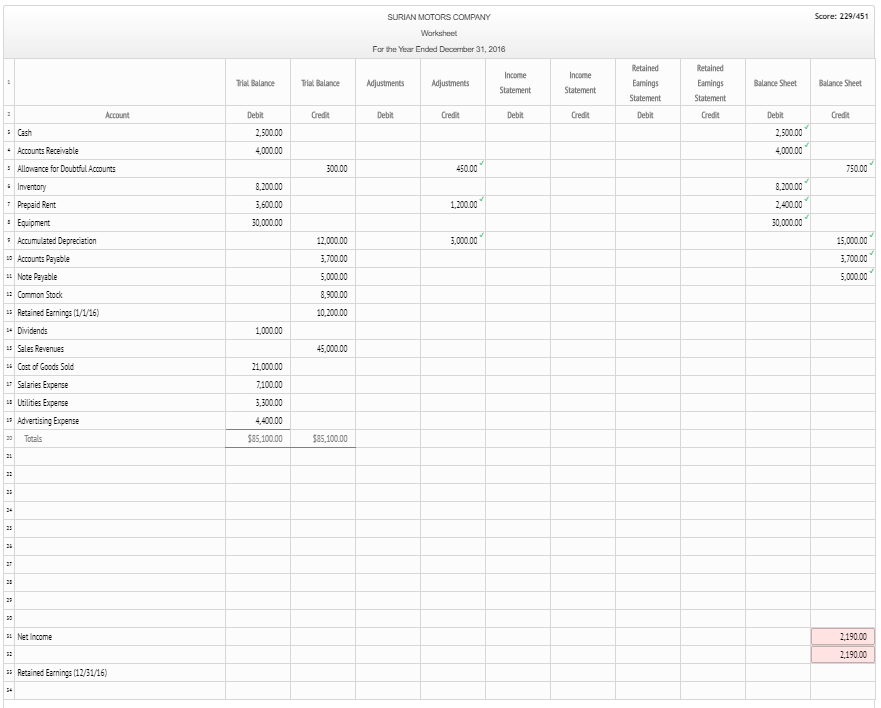

Surian Motors Company prepared a trial balance on the following partially completed worksheet for the year ended December 31, 2016: SURIAN MOTORS COMPANY Worksheet For

Surian Motors Company prepared a trial balance on the following partially completed worksheet for the year ended December 31, 2016:

| SURIAN MOTORS COMPANY |

| Worksheet |

| For the Year Ended December 31, 2016 |

| 1 | Trial Balance | Trial Balance | Adjustments | Adjustments | Income Statement | Income Statement | Retained Earnings Statement | Retained Earnings Statement | Balance Sheet | Balance Sheet | |

| 2 | Account | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit |

| 3 | Cash | 2,500.00 | |||||||||

| 4 | Accounts Receivable | 4,000.00 | |||||||||

| 5 | Allowance for Doubtful Accounts | 300.00 | |||||||||

| 6 | Inventory | 8,200.00 | |||||||||

| 7 | Prepaid Rent | 3,600.00 | |||||||||

| 8 | Equipment | 30,000.00 | |||||||||

| 9 | Accumulated Depreciation | 12,000.00 | |||||||||

| 10 | Accounts Payable | 3,700.00 | |||||||||

| 11 | Note Payable | 5,000.00 | |||||||||

| 12 | Common Stock | 8,900.00 | |||||||||

| 13 | Retained Earnings (1/1/16) | 10,200.00 | |||||||||

| 14 | Dividends | 1,000.00 | |||||||||

| 15 | Sales Revenues | 45,000.00 | |||||||||

| 16 | Cost of Goods Sold | 21,000.00 | |||||||||

| 17 | Salaries Expense | 7,100.00 | |||||||||

| 18 | Utilities Expense | 3,300.00 | |||||||||

| 19 | Advertising Expense | 4,400.00 | |||||||||

| 20 | Totals | $85,100.00 | $85,100.00 |

Additional information: (a) The equipment is being depreciated on a straight-line basis over a 10-year life, with no residual value; (b) salaries accrued but not recorded total $500; (c) on January 1, 2016, the company had paid 3 years rent in advance at $100 per month; (d) bad debts are expected to be 1% of total sales; (e) interest of $400 has accrued on the note payable (the note payable is due on July 1, 2017); and (f) the income tax rate is 40% on current income and will be paid in the first quarter of 2017.

I have finished everything EXCEPT for the worksheet. I have posted this question before and they were not able to do the worksheet right which is why I am now providing a screenshot. Please help.

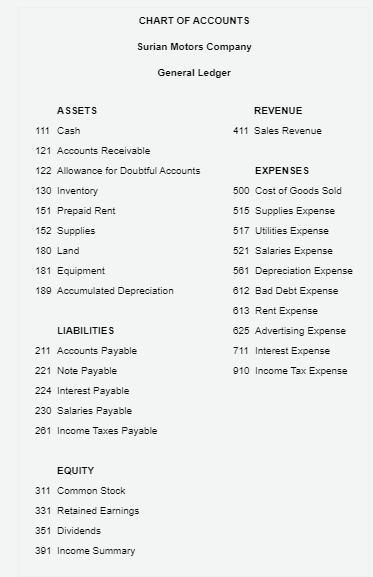

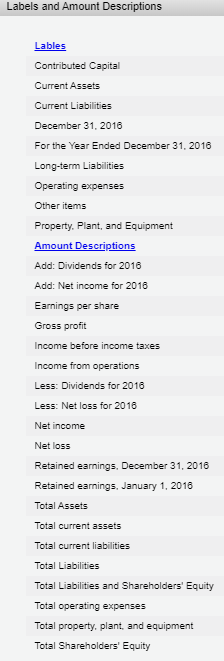

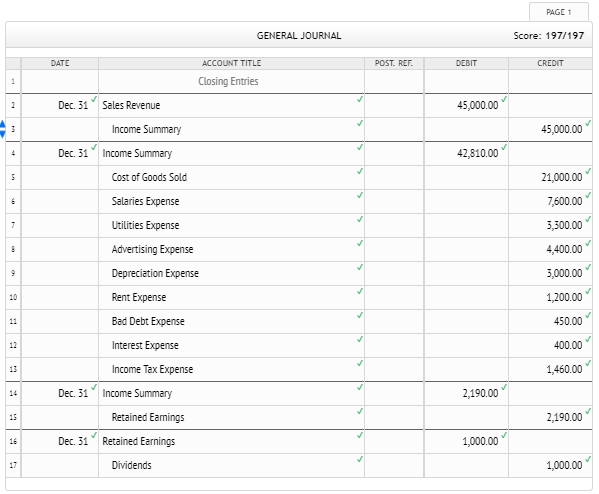

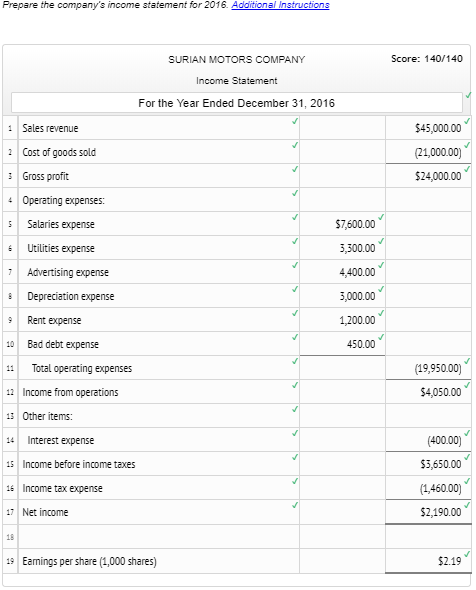

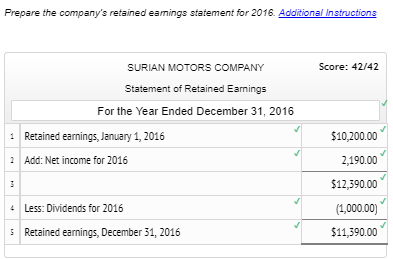

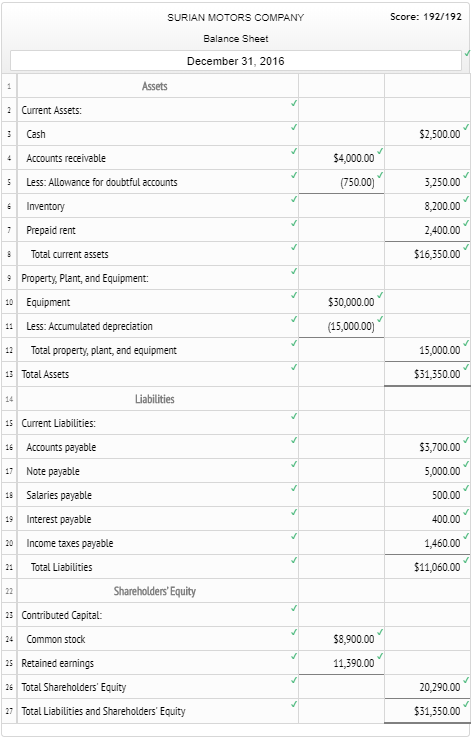

CHART OF ACCOUNTS Surian Motors Company General Ledger REVENUE 411 Sales Revenue ASSETS 111 Cash 121 Accounts Receivable 122 Allowance for Doubtful Accounts 130 Inventory 151 Prepaid Rent 152 Supplies 180 Land 181 Equipment 189 Accumulated Depreciation EXPENSES 500 Cost of Goods Sold 515 Supplies Expense 517 Utilities Expense 521 Salaries Expense 561 Depreciation Expense 612 Bad Debt Expense 613 Rent Expense 625 Advertising Expense 711 Interest Expense 910 Income Tax Expense LIABILITIES 211 Accounts Payable 221 Note Payable 224 Interest Payable 230 Salaries Payable 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings 351 Dividends 391 Income Summary Labels and Amount Descriptions Lables Contributed Capital Current Assets Current Liabilities December 31, 2016 For the Year Ended December 31, 2016 Long-term Liabilities Operating expenses Other items Property. Plant, and Equipment Amount Descriptions Add: Dividends for 2016 Add: Net income for 2016 Earnings per share Gross profit Income before income taxes Income from operations Less: Dividends for 2016 Less: Net loss for 2016 Net income Net loss Retained earnings. December 31, 2016 Retained earnings, January 1, 2016 Total Assets Total current assets Total current liabilities Total Liabilities Total Liabilities and Shareholders' Equity Total operating expenses Total property, plant, and equipment Total Shareholders' Equity PAGE 1 GENERAL JOURNAL Score: 197/197 DATE POST. REF. DEBIT CREDIT ACCOUNT TITLE Closing Entries 45,000.00 Dec. 31 Sales Revenue Income Summary 45,000.00 Dec. 31 42,810.00 Income Summary Cost of Goods Sold Salaries Expense Utilities Expense Advertising Expense Depreciation Expense Rent Expense Bad Debt Expense Interest Expense 21,000.00 7,600.00 5,300.00 4,400.00 3,000.00 1,200.00 450.00 400.00 1,460.00 Income Tax Expense 2,190.00 2,190.00 Dec. 31 Income Summary Retained Earnings Dec. 31 Retained Earnings Dividends 1,000.00 1,000.00 Prepare the company's income statement for 2016. Additional Instructions Score: 140/140 SURIAN MOTORS COMPANY Income Statement For the Year Ended December 31, 2016 Sales revenue Cost of goods sold $45,000.00 (21,000.00) $24,000.00 Gross profit Operating expenses: Salaries expense Utilities expense Advertising expense $7,600.00 3,300.00 4,400.00 3,000.00 1,200.00 450.00 Depreciation expense Rent expense Bad debt expense Total operating expenses (19,950.00) $4,050.00 12 Income from operations 13 Other items: Interest expense 15 Income before income taxes (400.00) $5,650.00 (1.460.00) $2,190.00 16 Income tax expense 17 Net income 19 Earnings per share 1,000 shares) $2.19 Prepare the company's retained earnings statement for 2016. Additional Instructions Score: 42/42 SURIAN MOTORS COMPANY Statement of Retained Earnings For the Year Ended December 31, 2016 Retained earnings, January 1, 2016 Add: Net income for 2016 $10,200.00 2,190.00 $13,390.00 (1,000.00) $11,390.00 Less: Dividends for 2016 Retained earnings, December 31, 2016 SURIAN MOTORS COMPANY Score: 192/192 Balance Sheet December 31, 2016 Assets 2 Current Assets: Cash $2,500.00 Accounts receivable $4,000.00 (750.00) Less: Allowance for doubtful accounts Inventory 3,250.00 8,200.00 2,400.00 $16,350.00 Prepaid rent Total current assets 9 Property, Plant, and Equipment: 10 Equipment $30,000.00 (15,000.00) 11 12 Less: Accumulated depreciation Total property, plant, and equipment 15,000.00 $31,350.00 13 Total Assets Liabilities 15 Current Liabilities: 16 Accounts payable 17 Note payable 18 Salaries payable $3,700.00 5,000.00 500.00 400.00 1,460.00 $11,060.00 19 Interest payable 20 Income taxes payable Total Liabilities Shareholders' Equity 23 Contributed Capital: Common stock $8,900.00 11,390.00 25 Retained earnings 26 Total Shareholders' Equity 20,290.00 $31,350.00 27 Total Liabilities and Shareholders' Equity Score: 229/451 SURIAN MOTORS COMPANY Worksheet For the Year Ended December 31, 2016 Trial Balance Trial Balance Adjustments Adjustments Income Statement Income Statement Retained Earnings Statement Balance Sheet Balance Sheet Retained Earnings Statement Credit Account Debit Credit Debit Credit Debit Credit Debit Debat Credit Cash 2,500.00 4,000.00 2,500.00 4,000.00 - Accounts Receivable : Allowance for Doubtful Accounts - Inventory 300.00 450.00 750.00 - Prepaid Rent 8,200.00 5,600.00 30,000.00 1,200.00 8.200.00 2.400.00 30,000.00 Equipment Accumulated Depreciation 3,000.00 12,000.00 5,700.00 5,000.00 8.900.00 10,200.00 15,000.00 5,700.00 5,000.00 -Accounts Payable -- Note Payable - Common Stock - Retained Earnings (1/1/16) Dividends - Sales Revenues - Cost of Goods Sold 1,000.00 45,000.00 21,000.00 7,100.00 Salaries Expense 15 Utilities Expense - Advertising Expense Totals 5,300.00 4,400.00 585,100.00 585,100.00 . Net Income 2,190.00 2,190.00 - Retained Earnings (12/31/16)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started