Answered step by step

Verified Expert Solution

Question

1 Approved Answer

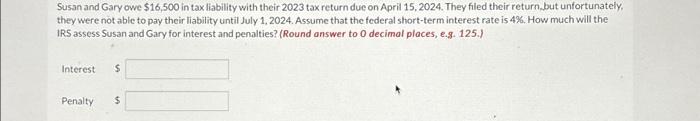

Susan and Gary owe $16,500 in tax liability with their 2023 tax return due on April 15, 2024. They filed their return, but unfortunately, they

Susan and Gary owe $16,500 in tax liability with their 2023 tax return due on April 15, 2024. They filed their return, but unfortunately, they were not able to pay their liability until July 1, 2024. Assume that the federal short-term interest rate is 4%. How much will the IRS assess Susan and Gary for interest and penalties? (Round answer to 0 decimal places, e.g. 125.) Interest Penalty LA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started