Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Susan operates a home-based business that designs clothing for children. Her most popular product is a very durable and stylish raincoat. The coat sells

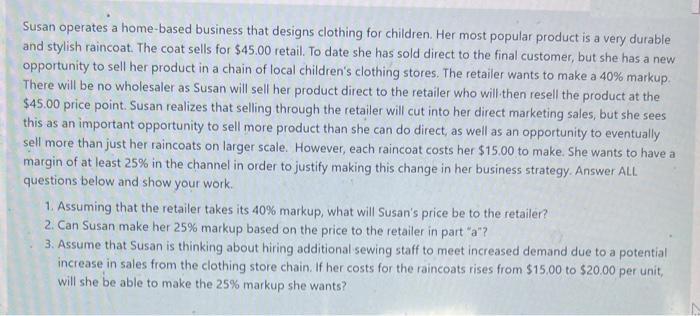

Susan operates a home-based business that designs clothing for children. Her most popular product is a very durable and stylish raincoat. The coat sells for $45.00 retail. To date she has sold direct to the final customer, but she has a new opportunity to sell her product in a chain of local children's clothing stores. The retailer wants to make a 40% markup. There will be no wholesaler as Susan will sell her product direct to the retailer who will then resell the product at the $45.00 price point. Susan realizes that selling through the retailer will cut into her direct marketing sales, but she sees this as an important opportunity to sell more product than she can do direct, as well as an opportunity to eventually sell more than just her raincoats on larger scale. However, each raincoat costs her $15.00 to make. She wants to have a margin of at least 25% in the channel in order to justify making this change in her business strategy. Answer ALL questions below and show your work. 1. Assuming that the retailer takes its 40% markup, what will Susan's price be to the retailer? 2. Can Susan make her 25% markup based on the price to the retailer in part "a"? 3. Assume that Susan is thinking about hiring additional sewing staff to meet increased demand due to a potential increase in sales from the clothing store chain. If her costs for the raincoats rises from $15.00 to $20.00 per unit, will she be able to make the 25% markup she wants?

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

STEP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started