Answered step by step

Verified Expert Solution

Question

1 Approved Answer

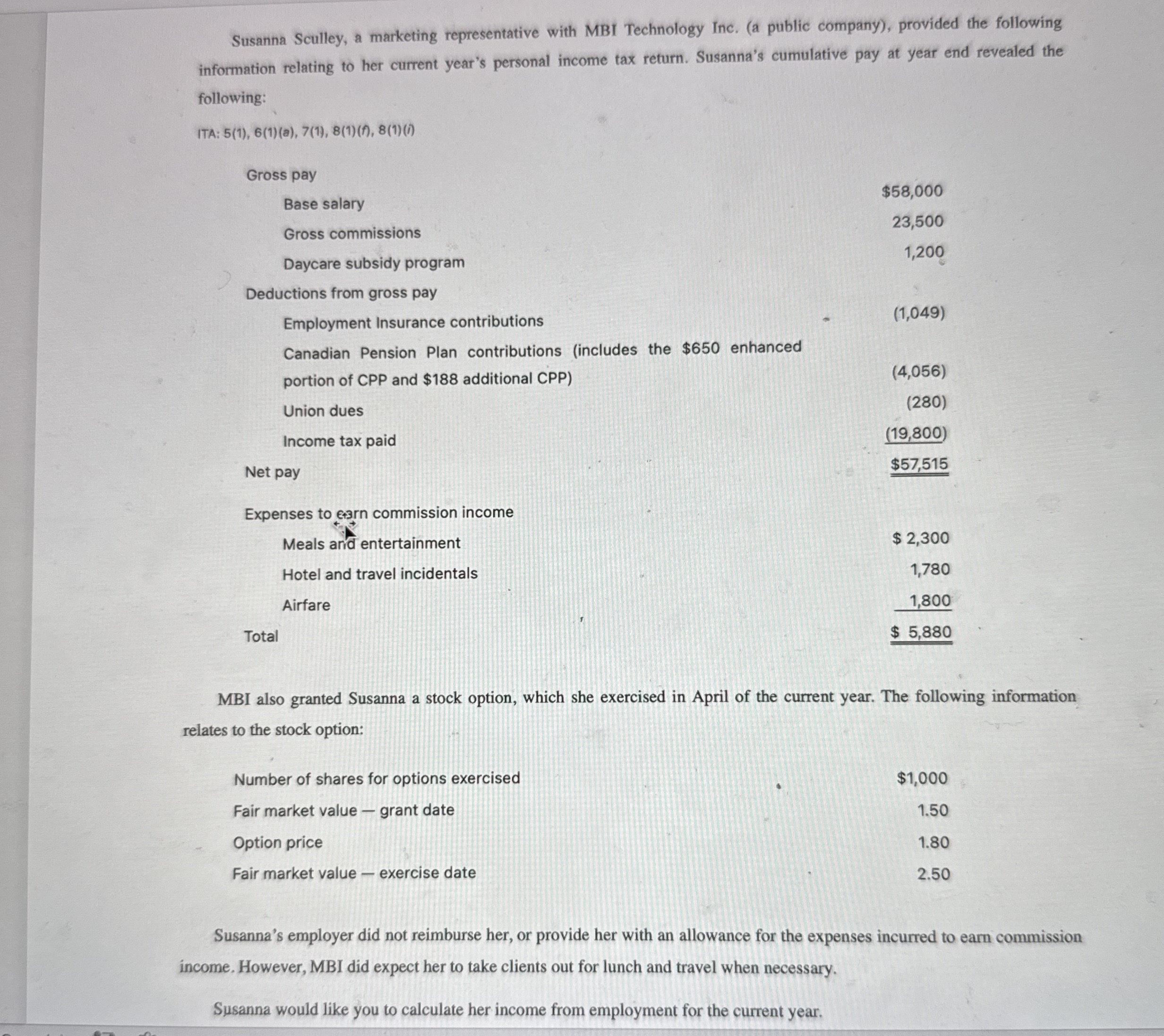

Susanna Sculley, a marketing representative with MBI Technology Inc. ( a public company ) , provided the following information relating to her current year's personal

Susanna Sculley, a marketing representative with MBI Technology Inc. a public company provided the following

information relating to her current year's personal income tax return. Susanna's cumulative pay at year end revealed the

following:

ITA: i

MBI also granted Susanna a stock option, which she exercised in April of the current year. The following information

relates to the stock option:

Number of shares for options exercised

Fair market value grant date

Option price

Fair market value exercise date

$

Susanna's employer did not reimburse her, or provide her with an allowance for the expenses incurred to earn commission

income. However, MBI did expect her to take clients out for lunch and travel when necessary.

Susanna would like you to calculate her income from employment for the current year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started