Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SV Ltd. manufactures a product which is oblained basically from a series of mixing operations. The finished product is packaged in the company-made glass bottles

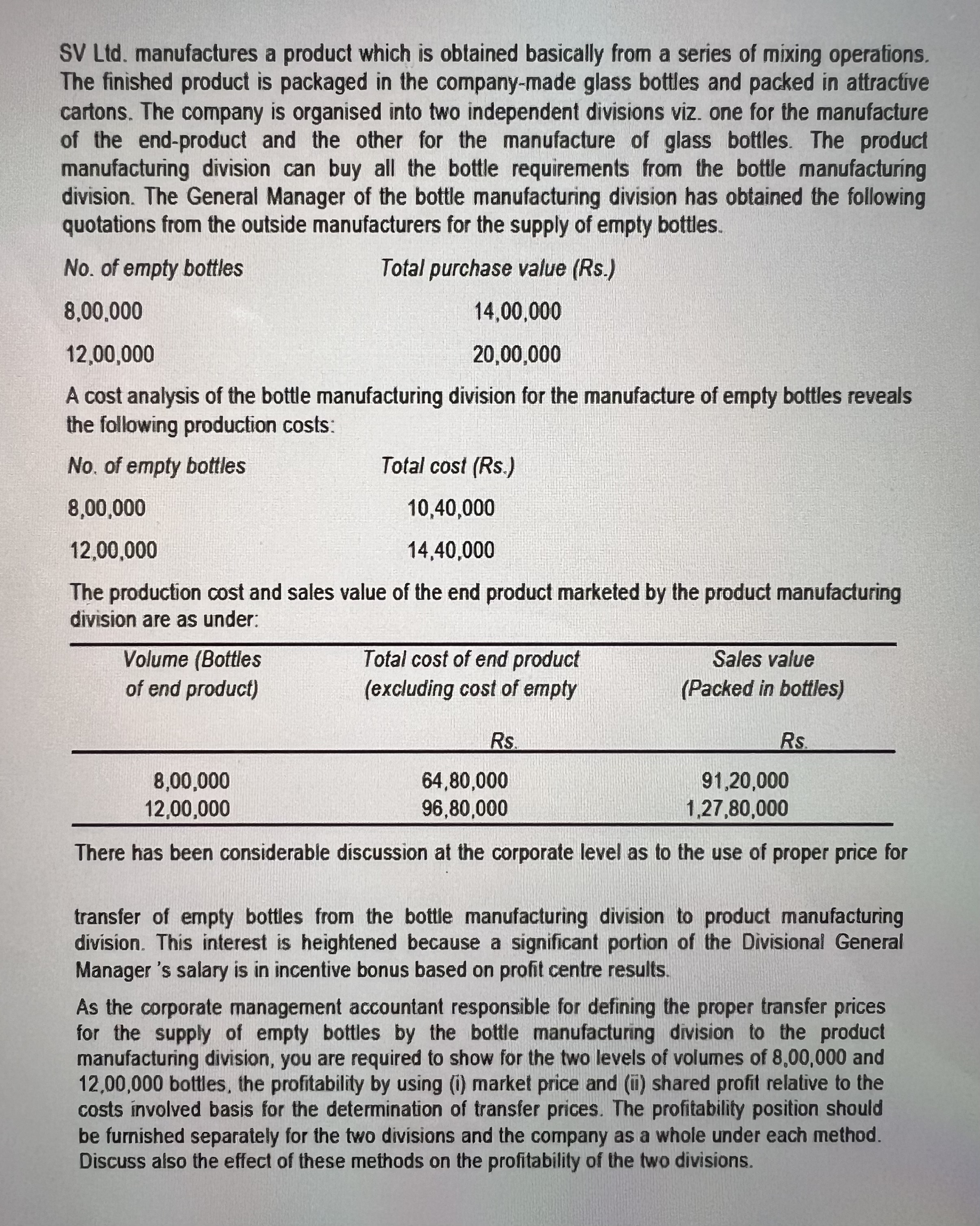

SV Ltd. manufactures a product which is oblained basically from a series of mixing operations. The finished product is packaged in the company-made glass bottles and packed in attractive cartons. The company is organised into two independent divisions viz. one for the manufacture of the end-product and the other for the manufacture of glass bottles. The product manufacturing division can buy all the bottle requirements from the bottle manufacturing division. The General Manager of the bottle manufacturing division has obtained the following quotations from the outside manufacturers for the supply of empty bottles. A cost analysis of the bottle manufacturing division for the manufacture of empty bottles reveals the following production costs: The production cost and sales value of the end product marketed by the product manufacturing division are as under: There has been considerable discussion at the corporate level as to the use of proper price for transfer of empty bottles from the bottle manufacturing division to product manufacturing division. This interest is heightened because a significant portion of the Divisional General Manager 's salary is in incentive bonus based on profit centre results. As the corporate management accountant responsible for defining the proper transfer prices for the supply of empty bottles by the bottle manufacturing division to the product manufacturing division, you are required to show for the two levels of volumes of 8,00,000 and 12,00,000 bottles, the profitability by using (i) market price and (ii) shared profit relative to the costs involved basis for the determination of transfer prices. The profitability position should be furnished separately for the two divisions and the company as a whole under each method. Discuss also the effect of these methods on the profitability of the two divisions

SV Ltd. manufactures a product which is oblained basically from a series of mixing operations. The finished product is packaged in the company-made glass bottles and packed in attractive cartons. The company is organised into two independent divisions viz. one for the manufacture of the end-product and the other for the manufacture of glass bottles. The product manufacturing division can buy all the bottle requirements from the bottle manufacturing division. The General Manager of the bottle manufacturing division has obtained the following quotations from the outside manufacturers for the supply of empty bottles. A cost analysis of the bottle manufacturing division for the manufacture of empty bottles reveals the following production costs: The production cost and sales value of the end product marketed by the product manufacturing division are as under: There has been considerable discussion at the corporate level as to the use of proper price for transfer of empty bottles from the bottle manufacturing division to product manufacturing division. This interest is heightened because a significant portion of the Divisional General Manager 's salary is in incentive bonus based on profit centre results. As the corporate management accountant responsible for defining the proper transfer prices for the supply of empty bottles by the bottle manufacturing division to the product manufacturing division, you are required to show for the two levels of volumes of 8,00,000 and 12,00,000 bottles, the profitability by using (i) market price and (ii) shared profit relative to the costs involved basis for the determination of transfer prices. The profitability position should be furnished separately for the two divisions and the company as a whole under each method. Discuss also the effect of these methods on the profitability of the two divisions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started