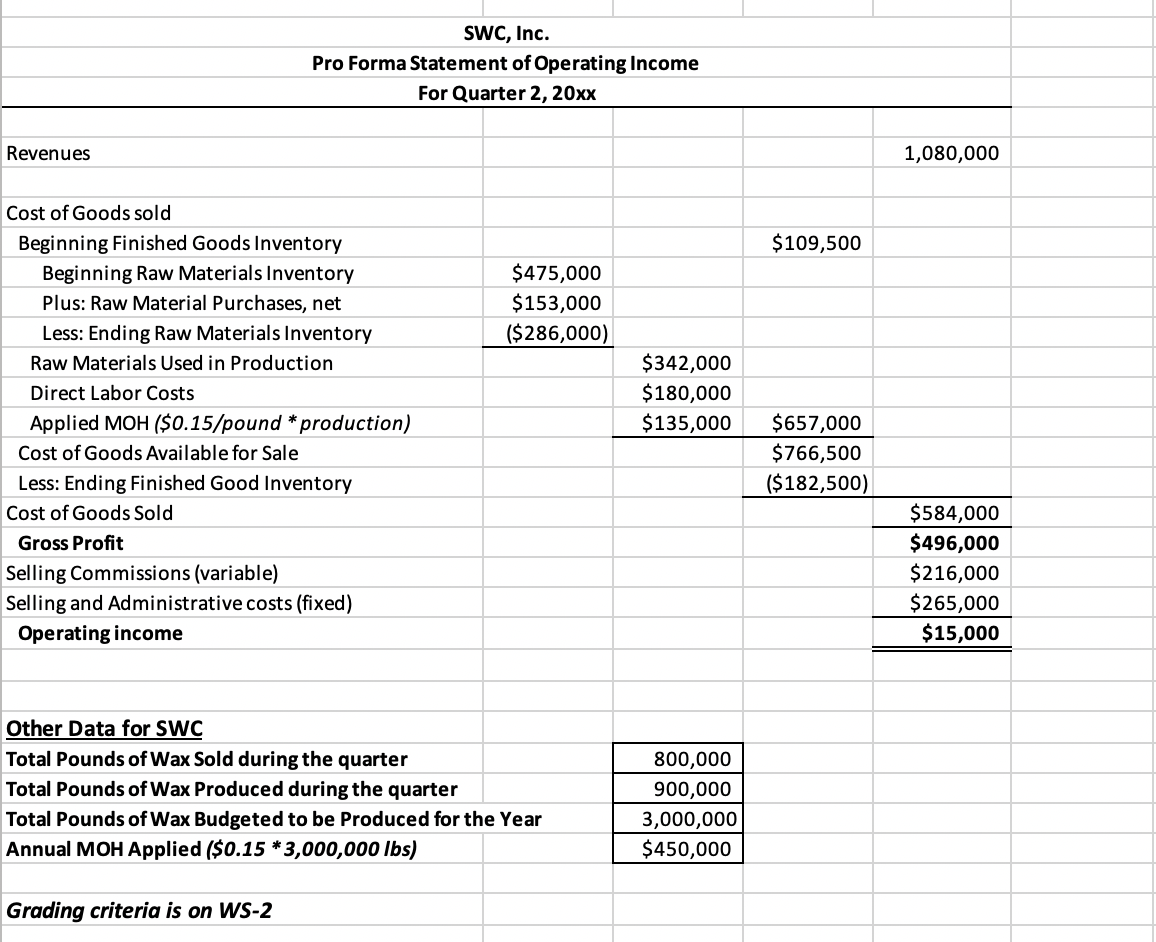

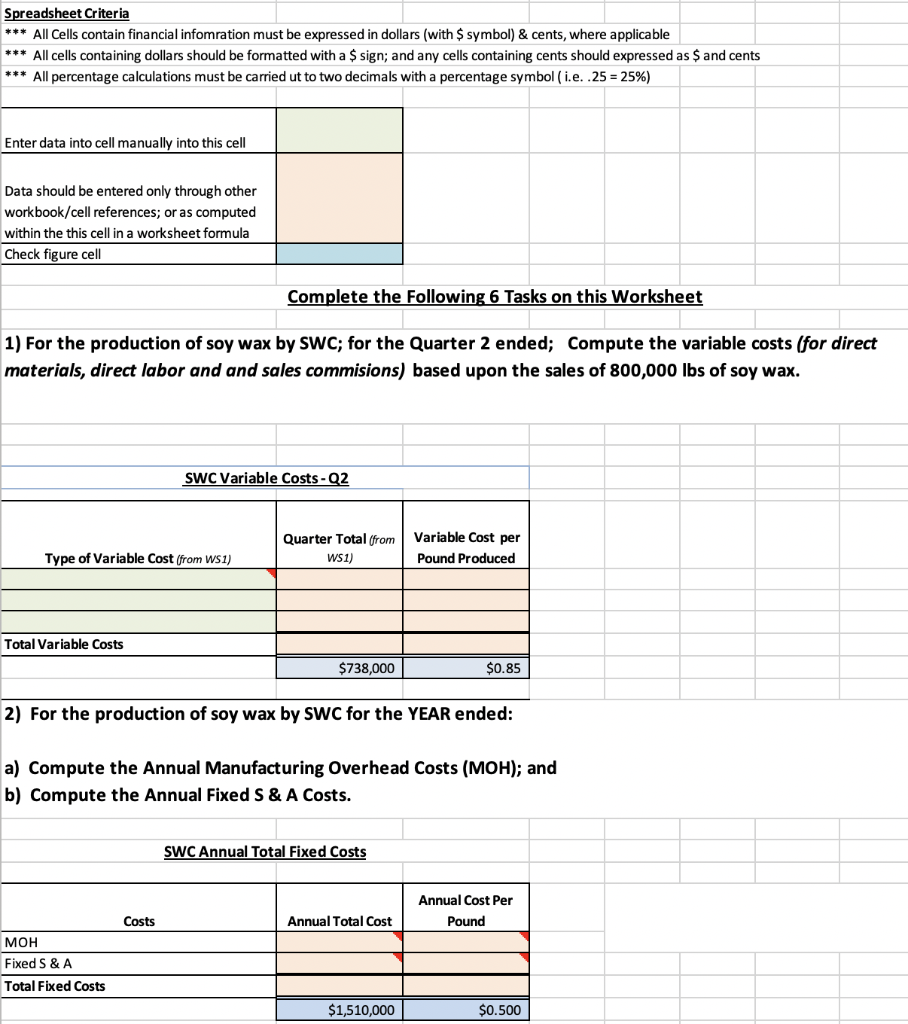

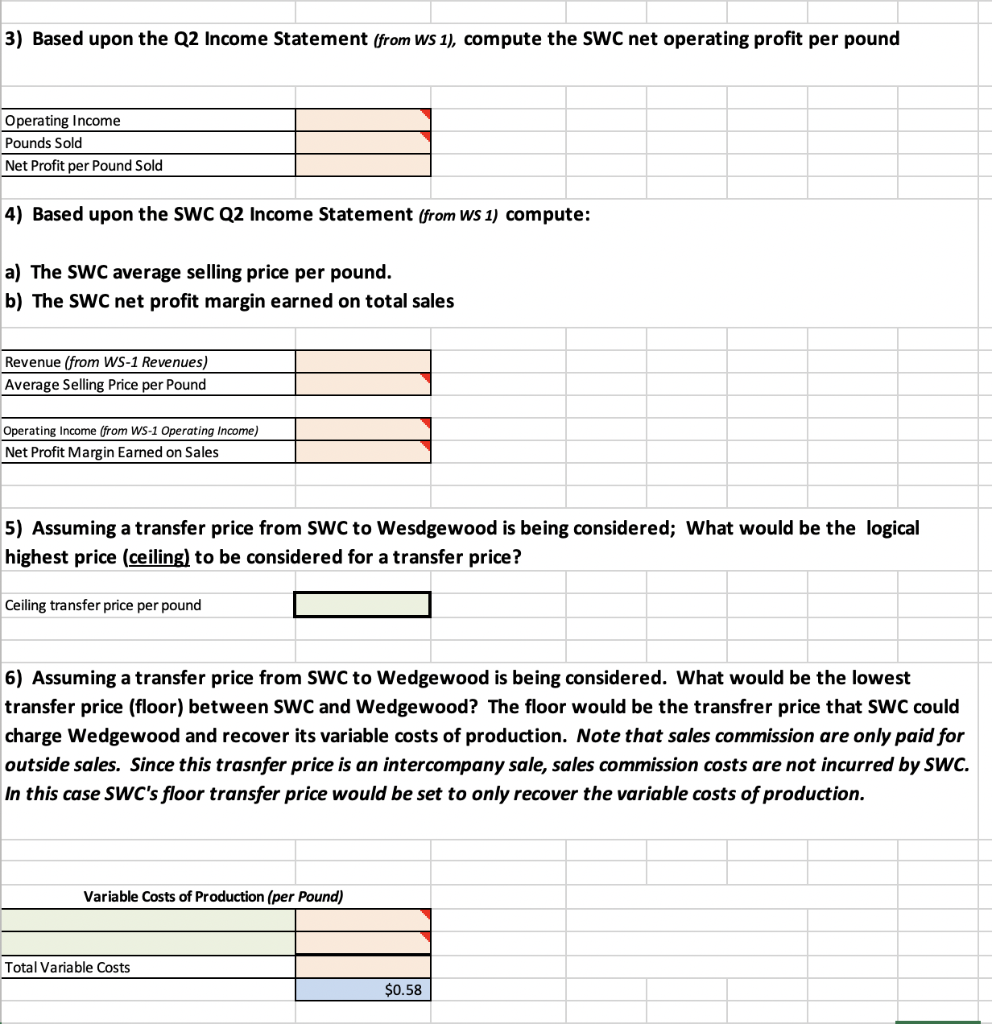

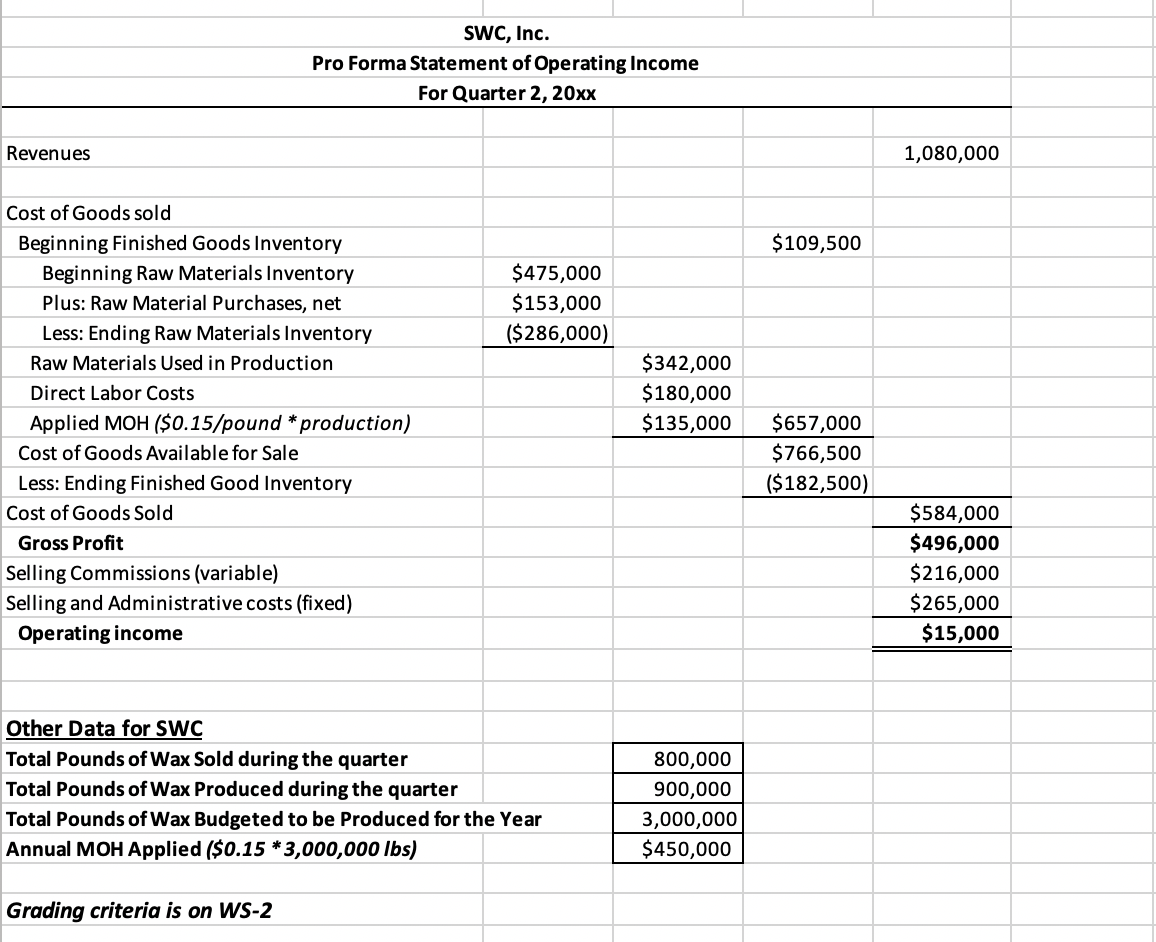

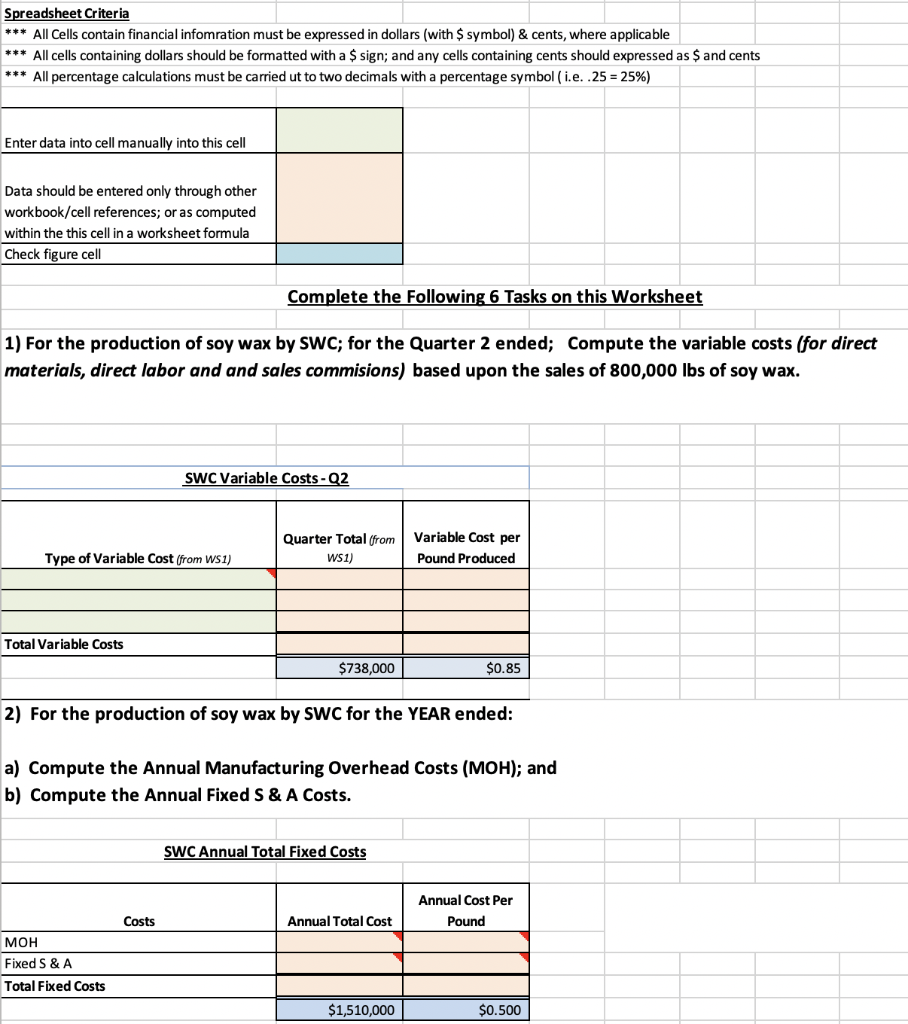

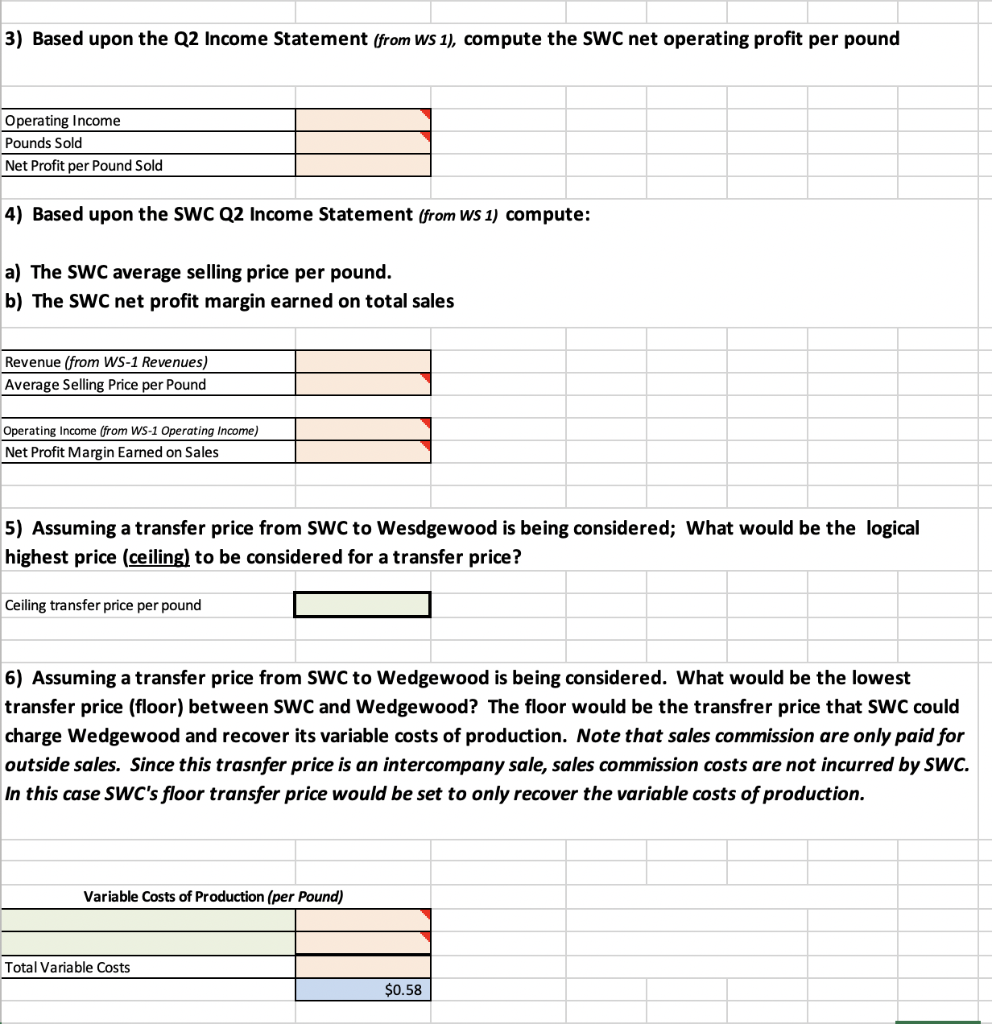

SWC, Inc. Pro Forma Statement of Operating Income For Quarter 2, 20xx Revenues 1,080,000 $109,500 $475,000 $153,000 ($286,000) Cost of Goods sold Beginning Finished Goods Inventory Beginning Raw Materials Inventory Plus: Raw Material Purchases, net Less: Ending Raw Materials Inventory Raw Materials Used in Production Direct Labor Costs Applied MOH ($0.15/pound * production) Cost of Goods Available for Sale Less: Ending Finished Good Inventory Cost of Goods Sold Gross Profit Selling Commissions (variable) Selling and Administrative costs (fixed) Operating income $342,000 $180,000 $135,000 $657,000 $766,500 ($182,500) $584,000 $496,000 $216,000 $265,000 $15,000 Other Data for SWC Total Pounds of Wax Sold during the quarter Total Pounds of Wax Produced during the quarter Total Pounds of Wax Budgeted to be Produced for the Year Annual MOH Applied ($0.15 * 3,000,000 lbs) 800,000 900,000 3,000,000 $450,000 Grading criteria is on WS-2 Spreadsheet Criteria *** All Cells contain financial infomration must be expressed in dollars (with $ symbol) & cents, where applicable *** All cells containing dollars should be formatted with a $ sign; and any cells containing cents should expressed as $ and cents *** All percentage calculations must be carried ut to two decimals with a percentage symbol (i...25 = 25%) Enter data into cell manually into this cell Data should be entered only through other workbook/cell references; or as computed within the this cell in a worksheet formula Check figure cell Complete the following 6 Tasks on this worksheet 1) For the production of soy wax by SWC; for the Quarter 2 ended; Compute the variable costs (for direct materials, direct labor and and sales commisions) based upon the sales of 800,000 lbs of soy wax. SWC Variable Costs - Q2 Quarter Total (from WS1) Variable Cost per Pound Produced Type of Variable Cost (from WS1) Total Variable Costs $738,000 $0.85 2) For the production of soy wax by SWC for the YEAR ended: a) Compute the Annual Manufacturing Overhead Costs (MOH); and b) Compute the Annual Fixed S & A Costs. SWC Annual Total Fixed Costs Costs Annual Cost Per Pound Annual Total Cost MOH Fixed S & A Total Fixed Costs $1,510,000 $0.500 3) Based upon the Q2 Income Statement (from WS 1), compute the SWC net operating profit per pound Operating Income Pounds Sold Net Profit per Pound Sold 4) Based upon the SWC Q2 Income Statement (from WS 1) compute: a) The SWC average selling price per pound. b) The SWC net profit margin earned on total sales Revenue (from WS-1 Revenues) Average Selling Price per Pound Operating Income (from WS-1 Operating Income) Net Profit Margin Earned on Sales 5) Assuming a transfer price from SWC to Wesdgewood is being considered; What would be the logical highest price (ceiling) to be considered for a transfer price? Ceiling transfer price per pound 6) Assuming a transfer price from SWC to Wedgewood is being considered. What would be the lowest transfer price (floor) between SWC and Wedgewood? The floor would be the transfrer price that SWC could charge Wedgewood and recover its variable costs of production. Note that sales commission are only paid for outside sales. Since this trasnfer price is an intercompany sale, sales commission costs are not incurred by SWC. In this case SWC's floor transfer price would be set to only recover the variable costs of production. Variable costs of Production (per Pound) Total Variable Costs $0.58 SWC, Inc. Pro Forma Statement of Operating Income For Quarter 2, 20xx Revenues 1,080,000 $109,500 $475,000 $153,000 ($286,000) Cost of Goods sold Beginning Finished Goods Inventory Beginning Raw Materials Inventory Plus: Raw Material Purchases, net Less: Ending Raw Materials Inventory Raw Materials Used in Production Direct Labor Costs Applied MOH ($0.15/pound * production) Cost of Goods Available for Sale Less: Ending Finished Good Inventory Cost of Goods Sold Gross Profit Selling Commissions (variable) Selling and Administrative costs (fixed) Operating income $342,000 $180,000 $135,000 $657,000 $766,500 ($182,500) $584,000 $496,000 $216,000 $265,000 $15,000 Other Data for SWC Total Pounds of Wax Sold during the quarter Total Pounds of Wax Produced during the quarter Total Pounds of Wax Budgeted to be Produced for the Year Annual MOH Applied ($0.15 * 3,000,000 lbs) 800,000 900,000 3,000,000 $450,000 Grading criteria is on WS-2 Spreadsheet Criteria *** All Cells contain financial infomration must be expressed in dollars (with $ symbol) & cents, where applicable *** All cells containing dollars should be formatted with a $ sign; and any cells containing cents should expressed as $ and cents *** All percentage calculations must be carried ut to two decimals with a percentage symbol (i...25 = 25%) Enter data into cell manually into this cell Data should be entered only through other workbook/cell references; or as computed within the this cell in a worksheet formula Check figure cell Complete the following 6 Tasks on this worksheet 1) For the production of soy wax by SWC; for the Quarter 2 ended; Compute the variable costs (for direct materials, direct labor and and sales commisions) based upon the sales of 800,000 lbs of soy wax. SWC Variable Costs - Q2 Quarter Total (from WS1) Variable Cost per Pound Produced Type of Variable Cost (from WS1) Total Variable Costs $738,000 $0.85 2) For the production of soy wax by SWC for the YEAR ended: a) Compute the Annual Manufacturing Overhead Costs (MOH); and b) Compute the Annual Fixed S & A Costs. SWC Annual Total Fixed Costs Costs Annual Cost Per Pound Annual Total Cost MOH Fixed S & A Total Fixed Costs $1,510,000 $0.500 3) Based upon the Q2 Income Statement (from WS 1), compute the SWC net operating profit per pound Operating Income Pounds Sold Net Profit per Pound Sold 4) Based upon the SWC Q2 Income Statement (from WS 1) compute: a) The SWC average selling price per pound. b) The SWC net profit margin earned on total sales Revenue (from WS-1 Revenues) Average Selling Price per Pound Operating Income (from WS-1 Operating Income) Net Profit Margin Earned on Sales 5) Assuming a transfer price from SWC to Wesdgewood is being considered; What would be the logical highest price (ceiling) to be considered for a transfer price? Ceiling transfer price per pound 6) Assuming a transfer price from SWC to Wedgewood is being considered. What would be the lowest transfer price (floor) between SWC and Wedgewood? The floor would be the transfrer price that SWC could charge Wedgewood and recover its variable costs of production. Note that sales commission are only paid for outside sales. Since this trasnfer price is an intercompany sale, sales commission costs are not incurred by SWC. In this case SWC's floor transfer price would be set to only recover the variable costs of production. Variable costs of Production (per Pound) Total Variable Costs $0.58