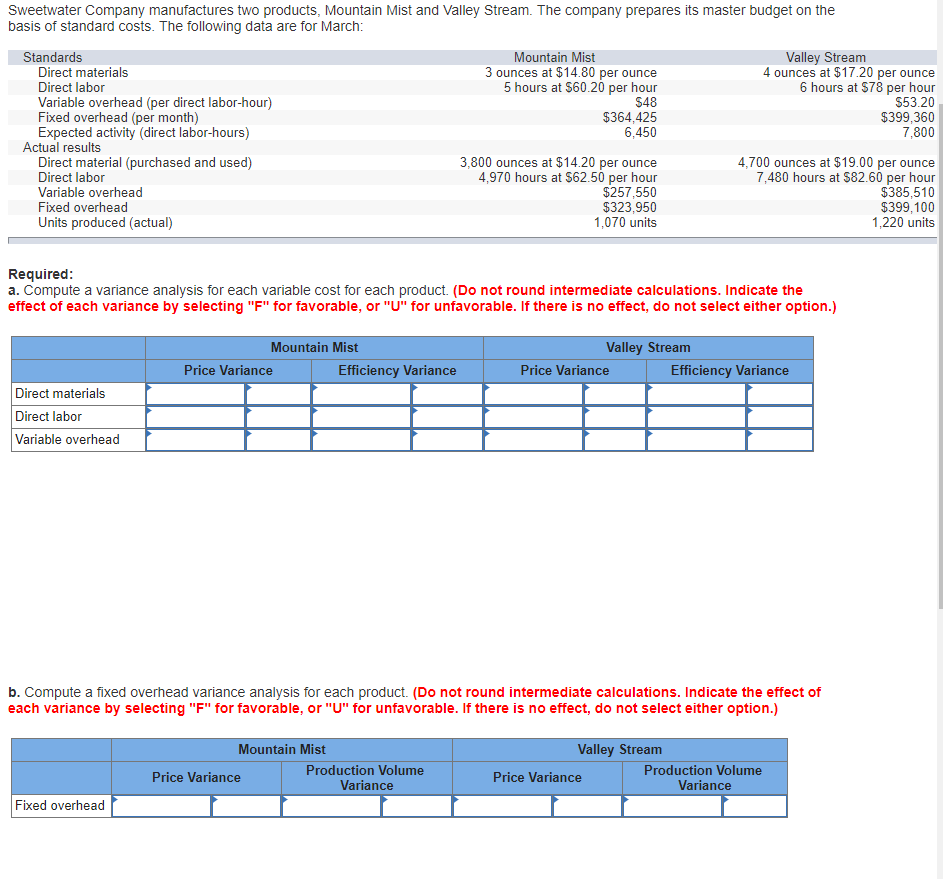

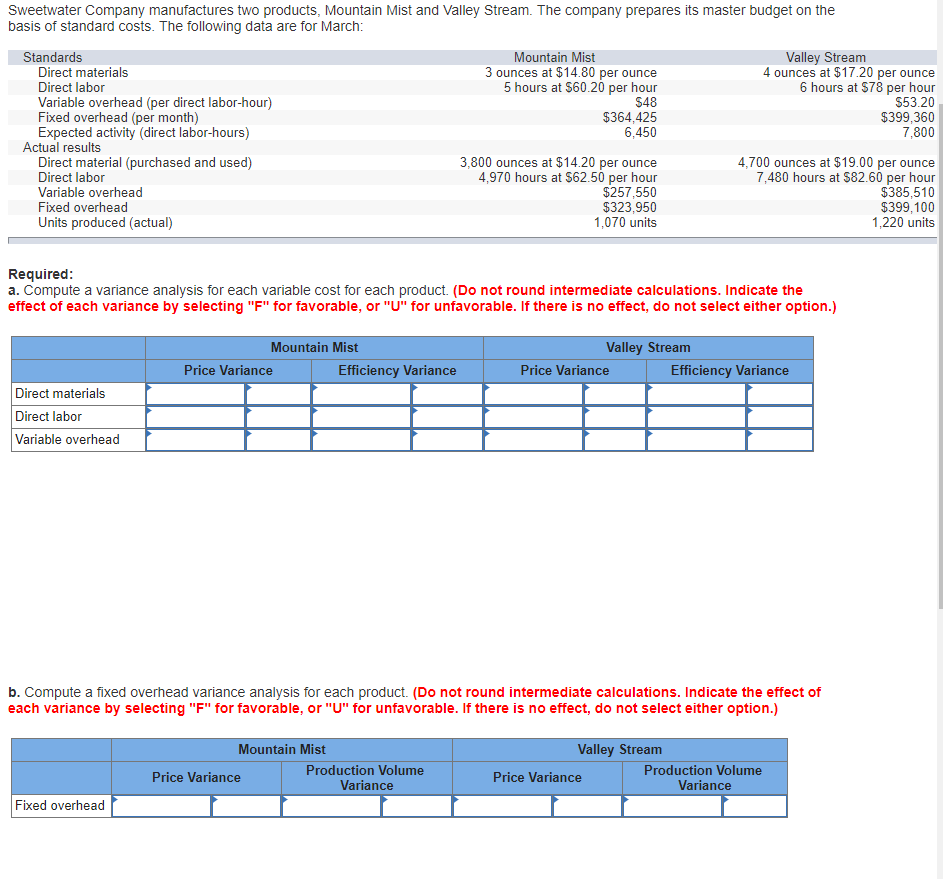

Sweetwater Company manufactures two products, Mountain Mist and Valley Stream. The company prepares its master budget on the basis of standard costs. The following data are for March: Standards Mountain Mist Valley Stream Direct materials Direct labor Variable overhead (per direct labor-hour) Fixed overhead (per month) Expected activity (direct labor-hours) 3 ounces at $14.80 per ounce 5 hours at $60.20 per hour $48 $364,425 6,450 4 ounces at $17.20 per ounce b hours at Sr8 per hour S53.20 $399,360 7,800 Actual results Direct material (purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) 3,800 ounces at $14.20 per ounce 4,970 hours at $62.50 per hour $257,550 $323,950 1,070 units 4,700 ounces at $19.00 per ounce 7,480 hours at $82.60 per hour $385,510 $399,100 1,220 units Required a. Compute a variance analysis for each variable cost for each product. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) Mountain Mist Valley Stream Price Variance Efficiency Variance Price Variance Efficiency Variance Direct materials Direct labor Variable overhead b. Compute a fixed overhead variance analysis for each product. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) Mountain Mist Valley Stream Production Volume Variance Production Volume Variance Price Variance Price Variance Fixed overhead Sweetwater Company manufactures two products, Mountain Mist and Valley Stream. The company prepares its master budget on the basis of standard costs. The following data are for March: Standards Mountain Mist Valley Stream Direct materials Direct labor Variable overhead (per direct labor-hour) Fixed overhead (per month) Expected activity (direct labor-hours) 3 ounces at $14.80 per ounce 5 hours at $60.20 per hour $48 $364,425 6,450 4 ounces at $17.20 per ounce b hours at Sr8 per hour S53.20 $399,360 7,800 Actual results Direct material (purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) 3,800 ounces at $14.20 per ounce 4,970 hours at $62.50 per hour $257,550 $323,950 1,070 units 4,700 ounces at $19.00 per ounce 7,480 hours at $82.60 per hour $385,510 $399,100 1,220 units Required a. Compute a variance analysis for each variable cost for each product. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) Mountain Mist Valley Stream Price Variance Efficiency Variance Price Variance Efficiency Variance Direct materials Direct labor Variable overhead b. Compute a fixed overhead variance analysis for each product. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) Mountain Mist Valley Stream Production Volume Variance Production Volume Variance Price Variance Price Variance Fixed overhead