Answered step by step

Verified Expert Solution

Question

1 Approved Answer

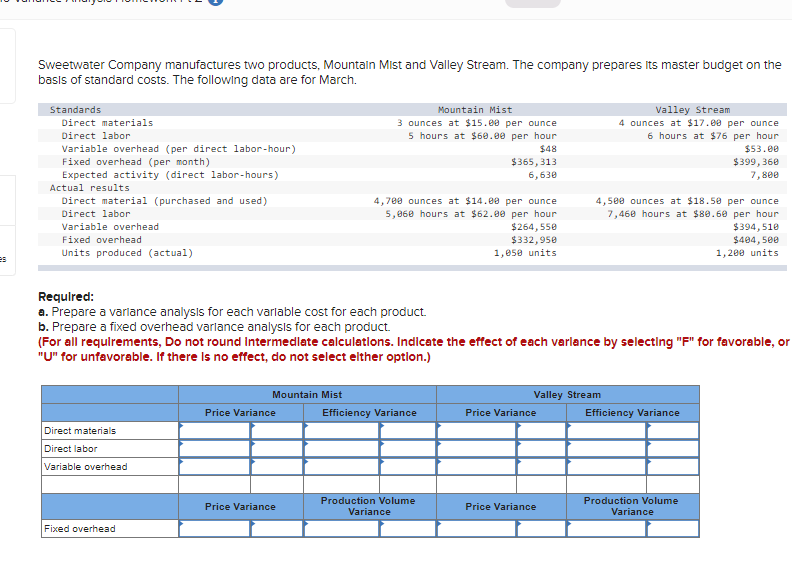

Sweetwater Company manufactures two products, Mountain Mist and Valley Stream. The company prepares its master budget on the basis of standard costs. The following data

Sweetwater Company manufactures two products, Mountain Mist and Valley Stream. The company prepares its master budget on the basis of standard costs. The following data are for March. Mountain Mist 3 ounces at $15.ee per ounce 5 hours at $60.80 per hour $48 $365, 313 6,630 Valley Stream 4 ounces at $17.00 per ounce 6 hours at $76 per hour $53.00 $399, 360 7, Bee Standards Direct materials Direct labor Variable overhead (per direct labor-hour) Fixed overhead (per month) Expected activity (direct labor-hours) Actual results Direct material purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) 4,708 ounces at $14.00 per ounce 5,869 hours at $62.00 per hour $264,550 $332,950 1,058 units 4,588 ounces at $18.58 per ounce 7,460 hours at $80.60 per hour $394,510 $494,500 1,200 units Required: a. Prepare a variance analysis for each variable cost for each product. b. Prepare a fixed overhead variance analysis for each product. (For all requirements, Do not round Intermediate calculations. Indicate the effect of each varlance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select elther option.) Mountain Mist Price Variance Efficiency Variance Valley Stream Price Variance Efficiency Variance Direct materials aterials Direct labor Variable overhead Price Variance Production Volume Variance Price Variance Production Volume Variance Fixed overhead Sweetwater Company manufactures two products, Mountain Mist and Valley Stream. The company prepares its master budget on the basis of standard costs. The following data are for March. Mountain Mist 3 ounces at $15.ee per ounce 5 hours at $60.80 per hour $48 $365, 313 6,630 Valley Stream 4 ounces at $17.00 per ounce 6 hours at $76 per hour $53.00 $399, 360 7, Bee Standards Direct materials Direct labor Variable overhead (per direct labor-hour) Fixed overhead (per month) Expected activity (direct labor-hours) Actual results Direct material purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) 4,708 ounces at $14.00 per ounce 5,869 hours at $62.00 per hour $264,550 $332,950 1,058 units 4,588 ounces at $18.58 per ounce 7,460 hours at $80.60 per hour $394,510 $494,500 1,200 units Required: a. Prepare a variance analysis for each variable cost for each product. b. Prepare a fixed overhead variance analysis for each product. (For all requirements, Do not round Intermediate calculations. Indicate the effect of each varlance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select elther option.) Mountain Mist Price Variance Efficiency Variance Valley Stream Price Variance Efficiency Variance Direct materials aterials Direct labor Variable overhead Price Variance Production Volume Variance Price Variance Production Volume Variance Fixed overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started