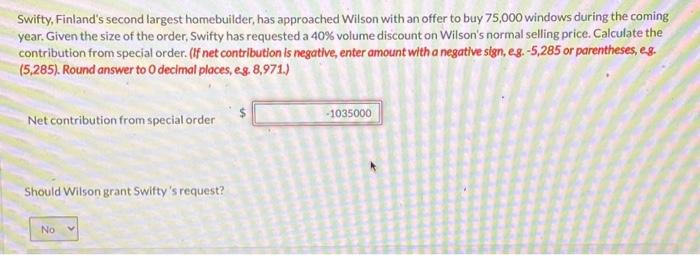

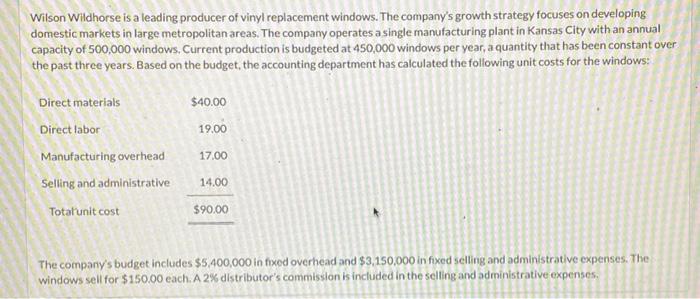

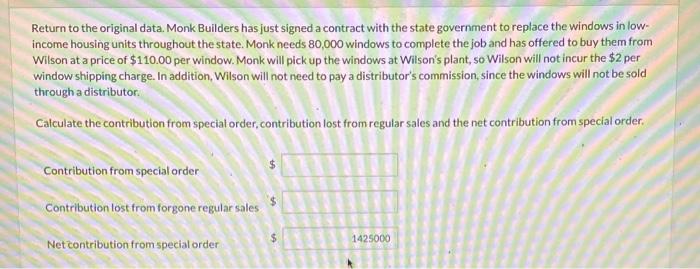

Swifty, Finland's second largest homebuilder, has approached Wilson with an offer to buy 75,000 windows during the coming year. Given the size of the order, Swifty has requested a 40% volume discount on Wilson's normal selling price. Calculate the contribution from special order. (If net contribution is negative, enter amount with a negative sign, eg. -5,285 or parentheses, eg. (5,285). Round answer to O decimal places, eg. 8,971.) Net contribution from special order -1035000 Should Wilson grant Swifty's request? No Wilson Wildhorse is a leading producer of vinyl replacement windows. The company's growth strategy focuses on developing domestic markets in large metropolitan areas. The company operates a single manufacturing plant in Kansas City with an annual capacity of 500,000 windows, Current production is budgeted at 450,000 windows per year, a quantity that has been constant over the past three years. Based on the budget, the accounting department has calculated the following unit costs for the windows: Direct materials $40.00 Direct labor 19.00 Manufacturing overhead 17.00 Selling and administrative 14.00 Totalunit cost $90,00 The company's budget Includes $5,400,000 in fixed overhead and $3,150,000 in fixed selling and administrative expenses. The windows sell for $150.00 each. A 2% distributor's commission is included in the selling and administrative expenses, Return to the original data. Monk Builders has just signed a contract with the state government to replace the windows in low- income housing units throughout the state. Monk needs 80,000 windows to complete the job and has offered to buy them from Wilson at a price of $110.00 per window. Monk will pick up the windows at Wilson's plant, so Wilson will not incur the $2 per window shipping charge. In addition, Wilson will not need to pay a distributor's commission, since the windows will not be sold through a distributor Calculate the contribution from special order, contribution lost from regular sales and the net contribution from special order. A Contribution from special order $ Contribution lost from forgone regular sales $ 1425000 Net contribution from special order