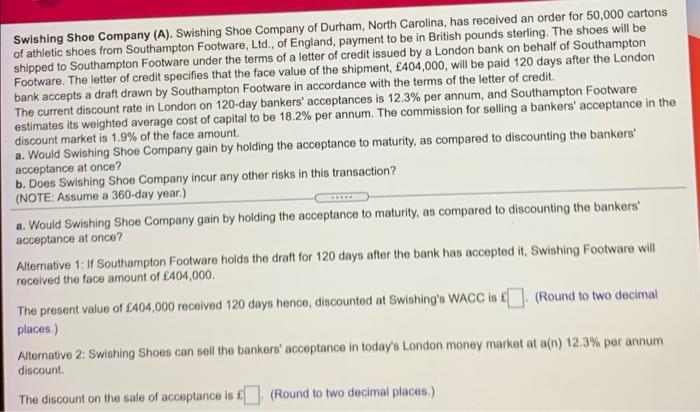

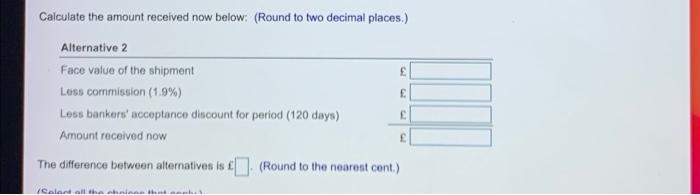

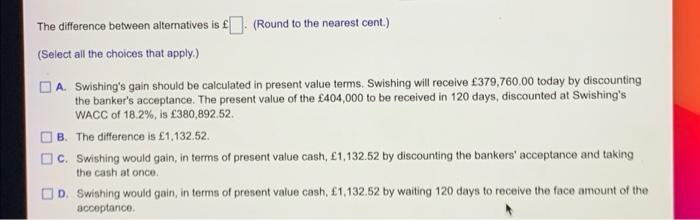

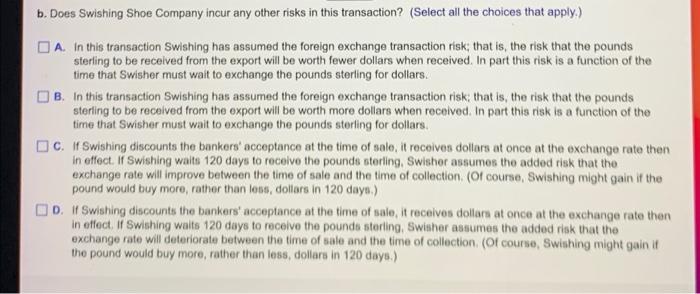

Swishing Shoe Company (A). Swishing Shoe Company of Durham, North Carolina, has received an order for 50,000 cartons of athletic shoes from Southampton Footware, Ltd., of England, payment to be in British pounds sterling. The shoes will be shipped to Southampton Footware under the terms of a letter of credit issued by a London bank on behalf of Southampton Footware. The letter of credit specifies that the face value of the shipment, 404,000, will be paid 120 days after the London bank accepts a draft drawn by Southampton Footware in accordance with the terms of the letter of credit. The current discount rate in London on 120-day bankers' acceptances is 12.3% per annum, and Southampton Footware estimates its weighted average cost of capital to be 18.2% per annum. The commission for selling a bankers' acceptance in the discount market is 1.9% of the face amount. a. Would Swishing Shoe Company gain by holding the acceptance to maturity, as compared to discounting the bankers' acceptance at once? b. Does Swishing Shoe Company incur any other risks in this transaction? (NOTE: Assume a 360-day year.) a. Would Swishing Shoe Company gain by holding the acceptance to maturity, as compared to discounting the bankers' acceptance at once? Alternative 1: If Southampton Footware holds the draft for 120 days after the bank has accepted it, Swishing Footware will received the face amount of 404,000. The present value of 404,000 received 120 days henco, discounted at Swishing's WACC is (Round to two decimal places.) Alternative 2: Swishing Shoes can sell the bankers' acceptance in today's London money market at a(n) 12.3% per annu discount The discount on the sale of acceptance is . (Round to two decimal places.) Calculate the amount received now below: (Round to two decimal places.) Alternative 2 Face value of the shipment Less commission (1.9%) Less bankers' acceptance discount for period (120 days) Amount received now The difference between alternatives is (Round to the nearest cont.) E Calandha The difference between alternatives is . (Round to the nearest cent.) (Select all the choices that apply.) A. Swishing's gain should be calculated in present value terms. Swishing will receive 379,760.00 today by discounting the banker's acceptance. The present value of the 404,000 to be received in 120 days, discounted at Swishing's WACC of 18,2%, is 380,892,52. B. The difference is 1,132.52. C. Swishing would gain, in terms of present value cash, 1,132.52 by discounting the bankers' acceptance and taking the cash at once OD. Swishing would gain, in terms of present value cash, 1,132 52 by waiting 120 days to receive the face amount of the acceptance. b. Does Swishing Shoe Company incur any other risks in this transaction? (Select all the choices that apply.) A. In this transaction Swishing has assumed the foreign exchange transaction risk that is, the risk that the pounds sterling to be received from the export will be worth fewer dollars when received. In part this risk is a function of the time that Swisher must wait to exchange the pounds sterling for dollars. B. In this transaction Swishing has assumed the foreign exchange transaction risk that is, the risk that the pounds sterling to be received from the export will be worth more dollars when received. In part this risk is a function of the time that Swisher must wait to exchange the pounds sterling for dollars. C. If Swishing discounts the bankers' acceptance at the time of sale, it receives dollars at once at the exchange rate then in effect. If Swishing waits 120 days to receive the pounds sterling, Swisher assumes the added risk that the exchange rate will improve between the time of sale and the time of collection. (Of course, Swishing might gain if the pound would buy more, rather than loss, dollars in 120 days.) OD. Swishing discounts the bankers' acceptance at the time of sale, it receives dollars at once at the exchange rate then in effect if Swishing waits 120 days to receive the pounds storting, Swisher assumes the added risk that the exchange rate will deteriorate between the time of sale and the time of collection (Of course, Swishing might gain it the pound would buy more, rather than loss, dollars in 120 days.)