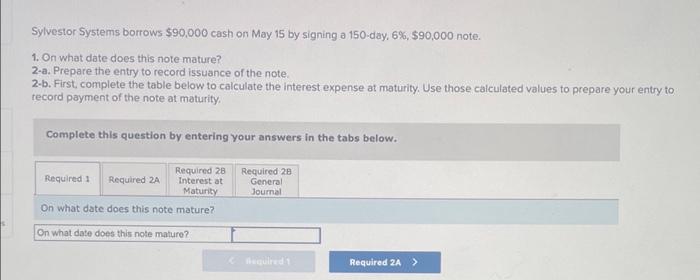

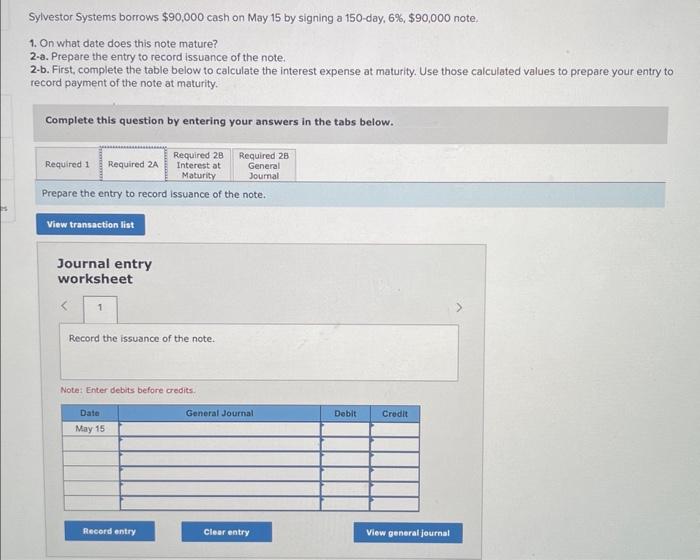

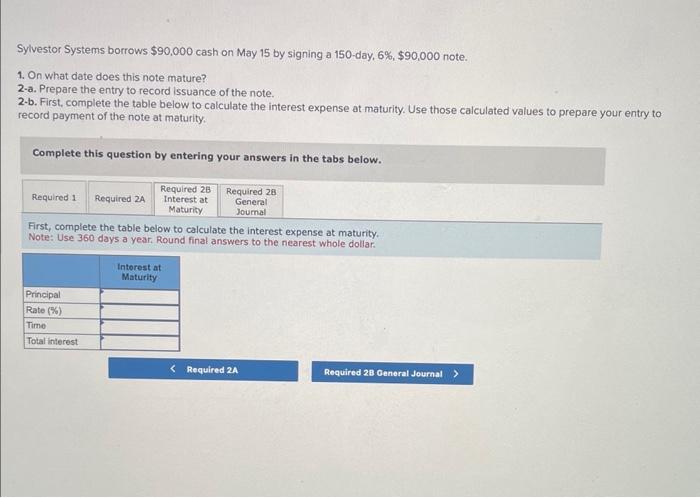

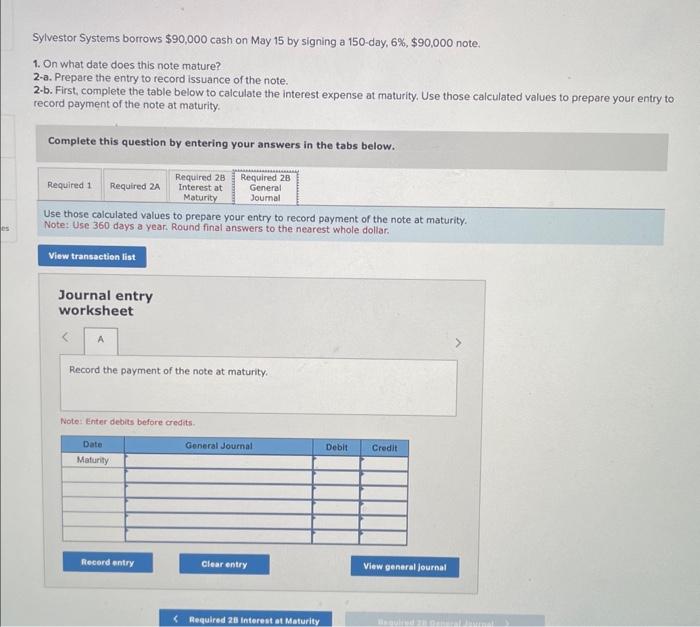

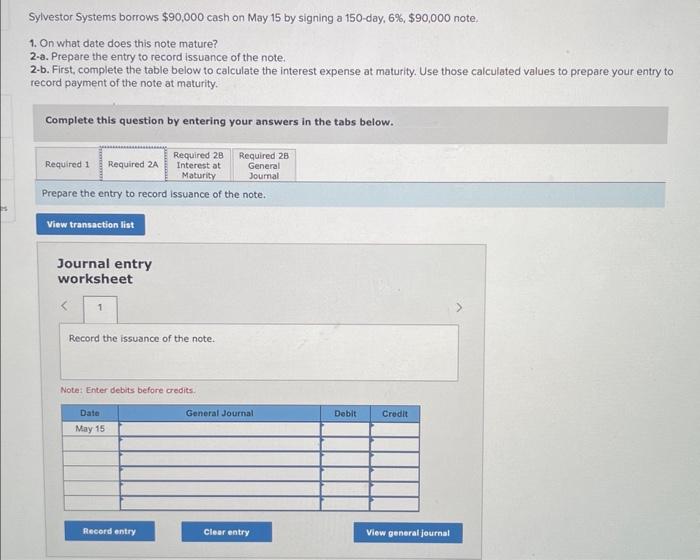

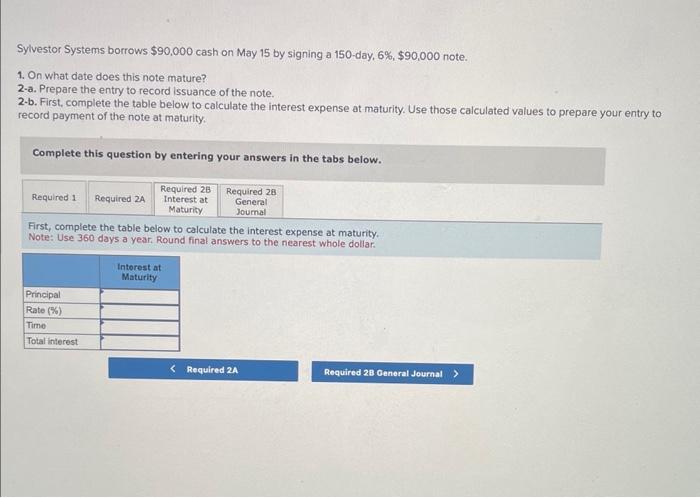

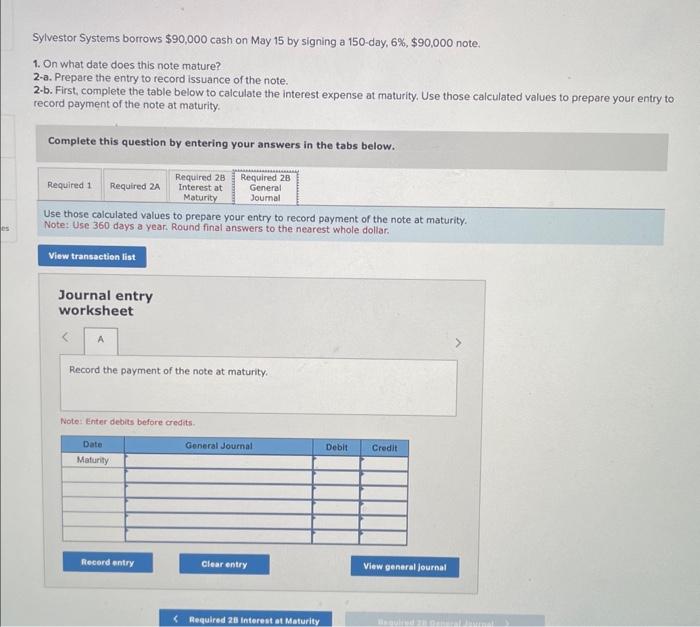

Sylvestor Systems borrows $90,000 cash on May 15 by signing a 150-day, 6%,$90,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those caiculated values to prepare your entry to tecord payment of the note at maturity. Complete this question by entering your answers in the tabs below. Sylvestor Systems borrows $90,000 cash on May 15 by signing a 150 -day, 6%,$90,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Prepare the entry to record issuance of the note. Journal entry worksheet Sylvestor Systems borrows $90,000 cash on May 15 by signing a 150-day, 6%,$90,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the interest expense at maturity. Note: Use 360 days a year. Round final answers to the nearest whole dollar. Sylvestor Systems borrows $90,000 cash on May 15 by signing a 150 -day, 6%,$90,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Use those calculated values to prepare your entry to record payment of the note at maturity. Note: Use 360 days a year. Round final answers to the nearest whole dollar. Journal entry worksheet Record the payment of the note at maturity. Note: Enter debits before credits