Answered step by step

Verified Expert Solution

Question

1 Approved Answer

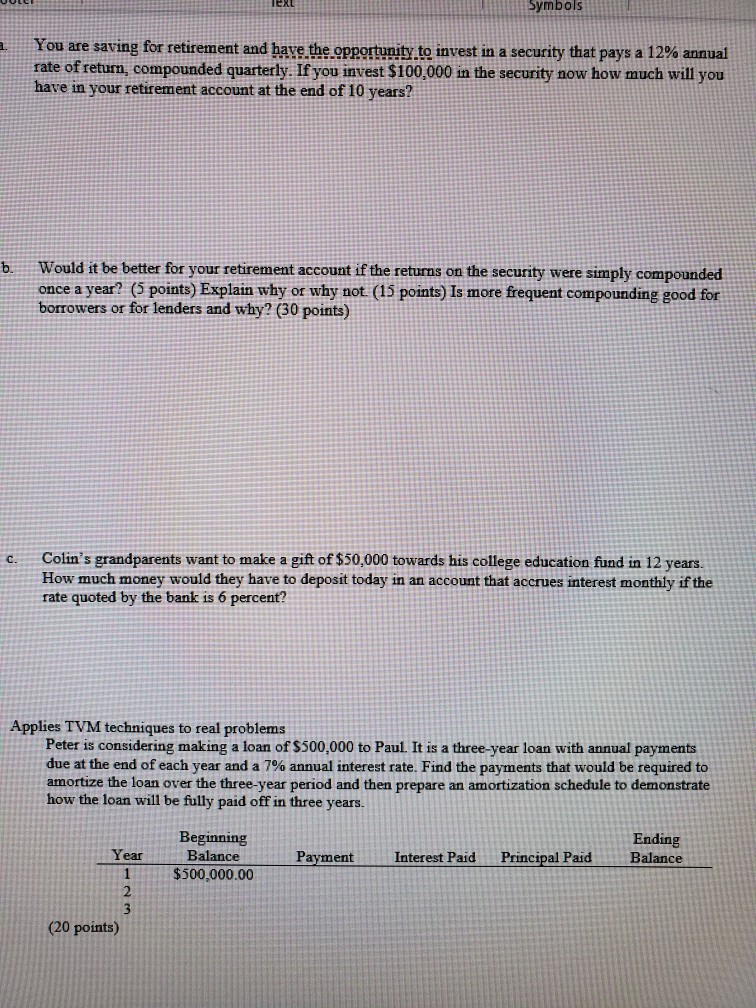

Symbols You are saving for retirement and have-the opportunit to invest in a security that pays a 12% annual rate of return, compounded quarterly. If

Symbols You are saving for retirement and have-the opportunit to invest in a security that pays a 12% annual rate of return, compounded quarterly. If you invest $100,000 in the secrity now how much will you have in your retirement account at the end of 10 years? b. Would it be better for your retirement account if the returns on the security were simply compounded once a year? (5 points) Explain why or why not (15 points) Is more frequent compounding eood for borrowers or for lenders and why? (30 points) Colin's grandparents want to make a gift of $50,000 towards his college education fund in 12 years. How much money would they have to deposit today in an account that acerues interest monthly if the rate quoted by the bank is 6 percent? c. Applies TVM techniques to real problems Peter is considering making a loan of $500,000 to Paul. It is a three-year loan with annual payments due at the end of each year and a 7% annual interest rate. Find the payments that would be required to amortize the loan over the three-year period and then prepare an amortization schedule to demonstrate how the loan will be fully paid off in three years. Beginning Balance Ending Payment Interest Paid Principal PaidBalance ear 1 $500,000.00 2 (20 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started