Answered step by step

Verified Expert Solution

Question

1 Approved Answer

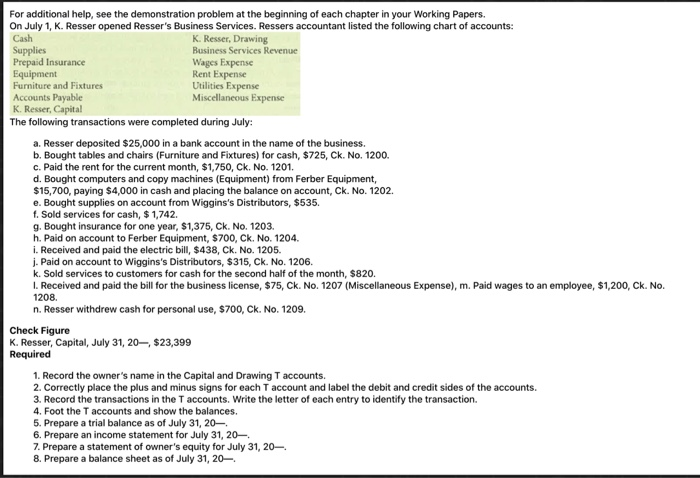

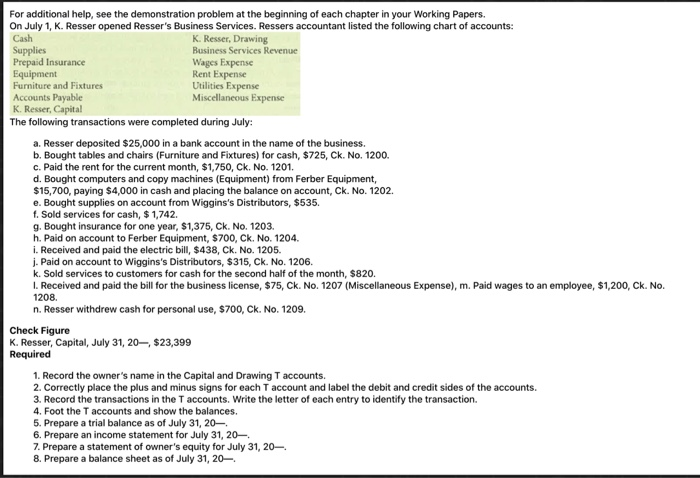

T accounts For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. On July 1, K. Resser opened

T accounts

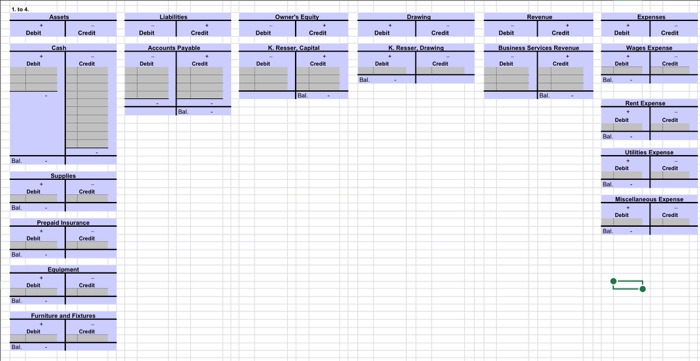

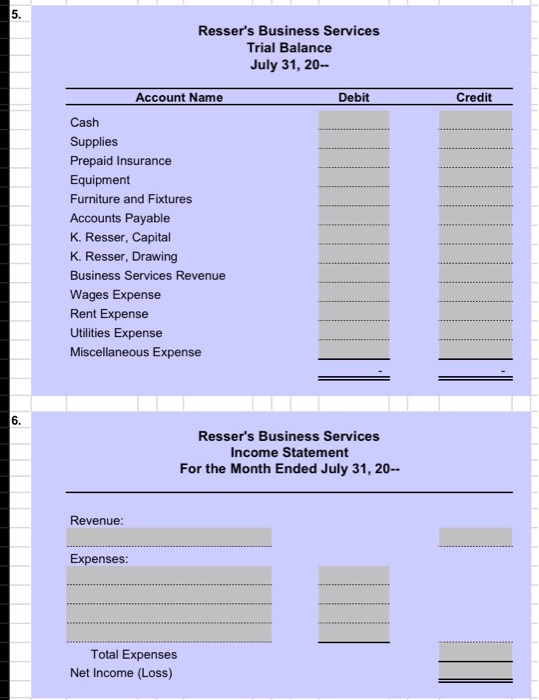

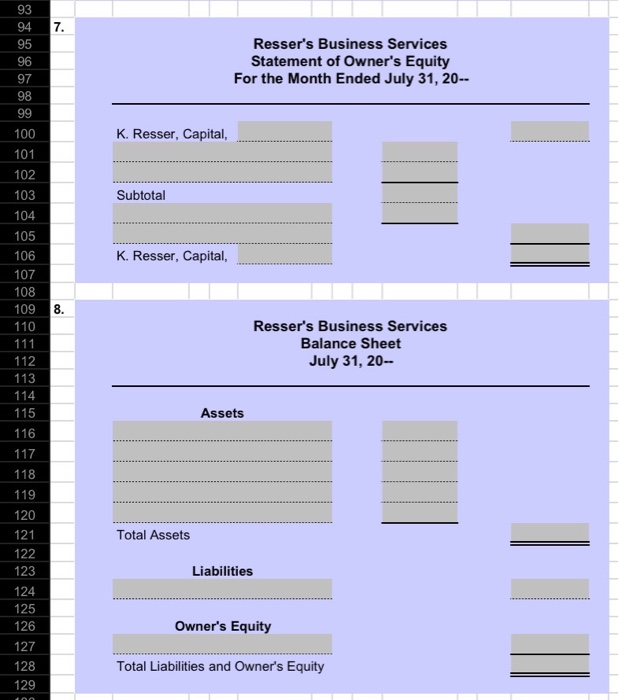

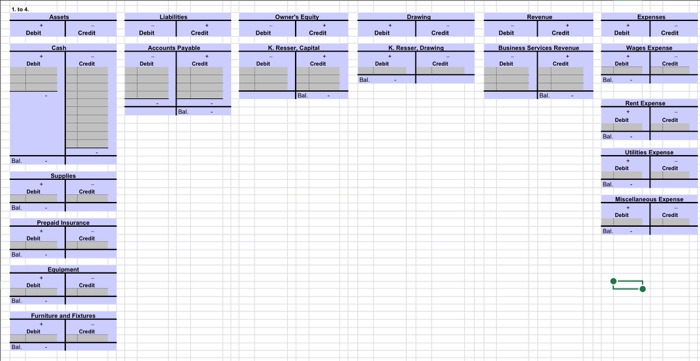

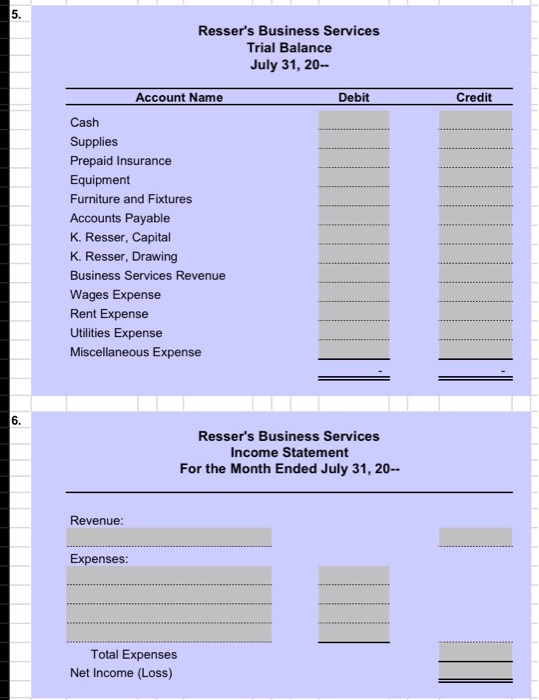

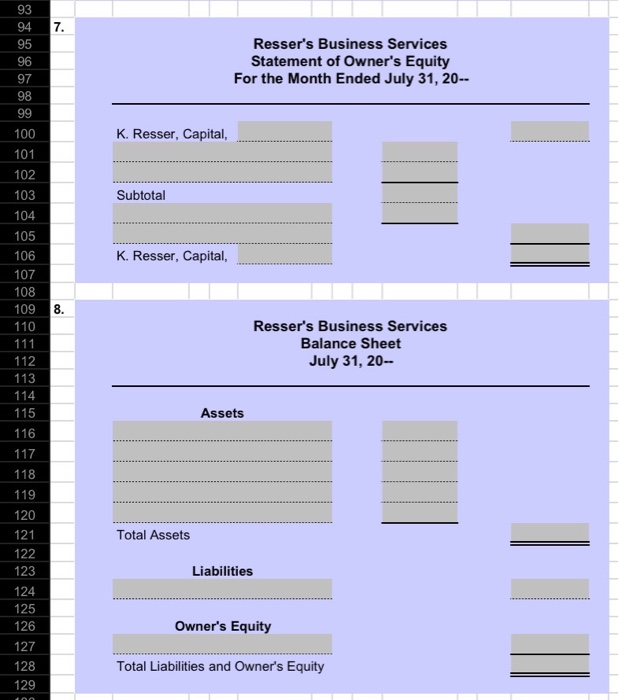

For additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. On July 1, K. Resser opened Resser's Business Services. Ressers accountant listed the following chart of accounts: Cash K. Resser, Drawing Supplies Business Services Revenue Prepaid Insurance Wages Expense Equipment Rent Expense Furniture and Fixtures Utilities Expense Accounts Payable Miscellaneous Expense K. Resser, Capital The following transactions were completed during July: a. Resser deposited $25,000 in a bank account in the name of the business. b. Bought tables and chairs (Furniture and Fixtures) for cash, $725, Ck. No. 1200. c. Paid the rent for the current month, $1,750, Ck. No. 1201. d. Bought computers and copy machines (Equipment) from Ferber Equipment, $15,700, paying $4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wiggins's Distributors, $535. f. Sold services for cash, $ 1,742. g. Bought insurance for one year, $1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, $700, Ck. No. 1204. i. Received and paid the electric bill, $438, Ck. No. 1205. j. Paid on account to Wiggins's Distributors, $315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, $820. 1. Received and paid the bill for the business license, $75,Ck. No. 1207 (Miscellaneous Expense), m. Paid wages to an employee, $1,200, Ck. No. 1208 n. Resser withdrew cash for personal use, $700, Ck. No. 1209. Check Figure K. Resser, Capital, July 31, 20 $23,399 Required 1. Record the owner's name in the Capital and Drawing Taccounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the Taccounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20 6. Prepare an income statement for July 31, 20- 7. Prepare a statement of owner's equity for July 31, 20 8. Prepare a balance sheet as of July 31, 20- 1. led Liabili Owner's Equity Drawing Espen Debit Credit Debit Credit Debit Credit De Credit Debit Credit Debit Credit Cash K. Resser. Capital K Reas Dewi Business Serious Raverve Wagen + Account Payable Debiet Credit Debit Crede Derbi Credo Debih Credit Debit Ce Bal. Bal Bal Rent Expense Bal Credit Ball Utsu Bal Crede + Debit Miscellaneous Bal Debit Credit Pendist Bal Det Crede 5 Bal Funiture and Futures Det Crea Bal 5. Resser's Business Services Trial Balance July 31, 20- Debit Credit Account Name Cash Supplies Prepaid Insurance Equipment Furniture and Fixtures Accounts Payable K. Resser, Capital K. Resser, Drawing Business Services Revenue Wages Expense Rent Expense Utilities Expense Miscellaneous Expense 6. Resser's Business Services Income Statement For the Month Ended July 31, 20-- Revenue: Expenses: Total Expenses Net Income (Loss) 7. Resser's Business Services Statement of Owner's Equity For the Month Ended July 31, 20-- K. Resser, Capital, Subtotal 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 K. Resser, Capital, 8. Resser's Business Services Balance Sheet July 31, 20- Assets 116 117 118 119 120 121 122 123 124 125 126 Total Assets Liabilities Owner's Equity 127 Total Liabilities and Owner's Equity 128 129

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started