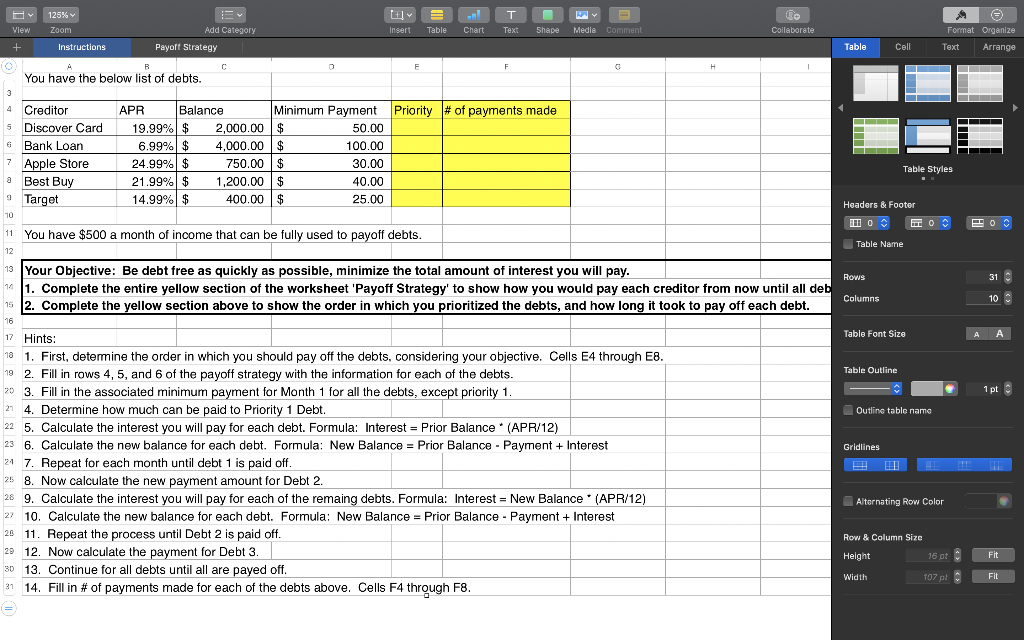

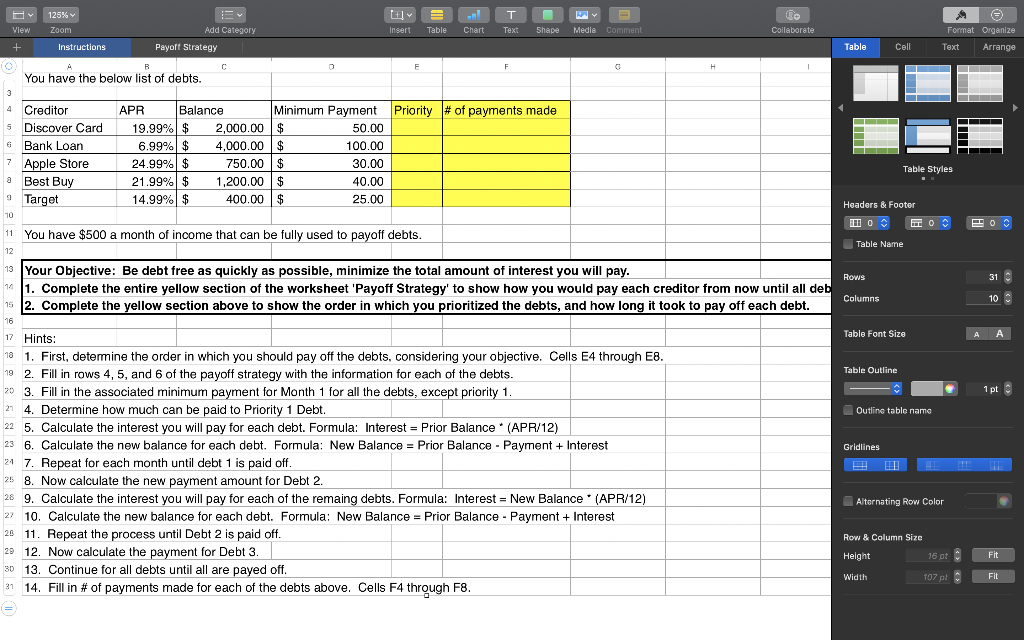

= T H 125% % View Zoom + Instructions ce Collaborate Insert Table Chart Text Shape Media Comment Add Category Payoff Strategy e Format Organize Text Arrange Table Cell F H B You have the below list of debts. 3 5 P IN 4 Creditor Discover Card 6 Bank Loan 7 Apple Store a Best Buy 9 Target APR Balance Minimum Payment Priority # of payments made 19.99% $ 2,000.00 $ 50.00 6.99 $ 4,000.00 $ 100.00 24.99% $ 750.00 $ 30.00 21.99% $ 1,200.00 $ 40.00 14.99% $ 400.00 $ 25.00 Table Styles 10 Headers & Footer & HO TO O 11 You have $500 a month of income that can be fully used to payoff debts. Table Name 12 Rows 31 Columns 10 Table Font Size A A 18 Table Outline 1 pt Outline table name 13 Your Objective: Be debt free as quickly as possible, minimize the total amount of interest you will pay. 11. Complete the entire yellow section of the worksheet 'Payoff Strategy' to show how you would pay each creditor from now until all deb 15 2. Complete the yellow section above to show the order in which you prioritized the debts, and how long it took to pay off each debt. 16 17 Hints: 1. First, determine the order in which you should pay off the debts, considering your objective. Cells E4 through E8. 19 2. Fill in rows 4, 5, and 6 of the payoff strategy with the information for each of the debts. 20 3. Fill in the associated minimum payment for Month 1 for all the debts, except priority 1. 21 4. Determine how much can be paid to Priority 1 Debt. 22 5. Calculate the interest you will pay for each debt. Formula: Interest = Prior Balance * (APR/12) 23 6. Calculate the new balance for each debt. Formula: New Balance = Prior Balance - Payment + Interest 21 7. Repeat for each month until debt 1 is paid off. 25 8. Now calculate the new payment amount for Debt 2. 9. Calculate the interest you will pay for each of the remaing debts. Formula: Interest = New Balance (APR/12) 27 10. Calculate the new balance for each debt. Formula: New Balance = Prior Balance - Payment + Interest 29 11. Repeat the process until Debt 2 is paid off. 29 12. Now calculate the payment for Debt 3. 30 13. Continue for all debts until all are payed off 32 14. Fill in # of payments made for each of the debts above. Cells F4 through F8. = Gridlines . 28 Alternating Row Color Row & Column Size Height 16 ot Fit Width 107 p ! Fit = T H 125% % View Zoom + Instructions ce Collaborate Insert Table Chart Text Shape Media Comment Add Category Payoff Strategy e Format Organize Text Arrange Table Cell F H B You have the below list of debts. 3 5 P IN 4 Creditor Discover Card 6 Bank Loan 7 Apple Store a Best Buy 9 Target APR Balance Minimum Payment Priority # of payments made 19.99% $ 2,000.00 $ 50.00 6.99 $ 4,000.00 $ 100.00 24.99% $ 750.00 $ 30.00 21.99% $ 1,200.00 $ 40.00 14.99% $ 400.00 $ 25.00 Table Styles 10 Headers & Footer & HO TO O 11 You have $500 a month of income that can be fully used to payoff debts. Table Name 12 Rows 31 Columns 10 Table Font Size A A 18 Table Outline 1 pt Outline table name 13 Your Objective: Be debt free as quickly as possible, minimize the total amount of interest you will pay. 11. Complete the entire yellow section of the worksheet 'Payoff Strategy' to show how you would pay each creditor from now until all deb 15 2. Complete the yellow section above to show the order in which you prioritized the debts, and how long it took to pay off each debt. 16 17 Hints: 1. First, determine the order in which you should pay off the debts, considering your objective. Cells E4 through E8. 19 2. Fill in rows 4, 5, and 6 of the payoff strategy with the information for each of the debts. 20 3. Fill in the associated minimum payment for Month 1 for all the debts, except priority 1. 21 4. Determine how much can be paid to Priority 1 Debt. 22 5. Calculate the interest you will pay for each debt. Formula: Interest = Prior Balance * (APR/12) 23 6. Calculate the new balance for each debt. Formula: New Balance = Prior Balance - Payment + Interest 21 7. Repeat for each month until debt 1 is paid off. 25 8. Now calculate the new payment amount for Debt 2. 9. Calculate the interest you will pay for each of the remaing debts. Formula: Interest = New Balance (APR/12) 27 10. Calculate the new balance for each debt. Formula: New Balance = Prior Balance - Payment + Interest 29 11. Repeat the process until Debt 2 is paid off. 29 12. Now calculate the payment for Debt 3. 30 13. Continue for all debts until all are payed off 32 14. Fill in # of payments made for each of the debts above. Cells F4 through F8. = Gridlines . 28 Alternating Row Color Row & Column Size Height 16 ot Fit Width 107 p ! Fit