t Lori and Peter enter into a partnership and decide to share profits and losses as follows 1. The first allocation is a salary

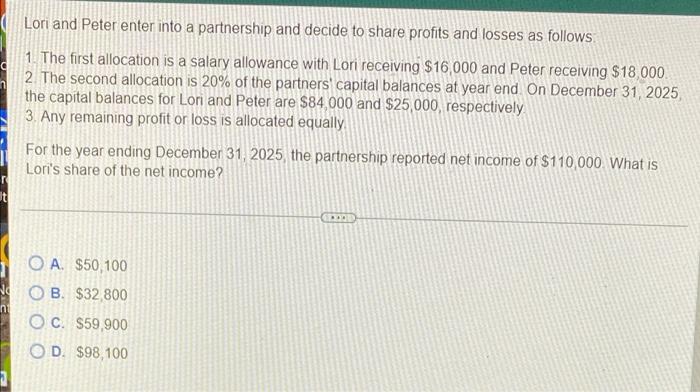

t Lori and Peter enter into a partnership and decide to share profits and losses as follows 1. The first allocation is a salary allowance with Lori receiving $16,000 and Peter receiving $18,000. 2. The second allocation is 20% of the partners' capital balances at year end. On December 31, 2025, the capital balances for Lori and Peter are $84,000 and $25,000, respectively 3. Any remaining profit or loss is allocated equally For the year ending December 31, 2025, the partnership reported net income of $110,000 What is Lori's share of the net income? OA. $50,100 NOB. $32,800 OC. $59,900 OD. $98,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started