Answered step by step

Verified Expert Solution

Question

1 Approved Answer

t please! Please help me finish this problem. Question 1 If your work involves with Excel spreadsheet, Please screenshot (or paste) Excel Answers into Word

t

t

please!

Please help me finish this problem.

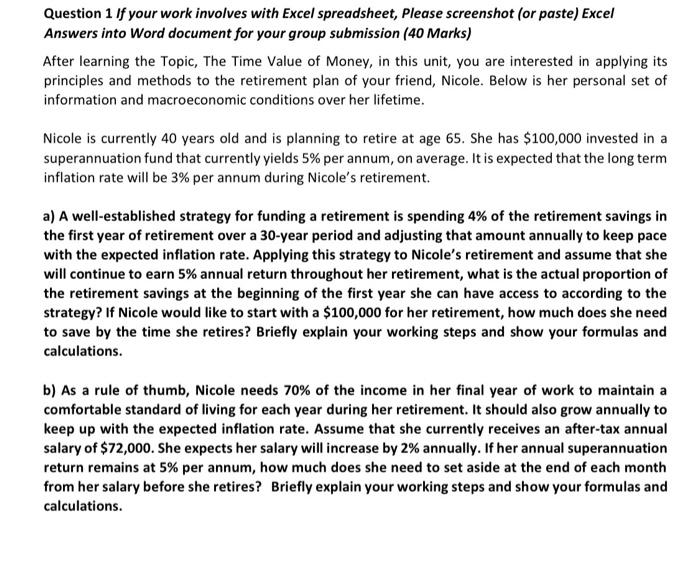

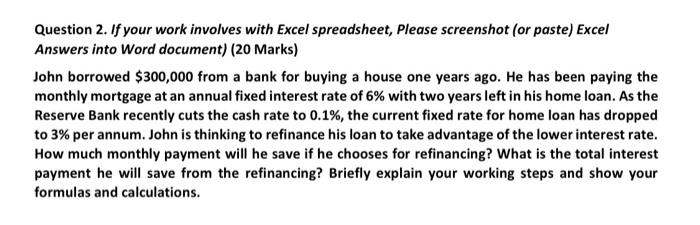

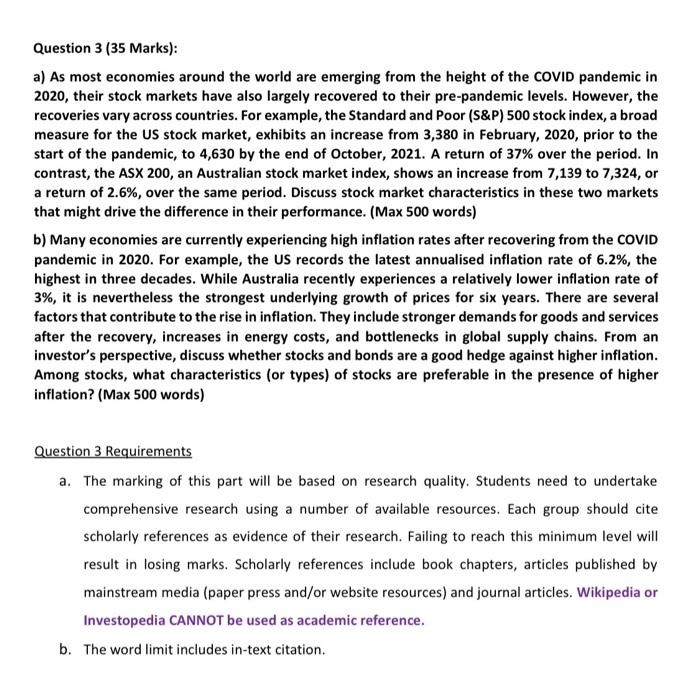

Question 1 If your work involves with Excel spreadsheet, Please screenshot (or paste) Excel Answers into Word document for your group submission (40 Marks) After learning the Topic, The Time Value of Money, in this unit, you are interested in applying its principles and methods to the retirement plan of your friend, Nicole. Below is her personal set of information and macroeconomic conditions over her lifetime. Nicole is currently 40 years old and is planning to retire at age 65. She has $100,000 invested in a superannuation fund that currently yields 5% per annum, on average. It is expected that the long term inflation rate will be 3% per annum during Nicole's retirement. a) A well-established strategy for funding a retirement is spending 4% of the retirement savings in the first year of retirement over a 30-year period and adjusting that amount annually to keep pace with the expected inflation rate. Applying this strategy to Nicole's retirement and assume that she will continue to earn 5% annual return throughout her retirement, what is the actual proportion of the retirement savings at the beginning of the first year she can have access to according to the strategy? If Nicole would like to start with a $100,000 for her retirement, how much does she need to save by the time she retires? Briefly explain your working steps and show your formulas and calculations. b) As a rule of thumb, Nicole needs 70% of the income in her final year of work to maintain a comfortable standard of living for each year during her retirement. It should also grow annually to keep up with the expected inflation rate. Assume that she currently receives an after-tax annual salary of $72,000. She expects her salary will increase by 2% annually. If her annual superannuation return remains at 5% per annum, how much does she need to set aside at the end of each month from her salary before she retires? Briefly explain your working steps and show your formulas and calculations. Question 2. If your work involves with Excel spreadsheet, Please screenshot (or paste) Excel Answers into Word document) (20 Marks) John borrowed $300,000 from a bank for buying a house one years ago. He has been paying the monthly mortgage at an annual fixed interest rate of 6% with two years left in his home loan. As the Reserve Bank recently cuts the cash rate to 0.1%, the current fixed rate for home loan has dropped to 3% per annum. John is thinking to refinance his loan to take advantage of the lower interest rate. How much monthly payment will he save if he chooses for refinancing? What is the total interest payment he will save from the refinancing? Briefly explain your working steps and show your formulas and calculations. Question 3 (35 Marks): a) As most economies around the world are emerging from the height of the COVID pandemic in 2020, their stock markets have also largely recovered to their pre-pandemic levels. However, the recoveries vary across countries. For example, the Standard and Poor (S&P) 500 stock index, a broad measure for the US stock market, exhibits an increase from 3,380 in February, 2020, prior to the start of the pandemic, to 4,630 by the end of October, 2021. A return of 37% over the period. In contrast, the ASX 200, an Australian stock market index, shows an increase from 7,139 to 7,324, or a return of 2.6%, over the same period. Discuss stock market characteristics in these two markets that might drive the difference in their performance. (Max 500 words) b) Many economies are currently experiencing high inflation rates after recovering from the COVID pandemic in 2020. For example, the US records the latest annualised inflation rate of 6.2%, the highest in three decades. While Australia recently experiences a relatively lower inflation rate of 3%, it is nevertheless the strongest underlying growth of prices for six years. There are several factors that contribute to the rise in inflation. They include stronger demands for goods and services after the recovery, increases in energy costs, and bottlenecks in global supply chains. From an investor's perspective, discuss whether stocks and bonds are a good hedge against higher inflation. Among stocks, what characteristics (or types) of stocks are preferable in the presence of higher inflation? (Max 500 words) Question 3 Requirements a. The marking of this part will be based on research quality. Students need to undertake comprehensive research using a number of available resources. Each group should cite scholarly references as evidence of their research. Failing to reach this minimum level will result in losing marks. Scholarly references include book chapters, articles published by mainstream media (paper press and/or website resources) and journal articles. Wikipedia or Investopedia CANNOT be used as academic reference. b. The word limit includes in-text citation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started