Answered step by step

Verified Expert Solution

Question

1 Approved Answer

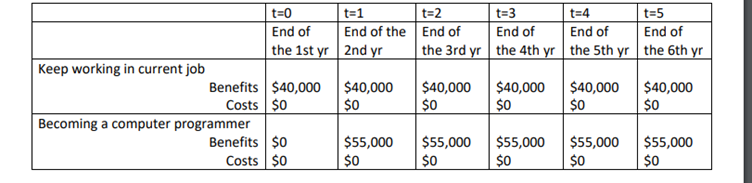

Keep working in current job t=0 End of the 1st yr Benefits $40,000 Costs $0 Becoming a computer programmer Benefits $0 Costs $0 t=1

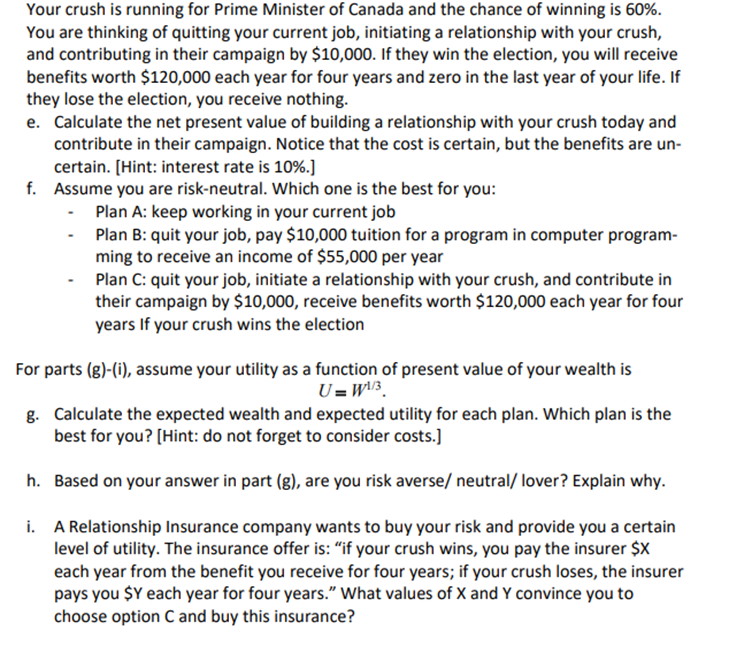

Keep working in current job t=0 End of the 1st yr Benefits $40,000 Costs $0 Becoming a computer programmer Benefits $0 Costs $0 t=1 End of the 2nd yr $40,000 $0 $55,000 $0 t=2 End of the 3rd yr $40,000 $0 $55,000 $0 t=4 t=3 End of End of the 4th yr the 5th yr $40,000 $40,000 $0 $0 $55,000 $0 $55,000 $0 t=5 End of the 6th yr $40,000 $0 $55,000 $0 Your crush is running for Prime Minister of Canada and the chance of winning is 60%. You are thinking of quitting your current job, initiating a relationship with your crush, and contributing in their campaign by $10,000. If they win the election, you will receive benefits worth $120,000 each year for four years and zero in the last year of your life. If they lose the election, you receive nothing. e. Calculate the net present value of building a relationship with your crush today and contribute in their campaign. Notice that the cost is certain, but the benefits are un- certain. [Hint: interest rate is 10%.] f. Assume you are risk-neutral. Which one is the best for you: Plan A: keep working in your current job Plan B: quit your job, pay $10,000 tuition for a program in computer program- ming to receive an income of $55,000 per year Plan C: quit your job, initiate a relationship with your crush, and contribute in their campaign by $10,000, receive benefits worth $120,000 each year for four years If your crush wins the election For parts (g)-(i), assume your utility as a function of present value of your wealth is U=W1/3 g. Calculate the expected wealth and expected utility for each plan. Which plan is the best for you? [Hint: do not forget to consider costs.] h. Based on your answer in part (g), are you risk averse/ neutral/ lover? Explain why. i. A Relationship Insurance company wants to buy your risk and provide you a certain level of utility. The insurance offer is: "if your crush wins, you pay the insurer $X each year from the benefit you receive for four years; if your crush loses, the insurer pays you $Y each year for four years." What values of X and Y convince you to choose option C and buy this insurance?

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

e To calculate the net present value NPV of building a relationship with your crush and contributing to their campaign we need to calculate the presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started