Answered step by step

Verified Expert Solution

Question

1 Approved Answer

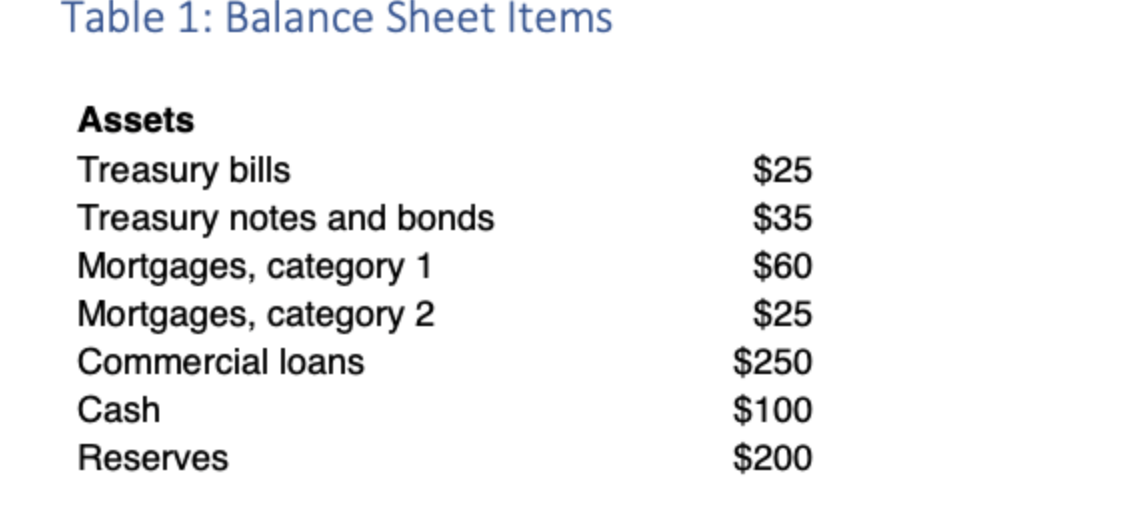

Table 1: Balance Sheet Items Assets Treasury bills Treasury notes and bonds Mortgages, category 1 Mortgages, category 2 Commercial loans Cash Reserves $25 $35

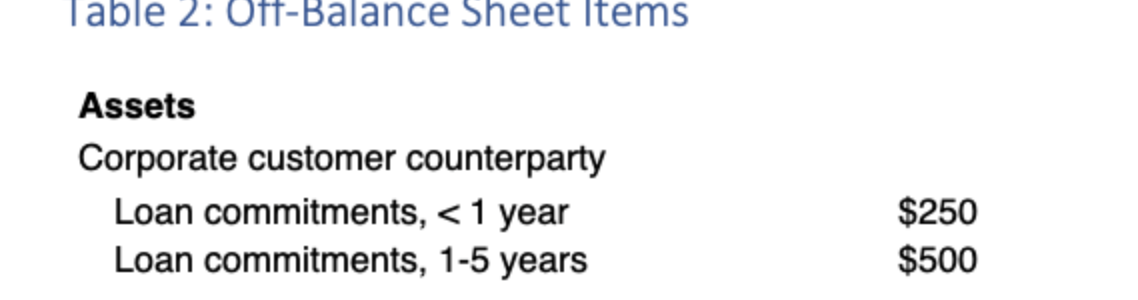

Table 1: Balance Sheet Items Assets Treasury bills Treasury notes and bonds Mortgages, category 1 Mortgages, category 2 Commercial loans Cash Reserves $25 $35 $60 $25 $250 $100 $200 You were recently hired by a bank that is subject to the capital adequacy requirements in the Basel III Accord. The CEO hands you the bank's balance sheet (see Table 1 below or click this URL) and asks you to calculate the minimum amount of common equity plus retained earnings (CET1) and the minimum amount of Tier 1 capital the bank needs to have in order to be adequately capitalized. ? Show your calculations and explain your steps in as much detail as necessary. The next day, the CEO pops into your office again. It turns out that she forgot to mention that the bank also has some off-balance-sheet items. They are listed in Table 2 below (or click this URL). Taking into account these off-balance-sheet items, recalculate the minimum amount of common equity plus retained earnings (CET1) and the minimum amount of Tier 1 capital the bank needs to have in order to be adequately capitalized. Show your calculations and explain your steps in as much detail as necessary. Table 2: Off-Balance Sheet Items Assets Corporate customer counterparty Loan commitments, < 1 year Loan commitments, 1-5 years $250 $500

Step by Step Solution

★★★★★

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started