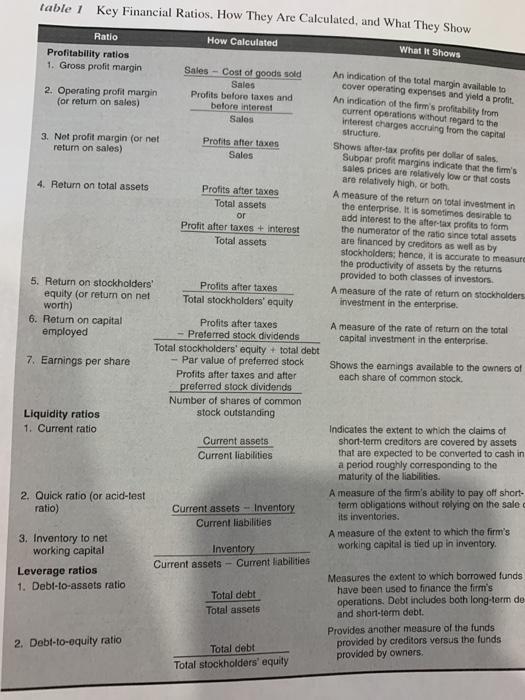

table 1 Key Financial Ratios. How They Are Calculated, and What They Show What It Shows Ratio How Calculated Profitability ratios 1. Gross profit margin Sales - Cost of goods sold An indication of the total margin available to Sales cover operating expenses and yield a profit 2. Operating profit margin Profits before taxes and An indication of the firm's profitability from (or return on sales) before interest current operations without regard to the Sales Interest charges accruing from the capital structure 3. Net profit margin (or net Profits after taxes Shows after-tax profits per dollar of sales. return on sales) Sales Subpar profit margins indicate that the firm's sales prices are relatively low or that costs are relatively high, or both 4. Return on total assets Profits after taxes A measure of the return on total investment in Total assets the enterprise. It is sometimes desirable to or add interest to the after-tax profits to form Profit after taxes + Interest the numerator of the ratio since total assets Total assets are financed by creditors as well as by stockholders; hence, it is accurate to measure the productivity of assets by the returns provided to both classes of investors 5. Return on stockholders' Profits after taxes A measure of the rate of return on stockholders equity (or return on net Total stockholders' equity investment in the enterprise worth) 6. Return on capital Profits after taxes A measure of the rate of return on the total employed - Preferred stock dividends capital investment in the enterprise. Total stockholders' equity + total debt 7. Earnings per share - Par value of preferred stock Shows the earings available to the owners of Profits after taxes and after each share of common stock. preferred stock dividends Number of shares of common stock outstanding Liquidity ratios Indicates the extent to which the claims of 1. Current ratio Current assets short-term creditors are covered by assets Current liabilities that are expected to be converted to cash in a period roughly corresponding to the maturity of the liabilities. A measure of the firm's ability to pay off short- 2. Quick ratio (or acid-test ratio) Current assets - Inventory term obligations without relying on the sale its inventories. Current liabilities A measure of the extent to which the firm's 3. Inventory to net working capital is tied up in inventory Inventory working capital Current assets - Current liabilities Leverage ratios Measures the extent to which borrowed funds 1. Debt-to-assets ratio have been used to finance the firm's Total debt operations. Debt includes both long-term de Total assets and short-term debt. Provides another measure of the funds rovided by creditors versus the funds 2. Debt-to-equity ratio Total debt provided by owners. Total stockholders' equity table 1 Key Financial Ratios. How They Are Calculated, and What They Show What It Shows Ratio How Calculated Profitability ratios 1. Gross profit margin Sales - Cost of goods sold An indication of the total margin available to Sales cover operating expenses and yield a profit 2. Operating profit margin Profits before taxes and An indication of the firm's profitability from (or return on sales) before interest current operations without regard to the Sales Interest charges accruing from the capital structure 3. Net profit margin (or net Profits after taxes Shows after-tax profits per dollar of sales. return on sales) Sales Subpar profit margins indicate that the firm's sales prices are relatively low or that costs are relatively high, or both 4. Return on total assets Profits after taxes A measure of the return on total investment in Total assets the enterprise. It is sometimes desirable to or add interest to the after-tax profits to form Profit after taxes + Interest the numerator of the ratio since total assets Total assets are financed by creditors as well as by stockholders; hence, it is accurate to measure the productivity of assets by the returns provided to both classes of investors 5. Return on stockholders' Profits after taxes A measure of the rate of return on stockholders equity (or return on net Total stockholders' equity investment in the enterprise worth) 6. Return on capital Profits after taxes A measure of the rate of return on the total employed - Preferred stock dividends capital investment in the enterprise. Total stockholders' equity + total debt 7. Earnings per share - Par value of preferred stock Shows the earings available to the owners of Profits after taxes and after each share of common stock. preferred stock dividends Number of shares of common stock outstanding Liquidity ratios Indicates the extent to which the claims of 1. Current ratio Current assets short-term creditors are covered by assets Current liabilities that are expected to be converted to cash in a period roughly corresponding to the maturity of the liabilities. A measure of the firm's ability to pay off short- 2. Quick ratio (or acid-test ratio) Current assets - Inventory term obligations without relying on the sale its inventories. Current liabilities A measure of the extent to which the firm's 3. Inventory to net working capital is tied up in inventory Inventory working capital Current assets - Current liabilities Leverage ratios Measures the extent to which borrowed funds 1. Debt-to-assets ratio have been used to finance the firm's Total debt operations. Debt includes both long-term de Total assets and short-term debt. Provides another measure of the funds rovided by creditors versus the funds 2. Debt-to-equity ratio Total debt provided by owners. Total stockholders' equity