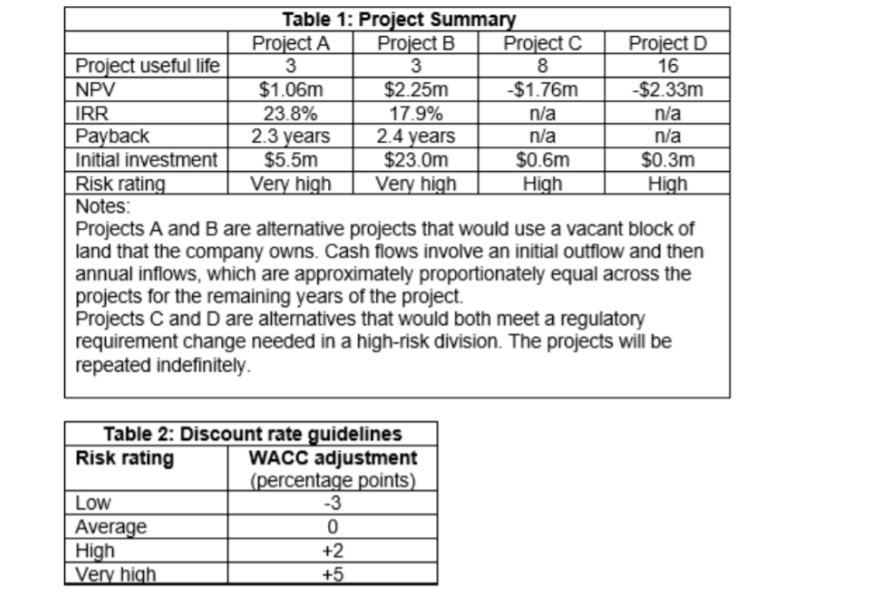

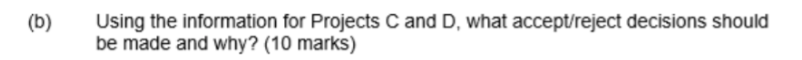

Table 1: Project Summary Project A Project B Project Project D Project useful life 3 3 8 16 NPV $1.06m $2.25m $1.76m $2.33m IRR 23.8% 17.9% n/a n/a Payback 2.3 years 2.4 years n/a n/a Initial investment $5.5m $23.0m $0.6m $0.3m Risk rating Very high Very high High High Notes: Projects A and B are alternative projects that would use a vacant block of land that the company owns. Cash flows involve an initial outflow and then annual inflows, which are approximately proportionately equal across the projects for the remaining years of the project. Projects C and D are alternatives that would both meet a regulatory requirement change needed in a high-risk division. The projects will be repeated indefinitely Table 2: Discount rate guidelines Risk rating WACC adjustment (percentage points) Low -3 Average 0 High +2 Very high +5 (a) Using the information for Projects A and B, answer the following questions. i. What accept/reject decisions should be made and why? (5 marks) ii. In what broad circumstances do the NPV and IRR sometimes suggest different decisions and what is the likely reason in this case. (5 marks) iii. What discount rate() should have been used in the analysis of these projects, what is this discount rate called, and why are such discount rates needed (5 marks) (b) Using the information for Projects C and D, what accept/reject decisions should be made and why? (10 marks) Table 1: Project Summary Project A Project B Project Project D Project useful life 3 3 8 16 NPV $1.06m $2.25m $1.76m $2.33m IRR 23.8% 17.9% n/a n/a Payback 2.3 years 2.4 years n/a n/a Initial investment $5.5m $23.0m $0.6m $0.3m Risk rating Very high Very high High High Notes: Projects A and B are alternative projects that would use a vacant block of land that the company owns. Cash flows involve an initial outflow and then annual inflows, which are approximately proportionately equal across the projects for the remaining years of the project. Projects C and D are alternatives that would both meet a regulatory requirement change needed in a high-risk division. The projects will be repeated indefinitely Table 2: Discount rate guidelines Risk rating WACC adjustment (percentage points) Low -3 Average 0 High +2 Very high +5 (a) Using the information for Projects A and B, answer the following questions. i. What accept/reject decisions should be made and why? (5 marks) ii. In what broad circumstances do the NPV and IRR sometimes suggest different decisions and what is the likely reason in this case. (5 marks) iii. What discount rate() should have been used in the analysis of these projects, what is this discount rate called, and why are such discount rates needed (5 marks) (b) Using the information for Projects C and D, what accept/reject decisions should be made and why? (10 marks)