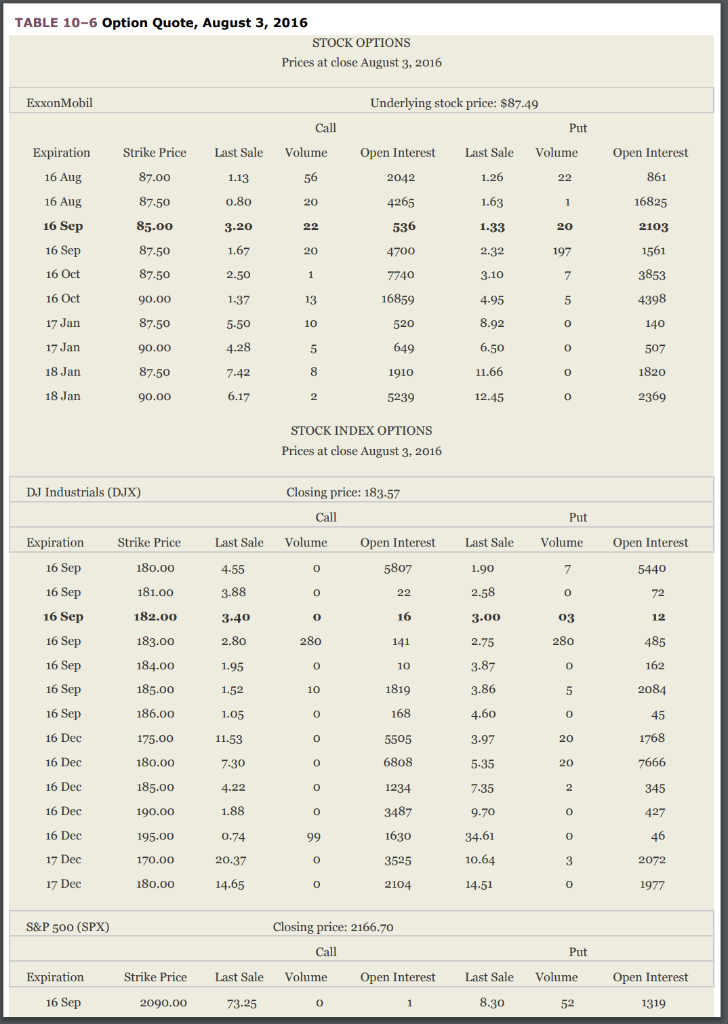

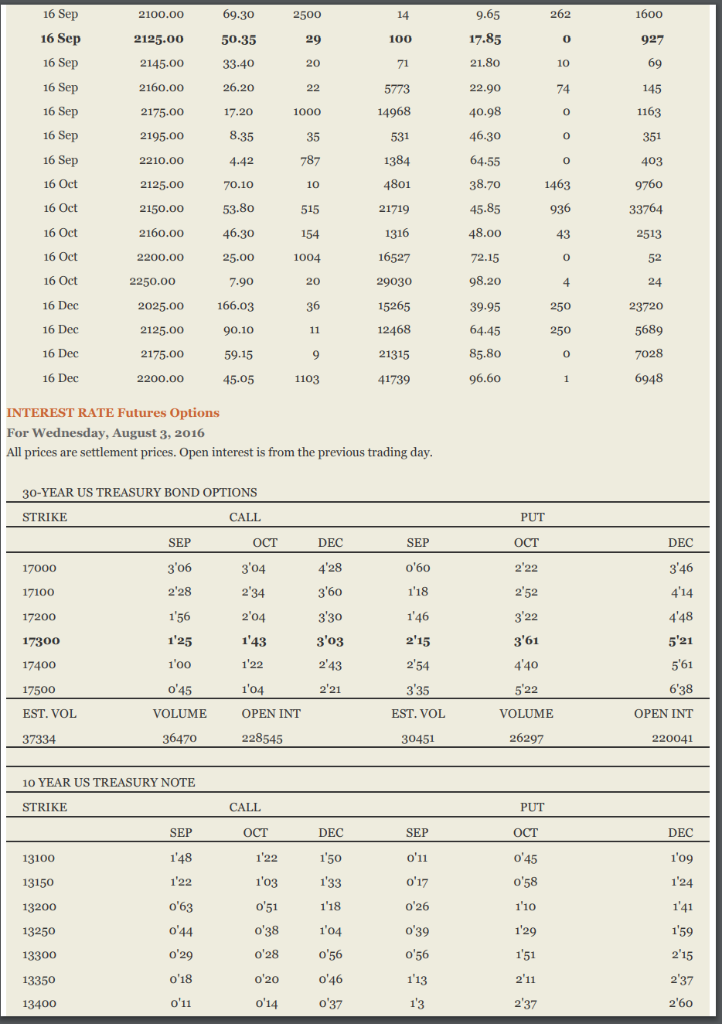

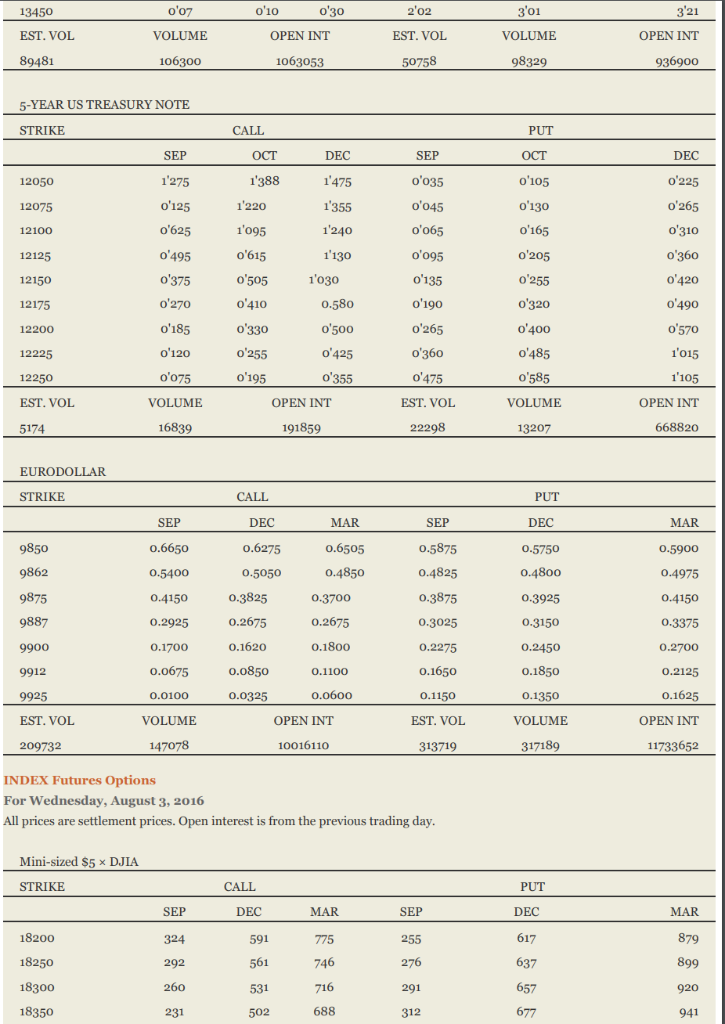

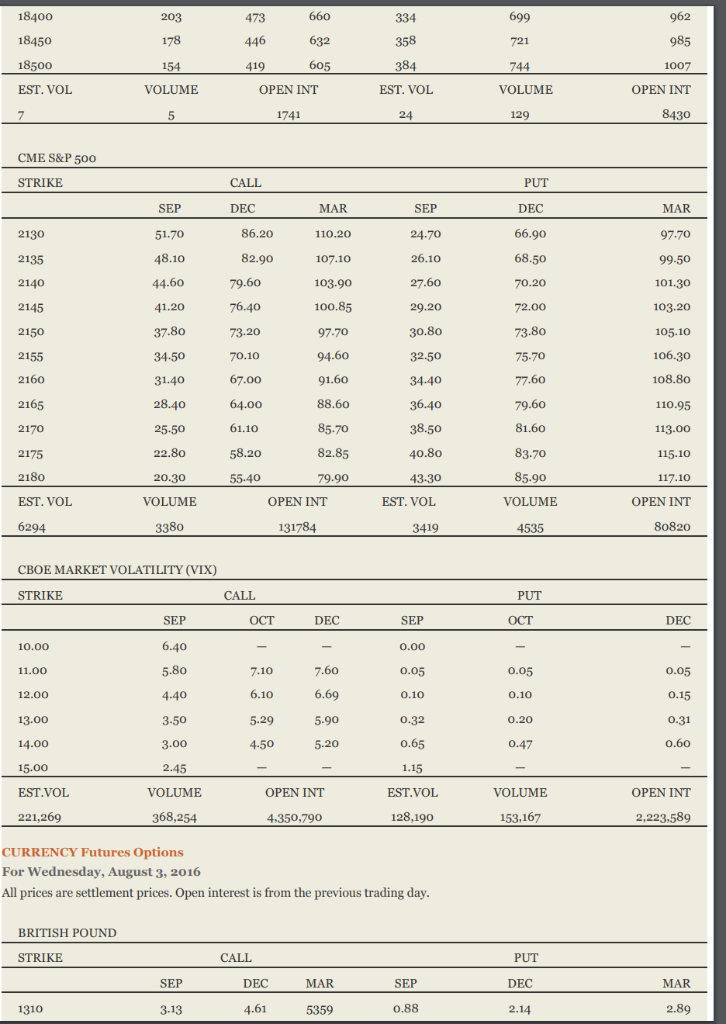

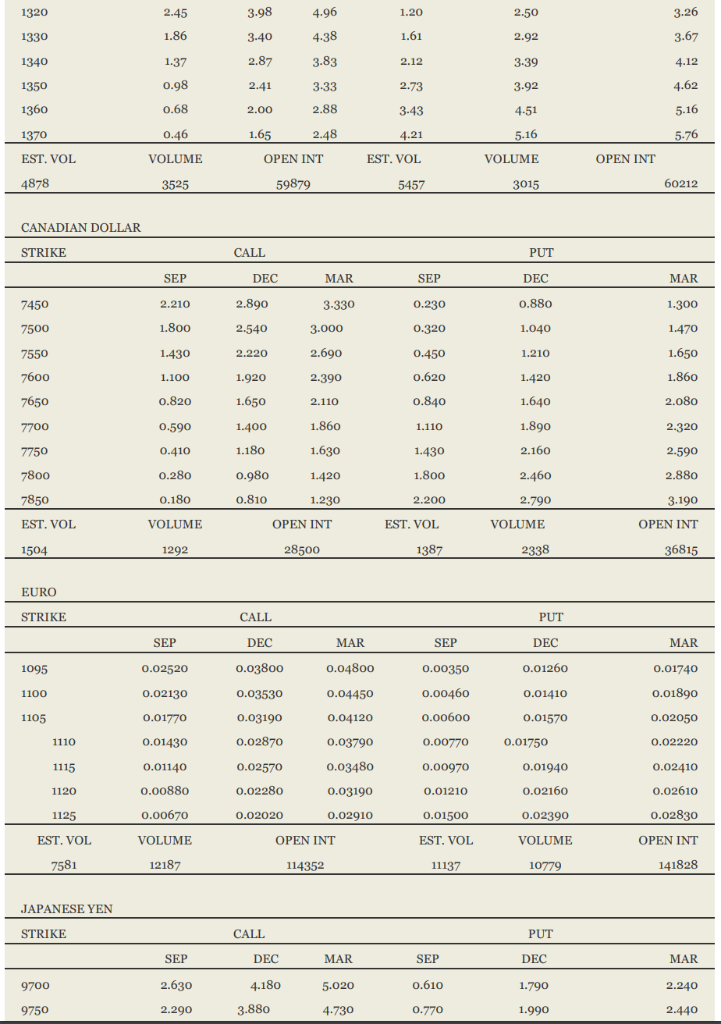

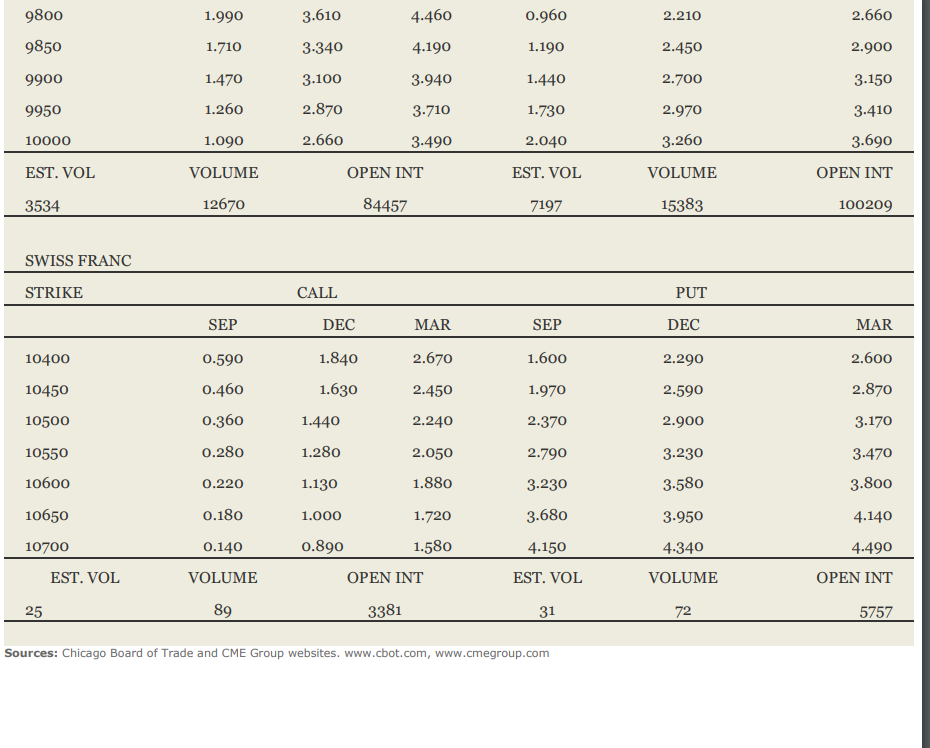

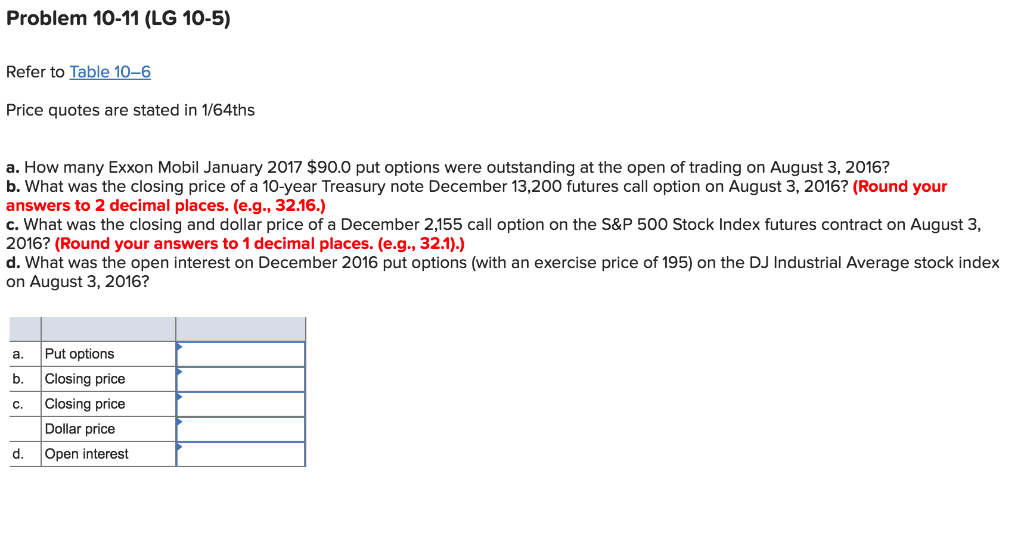

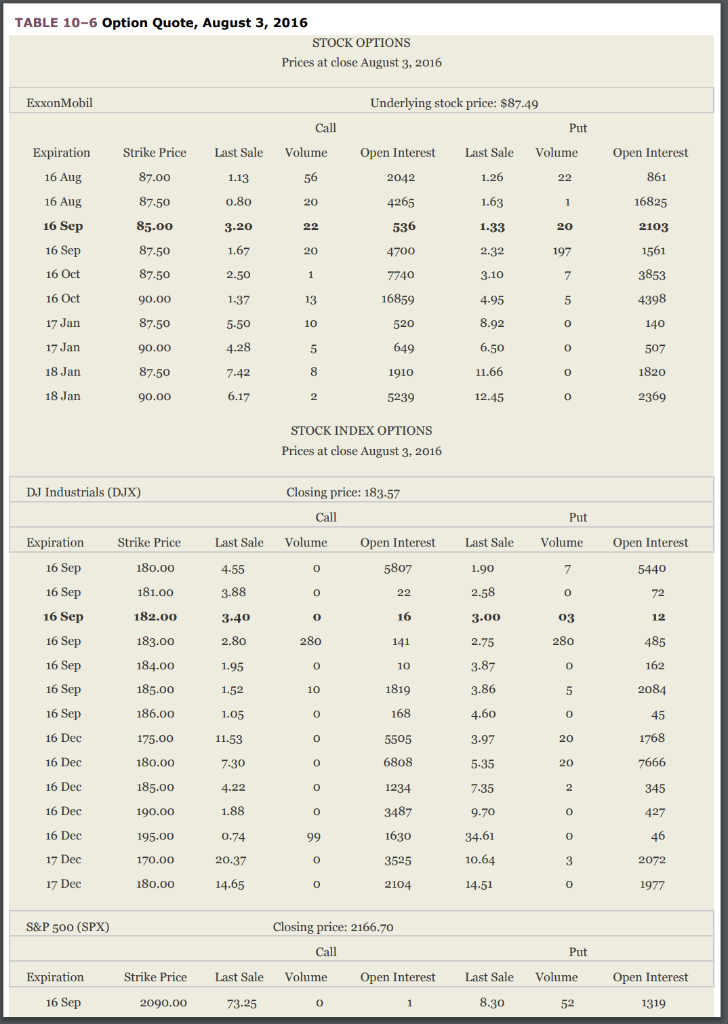

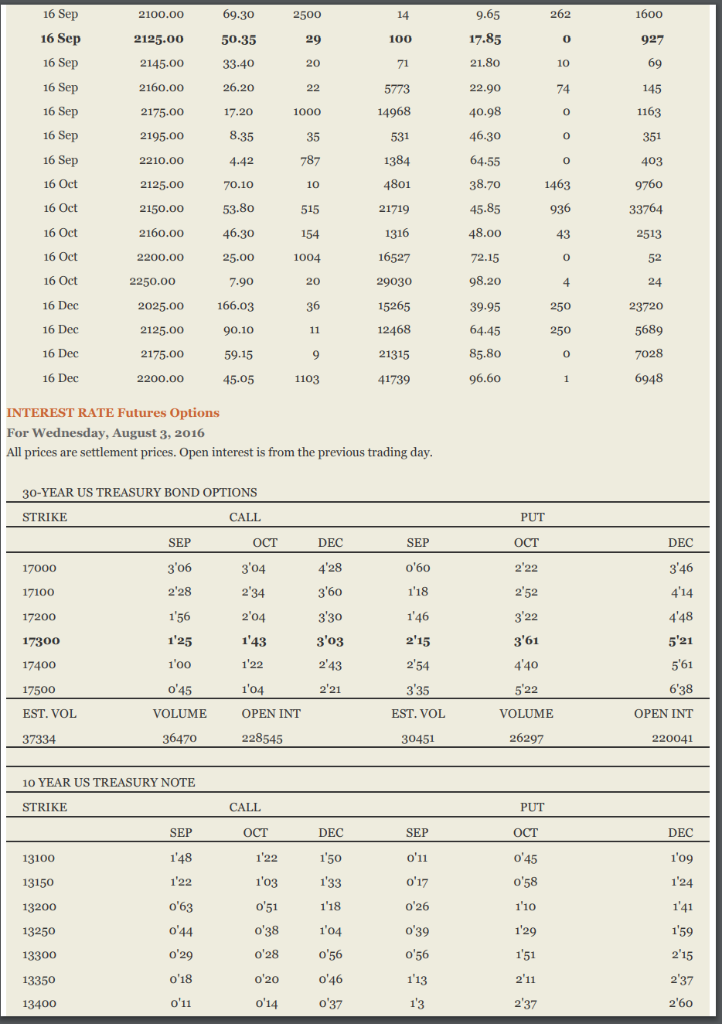

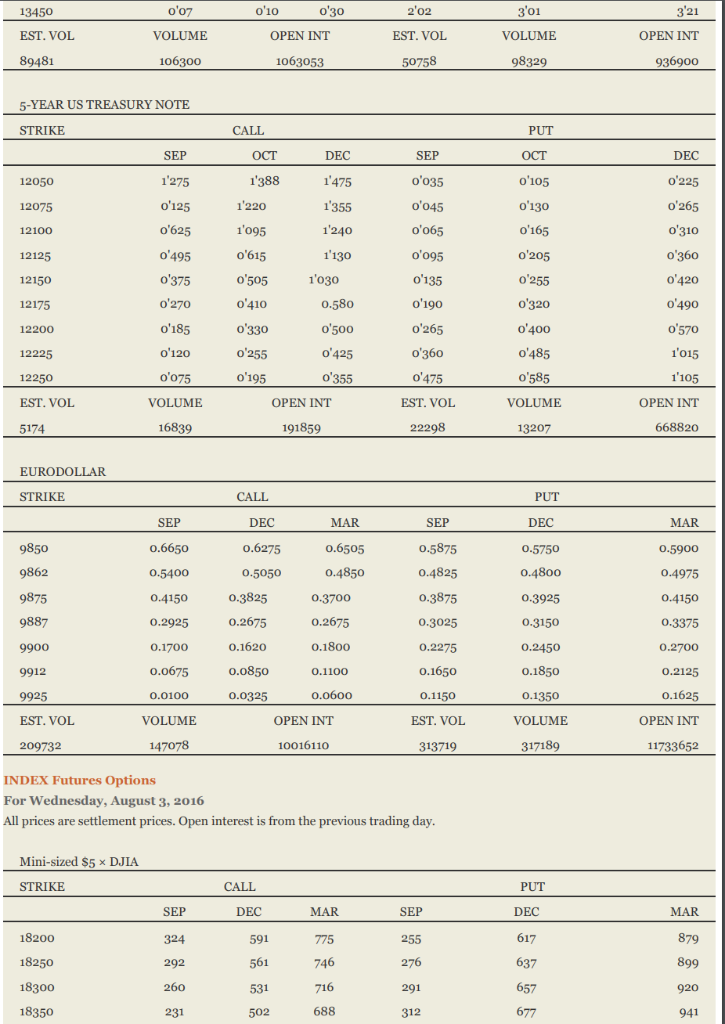

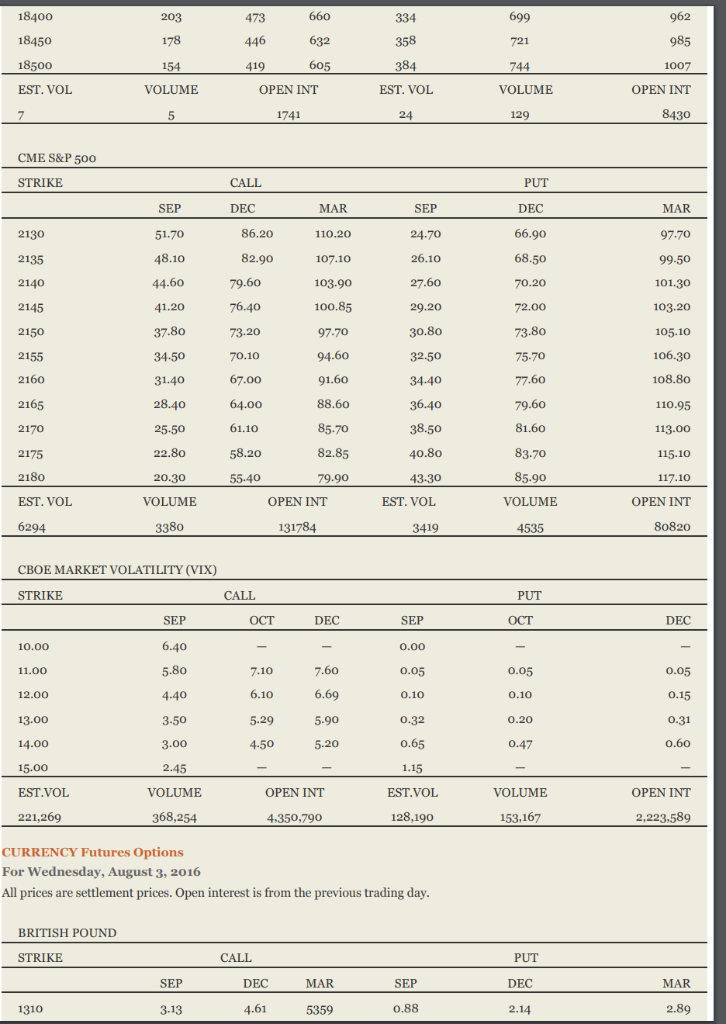

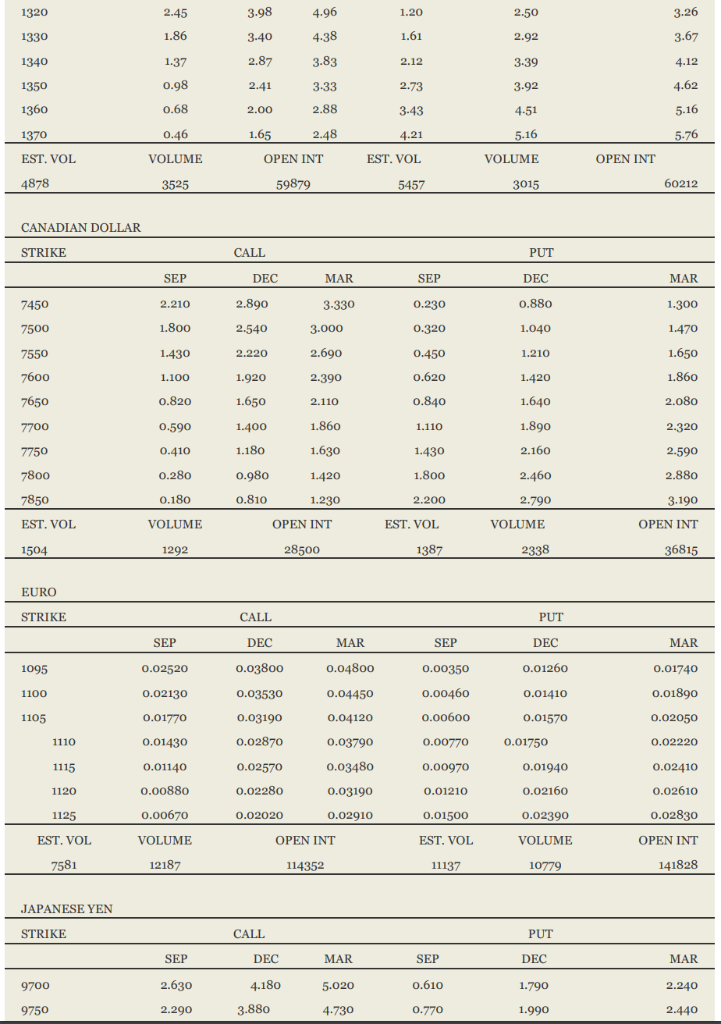

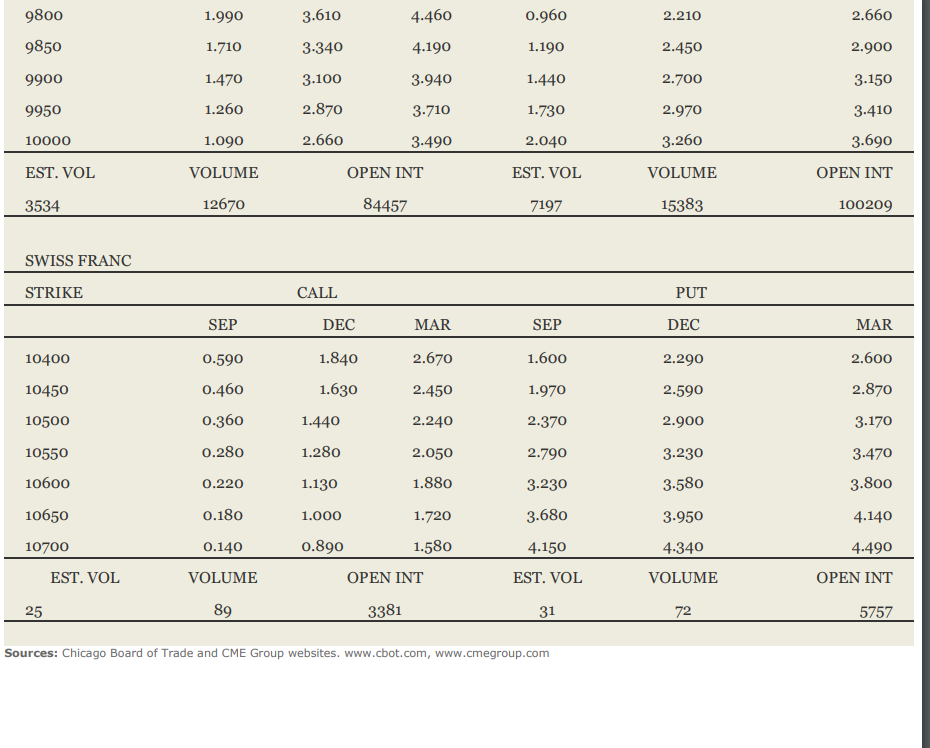

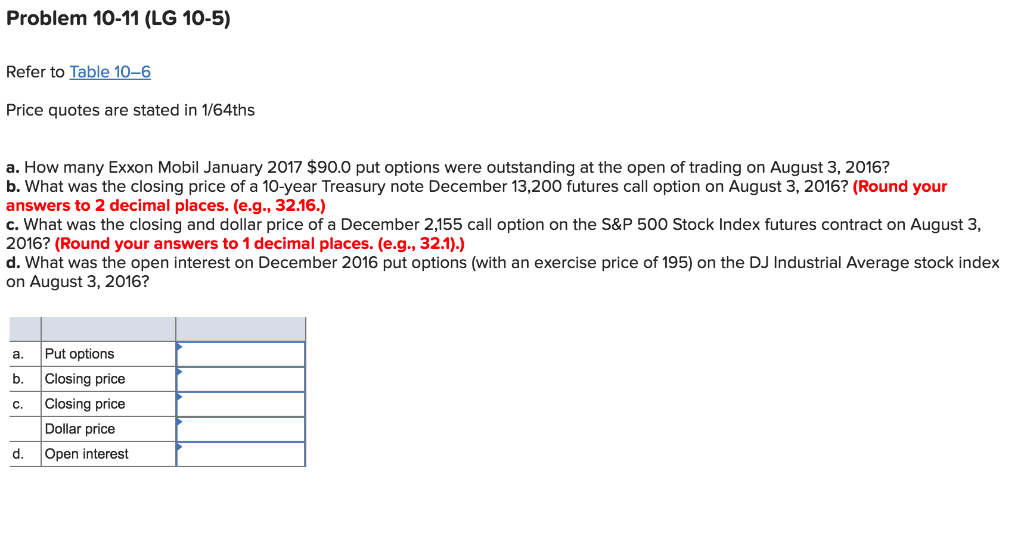

TABLE 10-6 Option Quote, August 3, 2016 STOCK OPTIONS Prices at close August 3, 2016 ExxonMobil Underlying stock price: $87.49 Call Expiration Strike Price Last Sale Volume Open Interest Last Sale Volume Open Interest 16 Aug 87.00 87.50 85.00 87.50 87.50 90.00 87.50 90.00 87.50 90.00 2042 1.26 16825 2103 1561 3853 4398 0.80 4265 16 Sep 16 Sep 16 Oct 16 Oct 17 Jan 17 Jan 18 Jan 18 Jan 3.20 20 4700 7740 16859 2.50 4.95 5.50 1910 11.66 1820 6.17 5239 2369 STOCK INDEX OPTIONS Prices at close August 3, 2016 DJ Industrials (DJX) Closing price: 183.57 Call Put Expiration Strike Price Last Sale Volume Open Interest Last Sale Volume Open Interest 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 180.00 181.00 182.00 183.00 184.00 185.00 186.00 175.00 180.00 185.00 190.00 195.00 170.00 180.00 4.55 5440 3.88 0 03 2.80 485 2.75 3.87 3.86 4.60 3.97 1.52 2084 16 Dec 16 Dec 16 Dec 16 Dec 16 Dec 17 Dec 17 Dec 11.53 7.30 4.22 1.88 0 5505 6808 7.35 345 3487 1630 3525 2104 0 9.70 20.37 2072 0 S&P 500 (SPX) Closing price: 2166.70 Expiration Strike Price Last Sale Volume Open Interest Last Sale Volume Open Interest 16 Sep 2090.00 73.25 8.30 1319 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Oct 16 Oct 16 Oct 16 Oct 16 Oct 16 Dec 16 Dec 16 Dec 16 Dec 2100.00 2125.00 2145.00 2160.00 2175.00 2195.00 2210.00 2500 17.85 21.80 22.90 50.35 100 33.40 1163 17.20 8.35 4.42 1000 14968 0 35 46.30 0 4801 21719 1316 38.70 53.80 45.85 2150.00 2160.00 2200.00 2513 1004 25.00 7.90 166.03 72.15 29030 15265 12468 21315 41739 2250.00 2025.00 2125.00 2175.00 2200.00 39.95 64.45 85.80 96.60 23720 59.15 7028 6948 INTEREST RATE Futures Options For Wednesday, August 3, 2016 All prices are settlement prices. Open interest is from the previous trading day 30-YEAR US TREASURY BOND OPTIONS STRIKE SEP DEC SEP DEC o'60 2' 22 17100 2'28 3'60 3'30 1'25 17300 17400 17500 EST. VOL 1'o0 1'22 2'21 VOLUME OPEN INT EST. VOL VOLUME OPEN INT 228545 30451 26297 220041 10 YEAR US TREASURY NOTE STRIKE CALL PUT SEP DEC SEP DEC 13100 1'22 1'22 0 0 0 0 o'26 13200 13250 13300 o'28 0 0 0'20 13400 o'14 0 37 2 37 13450 EST. VOL 89481 0'07 VOLUME 106300 2 02 EST. VOL 50758 OPEN INT VOLUME OPEN INT 1063053 98329 936900 5-YEAR US TREASURY NOTE STRIKE CALL SEP DEC SEP o'035 o'045 DEC 12050 12075 12100 1'220 12125 12150 12175 12200 o'495 o'095 0'205 0 0'420 0'490 0 o'320 o'400 o'500 0 120 o'075 VOLUME 16839 0'475 EST. VOL 22298 1'105 OPEN INT 668820 12250 EST. VOL OPEN INT VOLUME 191859 EURODOLLAR STRIKE PUT SEP DEC SEP 0.5875 0.4825 0.3875 0.3025 0.2275 0.1650 0.1150 EST. VOL 313719 DEC 9850 0.6505 0.5900 0.4800 0.3925 0.3150 0.4850 0.5400 0.4150 0 0.1700 0.5050 0.4975 0.2675 0.1620 0.0850 0.0325 0.2675 0.1800 0.1100 0.3375 12 0.2125 0.0100 EST. VO VOLUME OPEN INT VOLUME OPEN INT 209732 147078 10016110 317189 11733652 INDEX Futures Options For Wednesday, August 3, 2016 All prices are settlement prices. Open interest is from the previous trading day Mini-sized $5 x DJIA STRIKE SEP DEC SEP DEC 18200 591 746 18300 920 18350 18400 203 660 334 18500 605 384 744 1007 OPEN INT 8430 EST. VOL VOLUMIE OPEN INT EST. VOL VOLUMIE 1741 CME S&P 500 STRIKE CALL PUT DEC 66.90 68.50 70.20 SEP DEC MAR 110.20 107.10 103.90 100.85 97-70 94.60 91.60 88.60 85.70 SEP MAR 97-70 99.50 101.30 103.20 105.10 106.30 108.80 110.95 113.00 86.20 24.70 48.10 44.60 41.20 37.80 79.60 27.60 75-70 77.60 79.60 81.60 83.70 85.90 VOLUME 4535 2160 31.40 25.50 61.10 22.80 55.40 79.90 117.10 OPEN INT 80820 43.30 EST. VOL VOLUME OPEN INT EST. VOL 3380 3419 CBOE MARKET VOLATILITY (VIX) STRIKE CALL PUT SEP DEC SEP DEC 10.00 0.00 0.05 0.10 0.05 0.10 0.20 0.47 11.00 0.05 12.00 0.1 13.00 5.90 3.00 15.00 EST.VOI 221,269 VOLUME OPEN INT EST.VO VOLUME OPEN INT 128,190 2,223,589 CURRENCY Futures Options For Wednesday, August 3, 2016 All prices are settlement prices. Open interest is from the previous trading day BRITISH POUND STRIKE PUT DEC MAR SEP DEC MAR 0.88 1 ES.VOL OPEN INT EST. VOL VOLUME OPEN INT 59879 CANADIAN DOLLAR STRIKE 3.330 2 2 EST. VOL OPEN INT STRIKE DEC 0.04800 0.02870 0 0.02280 0.01210 112 0.0291O EST. VOL OPEN INT VOLUME 114352 JAPANESE YEN STRIKE MAR 5.020 4.730 DEC SEP 2.630 0 2.290 3.880 2.660 2.900 3.150 9800 9850 9900 9950 10000 EST. VOL 3534 1.990 4.460 0.960 2.210 3.340 3.100 2.870 2.660 2.450 2.700 2.970 3.260 VOLUME 15383 1.190 1.470 3.940 3.710 3.490 1.260 3.690 OPEN INT 100209 VOLUME OPEN INT EST. VOL 12670 84457 7197 SWISS FRANC STRIKE CALL PUT SEP 0.590 0.460 0.360 0.280 0.220 0.180 0.140 VOLUME 8 DEC MAR 2.670 2.450 10400 10450 10500 10550 10600 10650 10700 1.630 1.440 1.280 1.130 1.000 o.890 SEP 1.600 1.970 2.370 2.790 3.230 3.680 DEC 2.290 2.590 2.900 3.230 3.580 3.950 4-340 VOLUME 72 MAR 2.600 2.870 3.170 3.470 3.800 2.050 1.880 1.580 4.490 OPEN INT 5757 EST. VOL OPEN INT EST. VOL 2 3381 31 Sources: Chicago Board of Trade and CME Group websites. www.cbot.com, www.cmegroup.com Problem 10-11 (LG 10-5) Refer to Table 10-6 Price quotes are stated in 1/64ths a. How many Exxon Mobil January 2017 $90.0 put options were outstanding at the open of trading on August 3, 2016? b. What was the closing price of a 10-year Treasury note December 13,200 futures call option on August 3, 2016? (Round your answers to 2 decimal places. (e.g., 32.16.) c. What was the closing and dollar price of a December 2,155 call option on the S&P 500 Stock Index futures contract on August 3 2016? (Round your answers to 1 decimal places. (e.g., 32.1).) d. What was the open interest on December 2016 put options (with an exercise price of 195) on the DJ Industrial Average stock index on August 3, 2016? Put options b. Closing price c. Closing price a. Dollar price d. Open interest TABLE 10-6 Option Quote, August 3, 2016 STOCK OPTIONS Prices at close August 3, 2016 ExxonMobil Underlying stock price: $87.49 Call Expiration Strike Price Last Sale Volume Open Interest Last Sale Volume Open Interest 16 Aug 87.00 87.50 85.00 87.50 87.50 90.00 87.50 90.00 87.50 90.00 2042 1.26 16825 2103 1561 3853 4398 0.80 4265 16 Sep 16 Sep 16 Oct 16 Oct 17 Jan 17 Jan 18 Jan 18 Jan 3.20 20 4700 7740 16859 2.50 4.95 5.50 1910 11.66 1820 6.17 5239 2369 STOCK INDEX OPTIONS Prices at close August 3, 2016 DJ Industrials (DJX) Closing price: 183.57 Call Put Expiration Strike Price Last Sale Volume Open Interest Last Sale Volume Open Interest 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 180.00 181.00 182.00 183.00 184.00 185.00 186.00 175.00 180.00 185.00 190.00 195.00 170.00 180.00 4.55 5440 3.88 0 03 2.80 485 2.75 3.87 3.86 4.60 3.97 1.52 2084 16 Dec 16 Dec 16 Dec 16 Dec 16 Dec 17 Dec 17 Dec 11.53 7.30 4.22 1.88 0 5505 6808 7.35 345 3487 1630 3525 2104 0 9.70 20.37 2072 0 S&P 500 (SPX) Closing price: 2166.70 Expiration Strike Price Last Sale Volume Open Interest Last Sale Volume Open Interest 16 Sep 2090.00 73.25 8.30 1319 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Sep 16 Oct 16 Oct 16 Oct 16 Oct 16 Oct 16 Dec 16 Dec 16 Dec 16 Dec 2100.00 2125.00 2145.00 2160.00 2175.00 2195.00 2210.00 2500 17.85 21.80 22.90 50.35 100 33.40 1163 17.20 8.35 4.42 1000 14968 0 35 46.30 0 4801 21719 1316 38.70 53.80 45.85 2150.00 2160.00 2200.00 2513 1004 25.00 7.90 166.03 72.15 29030 15265 12468 21315 41739 2250.00 2025.00 2125.00 2175.00 2200.00 39.95 64.45 85.80 96.60 23720 59.15 7028 6948 INTEREST RATE Futures Options For Wednesday, August 3, 2016 All prices are settlement prices. Open interest is from the previous trading day 30-YEAR US TREASURY BOND OPTIONS STRIKE SEP DEC SEP DEC o'60 2' 22 17100 2'28 3'60 3'30 1'25 17300 17400 17500 EST. VOL 1'o0 1'22 2'21 VOLUME OPEN INT EST. VOL VOLUME OPEN INT 228545 30451 26297 220041 10 YEAR US TREASURY NOTE STRIKE CALL PUT SEP DEC SEP DEC 13100 1'22 1'22 0 0 0 0 o'26 13200 13250 13300 o'28 0 0 0'20 13400 o'14 0 37 2 37 13450 EST. VOL 89481 0'07 VOLUME 106300 2 02 EST. VOL 50758 OPEN INT VOLUME OPEN INT 1063053 98329 936900 5-YEAR US TREASURY NOTE STRIKE CALL SEP DEC SEP o'035 o'045 DEC 12050 12075 12100 1'220 12125 12150 12175 12200 o'495 o'095 0'205 0 0'420 0'490 0 o'320 o'400 o'500 0 120 o'075 VOLUME 16839 0'475 EST. VOL 22298 1'105 OPEN INT 668820 12250 EST. VOL OPEN INT VOLUME 191859 EURODOLLAR STRIKE PUT SEP DEC SEP 0.5875 0.4825 0.3875 0.3025 0.2275 0.1650 0.1150 EST. VOL 313719 DEC 9850 0.6505 0.5900 0.4800 0.3925 0.3150 0.4850 0.5400 0.4150 0 0.1700 0.5050 0.4975 0.2675 0.1620 0.0850 0.0325 0.2675 0.1800 0.1100 0.3375 12 0.2125 0.0100 EST. VO VOLUME OPEN INT VOLUME OPEN INT 209732 147078 10016110 317189 11733652 INDEX Futures Options For Wednesday, August 3, 2016 All prices are settlement prices. Open interest is from the previous trading day Mini-sized $5 x DJIA STRIKE SEP DEC SEP DEC 18200 591 746 18300 920 18350 18400 203 660 334 18500 605 384 744 1007 OPEN INT 8430 EST. VOL VOLUMIE OPEN INT EST. VOL VOLUMIE 1741 CME S&P 500 STRIKE CALL PUT DEC 66.90 68.50 70.20 SEP DEC MAR 110.20 107.10 103.90 100.85 97-70 94.60 91.60 88.60 85.70 SEP MAR 97-70 99.50 101.30 103.20 105.10 106.30 108.80 110.95 113.00 86.20 24.70 48.10 44.60 41.20 37.80 79.60 27.60 75-70 77.60 79.60 81.60 83.70 85.90 VOLUME 4535 2160 31.40 25.50 61.10 22.80 55.40 79.90 117.10 OPEN INT 80820 43.30 EST. VOL VOLUME OPEN INT EST. VOL 3380 3419 CBOE MARKET VOLATILITY (VIX) STRIKE CALL PUT SEP DEC SEP DEC 10.00 0.00 0.05 0.10 0.05 0.10 0.20 0.47 11.00 0.05 12.00 0.1 13.00 5.90 3.00 15.00 EST.VOI 221,269 VOLUME OPEN INT EST.VO VOLUME OPEN INT 128,190 2,223,589 CURRENCY Futures Options For Wednesday, August 3, 2016 All prices are settlement prices. Open interest is from the previous trading day BRITISH POUND STRIKE PUT DEC MAR SEP DEC MAR 0.88 1 ES.VOL OPEN INT EST. VOL VOLUME OPEN INT 59879 CANADIAN DOLLAR STRIKE 3.330 2 2 EST. VOL OPEN INT STRIKE DEC 0.04800 0.02870 0 0.02280 0.01210 112 0.0291O EST. VOL OPEN INT VOLUME 114352 JAPANESE YEN STRIKE MAR 5.020 4.730 DEC SEP 2.630 0 2.290 3.880 2.660 2.900 3.150 9800 9850 9900 9950 10000 EST. VOL 3534 1.990 4.460 0.960 2.210 3.340 3.100 2.870 2.660 2.450 2.700 2.970 3.260 VOLUME 15383 1.190 1.470 3.940 3.710 3.490 1.260 3.690 OPEN INT 100209 VOLUME OPEN INT EST. VOL 12670 84457 7197 SWISS FRANC STRIKE CALL PUT SEP 0.590 0.460 0.360 0.280 0.220 0.180 0.140 VOLUME 8 DEC MAR 2.670 2.450 10400 10450 10500 10550 10600 10650 10700 1.630 1.440 1.280 1.130 1.000 o.890 SEP 1.600 1.970 2.370 2.790 3.230 3.680 DEC 2.290 2.590 2.900 3.230 3.580 3.950 4-340 VOLUME 72 MAR 2.600 2.870 3.170 3.470 3.800 2.050 1.880 1.580 4.490 OPEN INT 5757 EST. VOL OPEN INT EST. VOL 2 3381 31 Sources: Chicago Board of Trade and CME Group websites. www.cbot.com, www.cmegroup.com Problem 10-11 (LG 10-5) Refer to Table 10-6 Price quotes are stated in 1/64ths a. How many Exxon Mobil January 2017 $90.0 put options were outstanding at the open of trading on August 3, 2016? b. What was the closing price of a 10-year Treasury note December 13,200 futures call option on August 3, 2016? (Round your answers to 2 decimal places. (e.g., 32.16.) c. What was the closing and dollar price of a December 2,155 call option on the S&P 500 Stock Index futures contract on August 3 2016? (Round your answers to 1 decimal places. (e.g., 32.1).) d. What was the open interest on December 2016 put options (with an exercise price of 195) on the DJ Industrial Average stock index on August 3, 2016? Put options b. Closing price c. Closing price a. Dollar price d. Open interest