Answered step by step

Verified Expert Solution

Question

1 Approved Answer

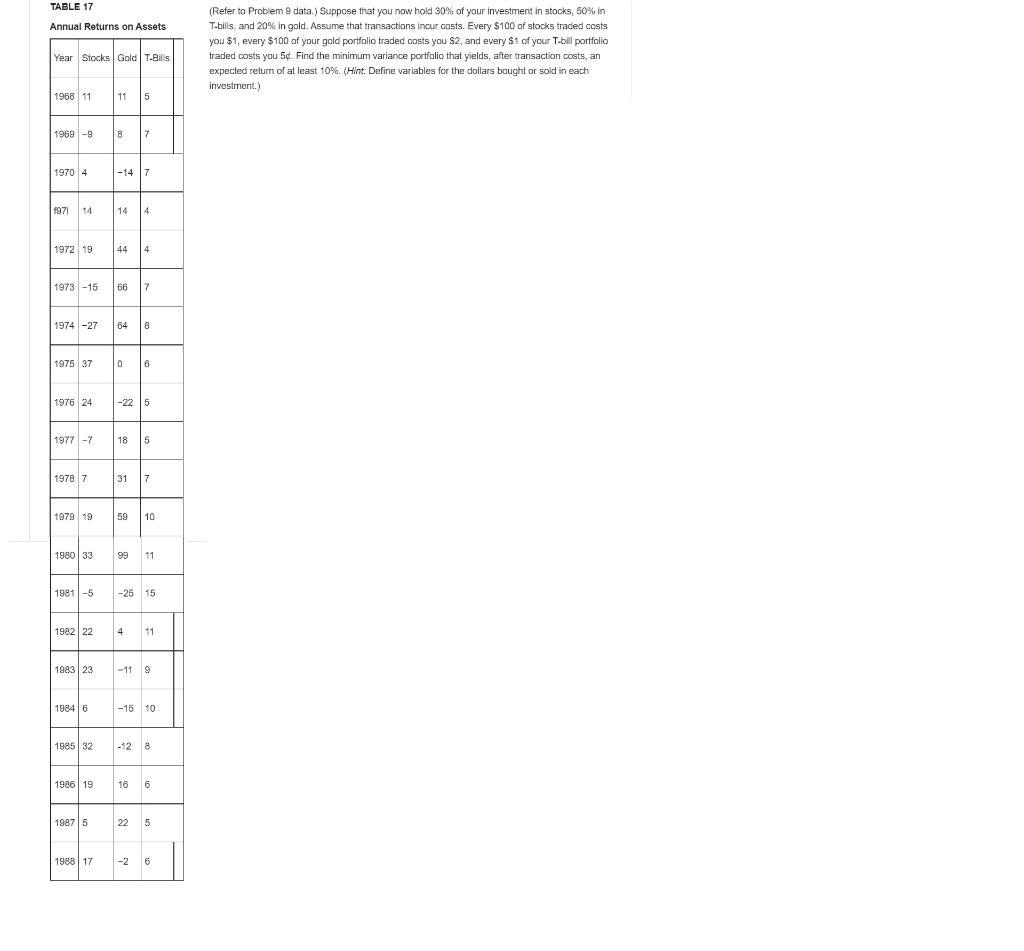

TABLE 17 Annual Returns on Assets Year Stocks Gold T-Bills 1968 11 1969 -9 1970 4 1971 14 1972 19 1976 24 1977-7 1973

TABLE 17 Annual Returns on Assets Year Stocks Gold T-Bills 1968 11 1969 -9 1970 4 1971 14 1972 19 1976 24 1977-7 1973 -15 66 7 1978 7 1974 -27 64 8 1979 19 1975 37 0 6 1980 33 1981-5 1982 22 1983 23 1984 6 1985 32 11 5 1986 19 8 7 1987 5 -14 7 1988 17 14 4 44 4 -22 5 18 5 31 7 59 10 99 11 -25 15 4 11 -11 9 -15 10 -12 8 16 6 22 5 -2 6 (Refer to Problem 9 data.) Suppose that you now hold 30% of your investment in stocks, 50% in T-bills, and 20% in gold. Assume that transactions incur costs. Every $100 of stocks traded costs you $1, every $100 of your gold portfolio traded costs you $2, and every $1 of your T-bill portfolio traded costs you 5d. Find the minimum variance portfolio that yields, after transaction costs, an expected return of at least 10%. (Hint: Define variables for the dollars bought or sold in each investment.)

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Let x dollars of st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started