Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Table 9 . 2 . Table 9 . 3 Manufacturing Overhead Budget for Jerry's Ice Cream By definition, total variable overhead costs change with changes

Table Table Manufacturing Overhead Budget for Jerry's Ice Cream By definition, total variable overhead costs change with changes in production and are calculated by multiplying

units to be produced by the cost per unit. For example, indirect materials cost for the first quarter of $ is

calculated by taking units to be produced $ cost per unit. Total fixed costs generally do not change

with changes in production and, therefore, remain the same each quarter. Note: In some situations, fixed

overhead costs can change from one quarter to the next. For example, hiring additional salaried personnel

during the year would increase fixed overhead costs, and purchasing equipment during the year would increase

depreciation costs. In this example, we assume fixed overhead costs do not change during the year.

Depreciation is deducted at the bottom of the manufacturing overhead budget to determine cash payments for

overhead because depreciation is not a cash transaction. We use this information later in the chapter for the

cash budget.

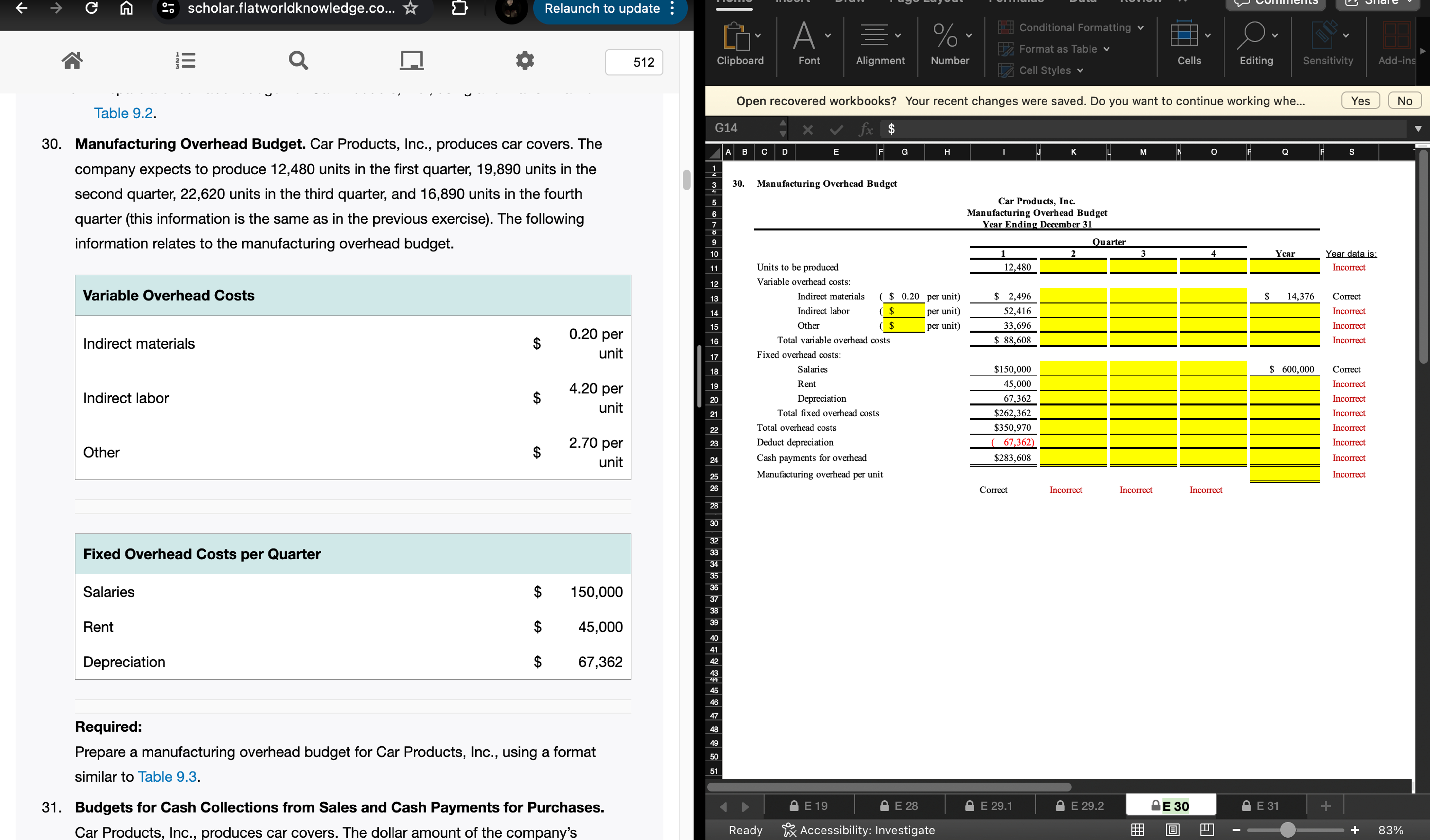

Manufacturing Overhead Budget. Car Products, Inc., produces car covers. The

company expects to produce units in the first quarter, units in the

second quarter, units in the third quarter, and units in the fourth

quarter this information is the same as in the previous exercise The following

information relates to the manufacturing overhead budget.

Required:

Prepare a manufacturing overhead budget for Car Products, Inc., using a format

similar to Table

Budgets for Cash Collections from Sales and Cash Payments for Purchases.

Car Products, Inc., produces car covers. The dollar amount of the company's

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started