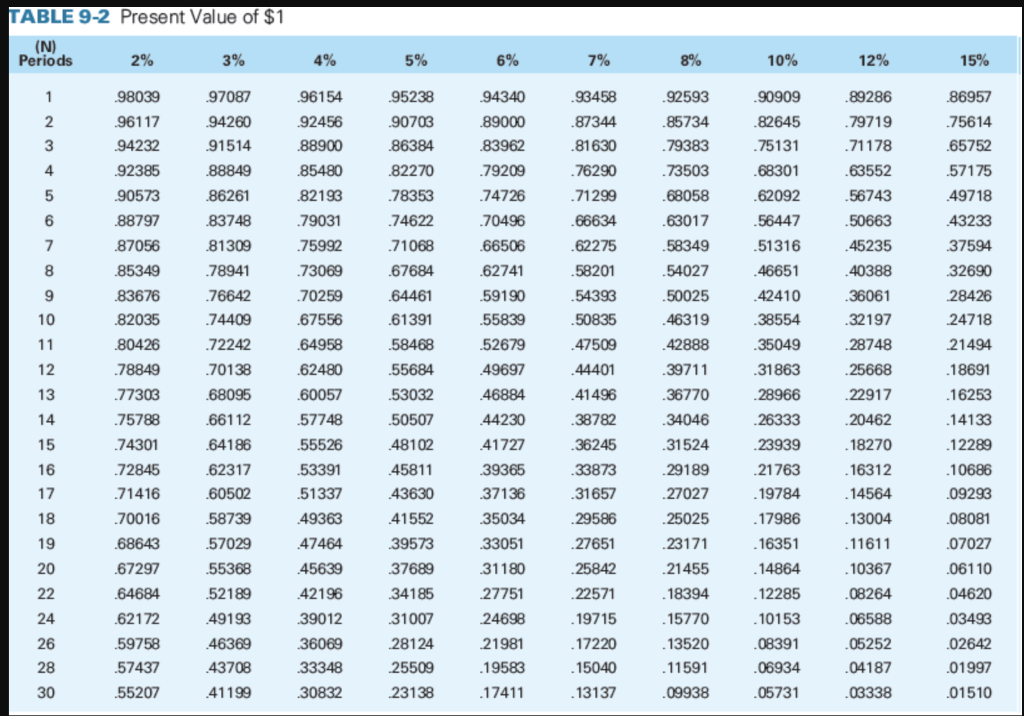

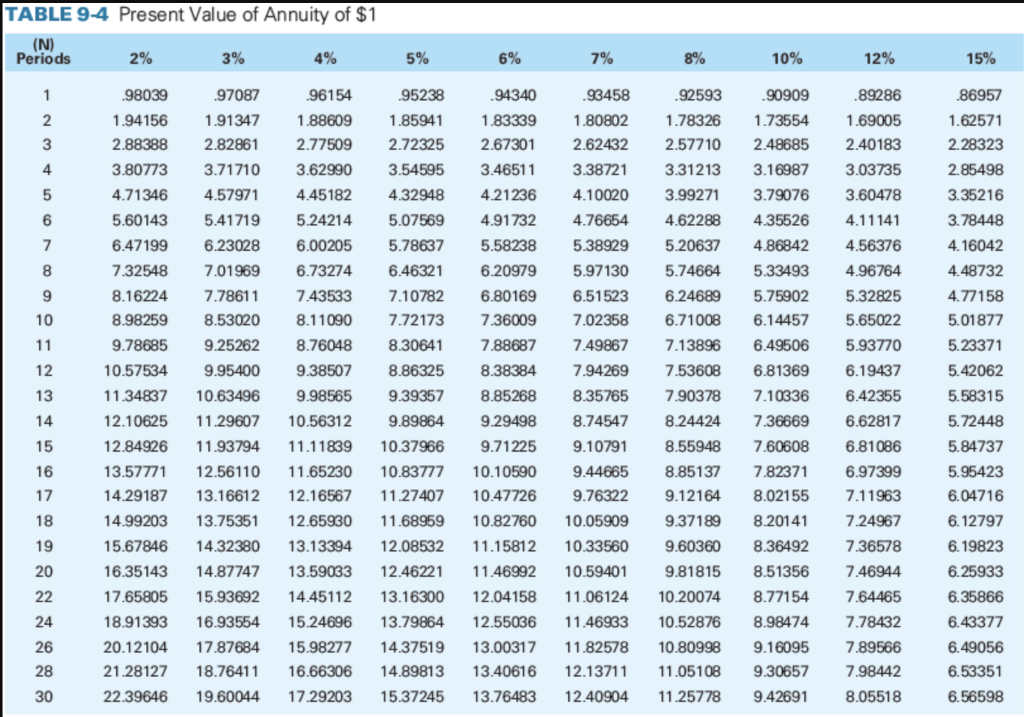

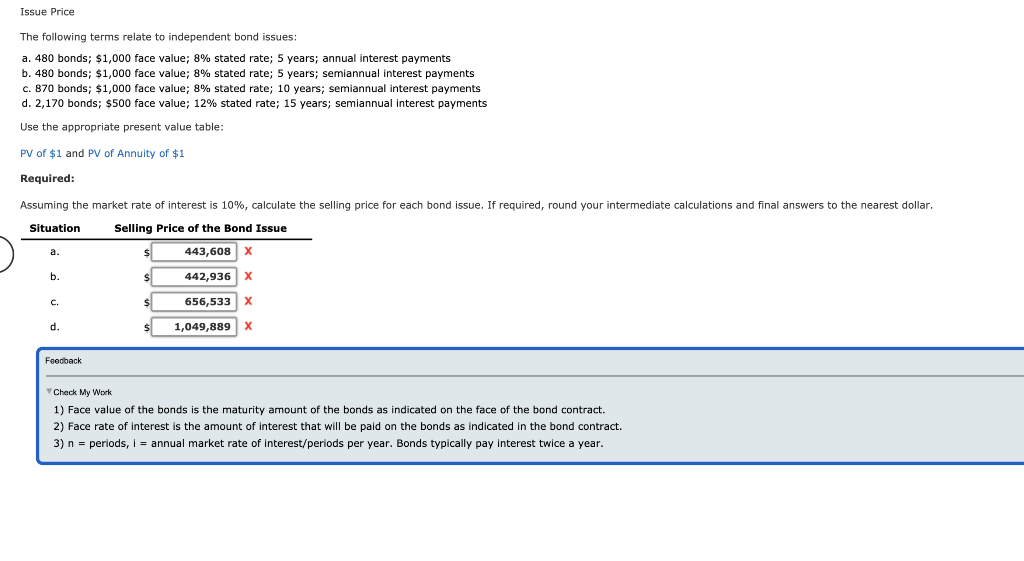

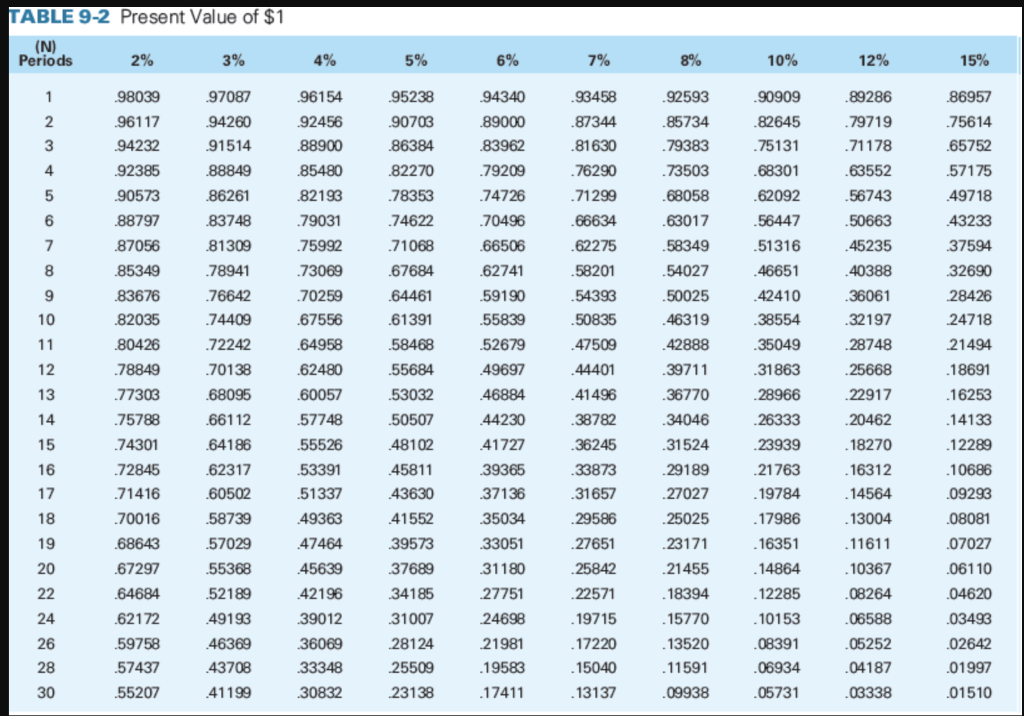

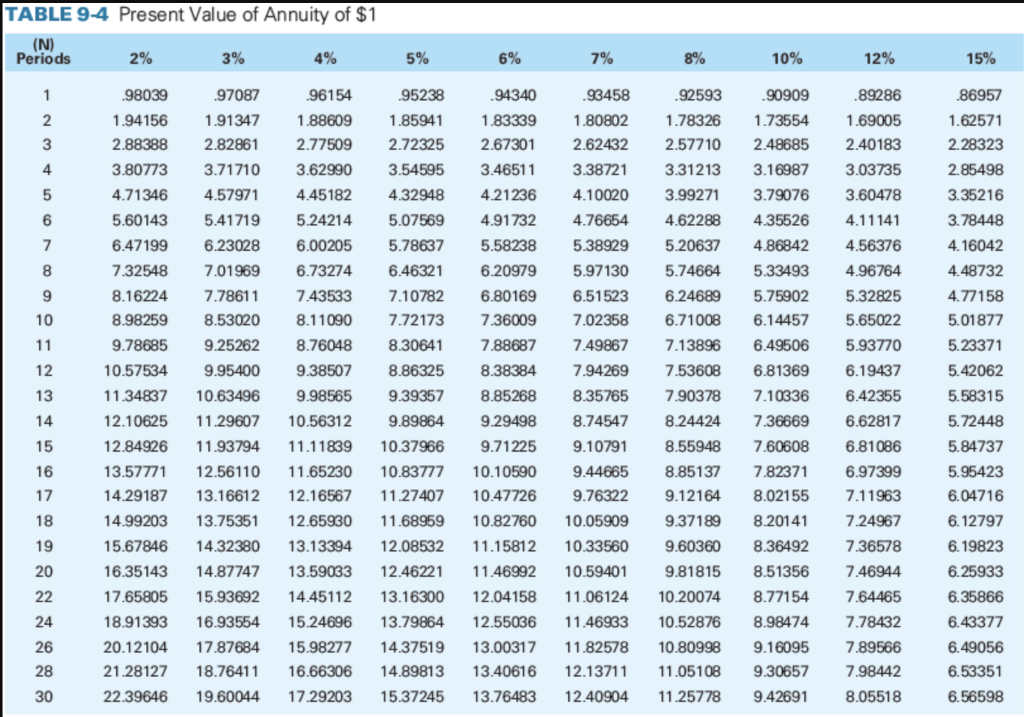

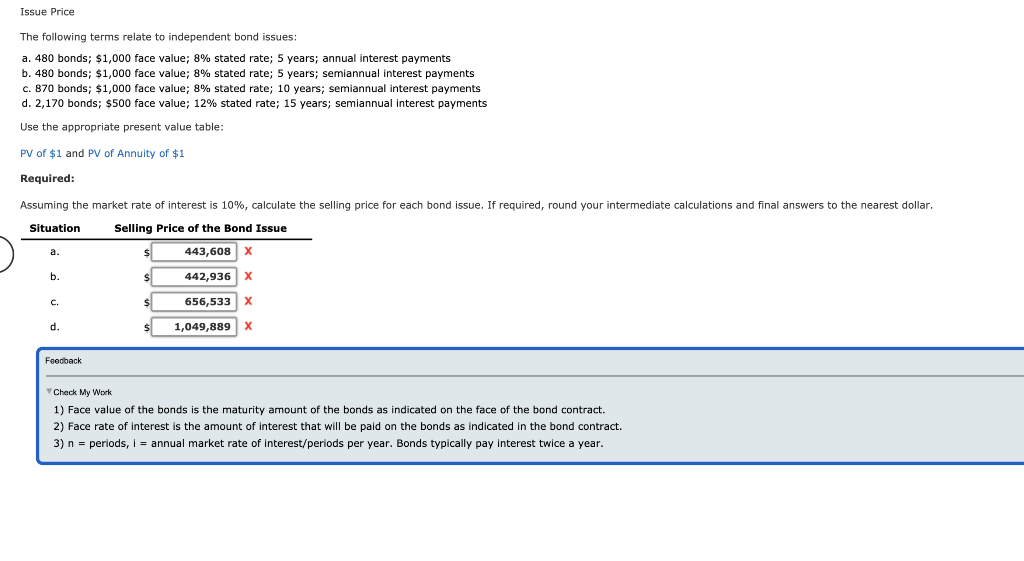

TABLE 9-2 Present Value of $1 (N) Periods 2% 3% 4% 5% 6% 7% 8% 10% 12% 15% 1 .96154 2 3 .92456 .88900 4 5 6 .85480 .82193 .79031 .75992 .73069 7 8 9 10 .70259 .67556 .64958 .62480 11 .98039 .96117 .94232 .92385 .90573 .88797 .87056 .85349 .83676 .82035 .80426 .78849 .77303 .75788 .74301 .72845 .71416 .70016 .68643 .67297 .64684 .62172 .59758 -57437 .55207 .94340 .89000 .83962 .79209 .74726 .70496 .66506 .62741 .59190 .55839 -52679 49697 46884 44230 41727 39365 37136 35034 33051 12 .97087 .94260 .91514 .88849 .86261 .83748 .81309 .78941 .76642 .74409 .72242 .70138 .68095 .66112 .64186 .62317 .60502 .58739 .57029 .55368 .52189 49193 46369 43708 41199 .86957 .75614 .65752 -57175 49718 43233 37594 32690 28426 24718 21494 .18691 .16253 .14133 13 .95238 .90703 .86384 .82270 .78353 .74622 .71068 .67684 .64461 .61391 .58468 .55684 .53032 .50507 48102 45811 43630 41552 39573 37689 34185 31007 28124 25509 23138 .93458 .87344 .81630 .76290 .71299 .66634 .62275 .58201 .54393 .50835 47509 44401 .41496 .38782 .36245 .33873 .31657 .29586 .27651 .25842 .22571 19715 .17220 .15040 .13137 .60057 .92593 .85734 .79383 .73503 .68058 .63017 58349 .54027 -50025 46319 42888 .39711 36770 .34046 31524 29189 .27027 25025 23171 21455 .18394 .15770 .13520 .11591 .09938 .89286 .79719 .71178 .63552 .56743 .50663 45235 40388 36061 .32197 28748 25668 22917 20462 .18270 16312 .14564 13004 .11611 10367 .08264 06588 .05252 .90909 .82645 .75131 .68301 .62092 .56447 .51316 46651 42410 .38554 .35049 .31863 .28966 .26333 .23939 21763 .19784 .17986 .16351 .14864 .12285 .10153 .08391 .06934 .05731 14 .57748 -55526 15 .12289 16 17 .53391 .51337 18 49363 19 47464 45639 .10686 .09293 .08081 .07027 .06110 .04620 .03493 20 22 42196 24 39012 31180 27751 24698 21981 .19583 .17411 26 28 30 36069 33348 30832 .04187 02642 .01997 .01510 .03338 TABLE 9-4 Present Value of Annuity of $1 (N) Periods 2% 3% 4% 5% 6% 7% 8% 10% 12% 15% 1 2. 3 4 .96154 1.88609 2.77509 3.62990 .92593 1.78326 2.57710 3.31213 3.99271 4.62288 4.45182 5 6 .86957 1.62571 2.28323 2.85498 3.35216 3.78448 4.16042 4.48732 4.77158 5.01877 5.23371 5.42062 7 8 9 10 11 12 13 .98039 1.94156 2.88388 3.80773 4.71346 5.60143 6.47199 7.32548 8.16224 8.98259 9.78685 10.57534 11.34837 12.10625 12.84926 13.57771 14.29187 14.99203 15.67846 16.35143 17.65805 18.91393 20.12104 21.28127 22.39646 97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 13.16612 13.75351 14.32380 14.87747 15.93692 16.93554 17.87684 18.76411 19.60044 .95238 1.85941 2.72325 3.54595 4.32948 5.07569 5.78637 6.46321 7.10782 7.72173 8.30641 8.86325 9.39357 9.89864 10.37966 10.83777 11.27407 11.68959 12.08532 12.46221 13.16300 13.79864 14.37519 14.89813 15.37245 .94340 1.83339 2.67301 3.46511 4.21236 4.91732 5.58238 6.20979 6.80169 7.36009 7.88687 8.38384 8.85268 9.29498 9.71225 10.10590 10.47726 10.82760 11.15812 11.46992 12.04158 12.55036 13.00317 13.40616 13.76483 .93458 1.80802 2.62432 3.38721 4.10020 4.76654 5.38929 5.97130 6.51523 7.02358 7.49867 7.94269 8.35765 8.74547 9.10791 9.44665 9.76322 10.05909 10.33560 10.59401 11.06124 11.46933 11.82578 12.13711 12.40904 5.24214 6.00205 6.73274 7.43533 8.11090 8.76048 9.38507 9.98565 10.56312 11.11839 11.65230 12.16567 12.65930 13.13394 13.59033 14.45112 15.24696 15.98277 16.66306 17.29203 .90909 1.73554 2.48685 3.16987 3.79076 4.35526 4.86842 5.33493 5.75902 6.14457 6.49506 6.81369 7.10336 7.36669 7.60608 7.82371 8.02155 8.20141 8.36492 8.51356 8.77154 8.98474 9.16095 9.30657 9.42691 5.58315 .89286 1.69005 2.40183 3.03735 3.60478 4.11141 4.56376 4.96764 5.32825 5.65022 5.93770 6.19437 6.42355 6.62817 6.81086 6.97399 7.11963 7.24967 7.36578 7.46944 7.64465 7.78432 7.89566 7.98442 8.05518 14 15 5.20637 5.74664 6.24689 6.71008 7.13896 7.53608 7.90378 8.24424 8.55948 8.85137 9.12164 9.37189 9.60360 9.81815 10.20074 10.52876 10.80998 11.05108 11.25778 16 17 18 19 5.72448 5.84737 5.95423 6.04716 6.12797 6.19823 6.25933 6.35866 6.43377 6.49056 6.53351 20 22 24 26 28 30 6.56598 Issue Price The following terms relate to independent bond issues: a. 480 bonds; $1,000 face value; 8% stated rate; years; annual interest payments b. 480 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments c. 870 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments d. 2,170 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: Assuming the market rate of interest is 10%, calculate the selling price for each bond issue. If required, round your intermediate calculations and final answers to the nearest dollar. Situation Selling Price of the Bond Issue 443,608 b 442,936 X C. 656,533 X d. 1,049,889 X Feedback Check My Work 1) Face value of the bonds is the maturity amount of the bonds as indicated on the face of the bond contract. 2) Face rate of interest is the amount of interest that will be paid on the bonds as indicated in the bond contract. 3) n = periods, I = annual market rate of interest/periods per year. Bonds typically pay interest twice a year