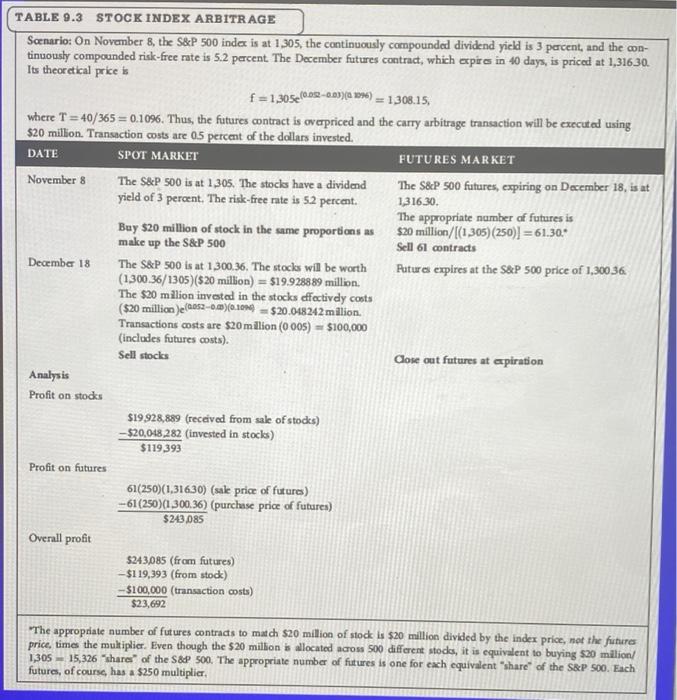

TABLE 9.3 STOCK INDEX ARBITRAGE Scenario: On November 8, the S&P 500 indo is at 1,305, the continuously compounded dividend yield is 3 percent, and the con- tinuously compounded risk-free rate is 5.2 percent The December futures contract, which expires in 40 days, is priced at 1,316.30. Its theoretical prices f = 1,305e001-603)( 1096) = 1308.15, where T = 40/365 = 0.1096. Thus, the futures contract is overpriced and the carry arbitrage transaction will be executed using $20 million. Transaction costs are 05 percent of the dollars invested DATE SPOT MARKET FUTURES MARKET November 8 The S&P 500 is at 1305. The stocks have a dividend The S&P 500 futures, expiring on December 18, is at yield of 3 percent. The risk-free rate is 52 percent. 1,316.30. The appropriate number of futures is Buy $20 million of stock in the same proportions as $20 million/[(1 305) (250)] = 61.30.- make up the S&P 500 Sell 61 contracts December 18 The S&P 500 is at 1,300.36. The stocks will be worth Futures expires at the S&P 500 price of 1,300.36 (1300.36/1305)($20 million) = $19.9288 89 million. The $20 million invested in the stocks efectivdy costs ($20 million )e(2352-008)(0.1084 = $20.048242 million Transactions costs are $20 million (0005) = $100,000 (includes futures costs). Sell stocks Close out futures at apiration Analysis Profit on stocks $19928,889 (received from sale of stocks) -$20,018,282 (invested in stocks) $119,393 Profit on futures 61(250)(1,31630) (sale price of futures) -61(250)(1.300.36) (purchase price of futures) $243 085 Overall profit $243,085 (from futures) -- $119,393 (from stock) -- $100,000 (transaction costs) $23,692 "The appropriate number of futures contracts to match $20 million of stock is $20 million divided by the index price, not the futures price, times the multiplier. Even though the $20 million is allocated acros 500 different stodes, it is equivalent to buying $20 milion/ 1,305-15,326 "shares of the S&P 500. The appropriate number of futures is one for each equivalent share of the S&P 500. Each futures, of course, has a $250 multiplier Please refer to Chapter 9 PPT Slide #12. You need to explain Table 9.3. 1) Explain Table 9.3 as it is constructed on #12 slide. 2) Now create the same information with columns representing time and rows representing spot and futures market. Explain your numbers now. 3) Now verify that the profit obtained in both cases equal the amount of mispricing without the transaction cost. TABLE 9.3 STOCK INDEX ARBITRAGE Scenario: On November 8, the S&P 500 indo is at 1,305, the continuously compounded dividend yield is 3 percent, and the con- tinuously compounded risk-free rate is 5.2 percent The December futures contract, which expires in 40 days, is priced at 1,316.30. Its theoretical prices f = 1,305e001-603)( 1096) = 1308.15, where T = 40/365 = 0.1096. Thus, the futures contract is overpriced and the carry arbitrage transaction will be executed using $20 million. Transaction costs are 05 percent of the dollars invested DATE SPOT MARKET FUTURES MARKET November 8 The S&P 500 is at 1305. The stocks have a dividend The S&P 500 futures, expiring on December 18, is at yield of 3 percent. The risk-free rate is 52 percent. 1,316.30. The appropriate number of futures is Buy $20 million of stock in the same proportions as $20 million/[(1 305) (250)] = 61.30.- make up the S&P 500 Sell 61 contracts December 18 The S&P 500 is at 1,300.36. The stocks will be worth Futures expires at the S&P 500 price of 1,300.36 (1300.36/1305)($20 million) = $19.9288 89 million. The $20 million invested in the stocks efectivdy costs ($20 million )e(2352-008)(0.1084 = $20.048242 million Transactions costs are $20 million (0005) = $100,000 (includes futures costs). Sell stocks Close out futures at apiration Analysis Profit on stocks $19928,889 (received from sale of stocks) -$20,018,282 (invested in stocks) $119,393 Profit on futures 61(250)(1,31630) (sale price of futures) -61(250)(1.300.36) (purchase price of futures) $243 085 Overall profit $243,085 (from futures) -- $119,393 (from stock) -- $100,000 (transaction costs) $23,692 "The appropriate number of futures contracts to match $20 million of stock is $20 million divided by the index price, not the futures price, times the multiplier. Even though the $20 million is allocated acros 500 different stodes, it is equivalent to buying $20 milion/ 1,305-15,326 "shares of the S&P 500. The appropriate number of futures is one for each equivalent share of the S&P 500. Each futures, of course, has a $250 multiplier Please refer to Chapter 9 PPT Slide #12. You need to explain Table 9.3. 1) Explain Table 9.3 as it is constructed on #12 slide. 2) Now create the same information with columns representing time and rows representing spot and futures market. Explain your numbers now. 3) Now verify that the profit obtained in both cases equal the amount of mispricing without the transaction cost